PNC Bank 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

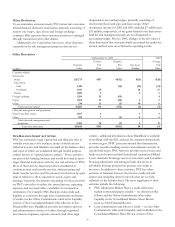

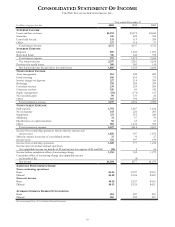

Noninterest Expense

Noninterest expense was $3.414 billion for 2001 compared

with $3.103 billion for 2000. Costs to exit the vehicle leasing

business, including the impairment of goodwill associated with

a prior acquisition and employee severance costs, and

additions to reserves related to insured residual value

exposures totaled $135 million and are included in 2001

noninterest expense. In addition, $56 million of integration

and severance costs related to other strategic initiatives were

incurred in 2001. Excluding these items, noninterest expense

increased 4% compared with 2000. The increase was primarily

in businesses that have shown higher revenue growth

including Regional Community Banking, BlackRock and

PFPC. Average full-time equivalent employees totaled

approximately 24,500 and 24,100 for 2001 and 2000,

respectively. The increase was mainly in asset management and

processing businesses.

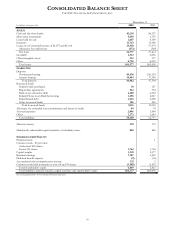

CONSOLIDATED BALANCE SHEET REVIEW

Loans

Loans were $38.0 billion at December 31, 2001, a decrease of

$12.6 billion from year end 2000 primarily due to residential

mortgage securitizations and runoff, transfers to held for sale

and the managed reduction of institutional loans. Loans at

December 31, 2001 included $1.9 billion of vehicle leases and

$200 million of commercial loans that have been designated

for exit.

Loans Held For Sale

Loans held for sale were $4.2 billion at December 31, 2001

compared with $1.7 billion at December 31, 2000. In the

fourth quarter of 2001, PNC designated for exit $3.1 billion of

loans and $7.9 billion of institutional credit exposure. Of these

amounts, $2.3 billion, net of $.6 billion of related charges, with

total credit exposure of $4.6 billion were transferred to loans

held for sale. Approximately $276 million of loans held at

December 31, 2001 by companies formed with AIG are

classified in the consolidated financial statements as loans held

for sale.

Securities

Total securities at December 31, 2001 were $13.9 billion

compared with $5.9 billion at December 31, 2000. Total

securities represented 20% of total assets at December 31,

2001 compared with 8% at December 31, 2000. The increase

was primarily due to purchases of mortgage-backed and asset-

backed securities during 2001 and the retention of interests

from the securitization of residential mortgage loans as loans

declined and were replaced with securities. At December 31,

2001, the securities available for sale balance included a net

unrealized loss of $132 million, which represented the

difference between fair value and amortized cost. The

comparable amount at December 31, 2000 was a net

unrealized loss of $54 million. The expected weighted-average

life of securities available for sale was 4 years at December 31,

2001 compared with 4 years and 5 months at December 31,

2000.

The expected weighted-average life of securities held to

maturity was 18 years and 11 months at December 31, 2001.

PNC had no securities held for maturity at December 31,

2000. The securities classified as held to maturity are carried at

amortized cost and are owned by companies formed with AIG

in 2001 that are consolidated in PNC’s financial statements.

Funding Sources

Total funding sources were $59.4 billion at December 31, 2001

and 2000. The change in the composition of borrowed funds

reflected a shift within categories to manage overall funding

costs.

Total deposits were $47.3 billion at December 31, 2001

compared with $47.7 billion at December 31, 2000. Demand

and money market deposits increased due to ongoing strategic

marketing efforts to retain customers, as higher-cost, less

valuable retail certificates of deposit were de-emphasized.

Asset Quality

Nonperforming assets were $391 million at December 31,

2001 compared with $372 million at December 31, 2000. The

ratio of nonperforming assets to total loans, loans held for sale

and foreclosed assets was .93% at December 31, 2001

compared with .71% at December 31, 2000. The allowance

for credit losses was $560 million and represented 1.47% of

total loans and 265% of nonperforming loans at December 31,

2001. The comparable amounts were $598 million, 1.18% and

185%, respectively, at December 31, 2000.

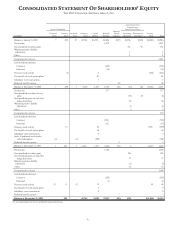

Capital

Shareholders’ equity totaled $5.8 billion at December 31, 2001

compared with $6.7 billion at December 31, 2000. The

payment of dividends, the impact of share buybacks, the

retirement of preferred stock and lower earnings in 2001

accounted for the decline. During 2001, PNC repurchased 9.5

million shares of common stock through open market or

privately negotiated transactions and purchased or redeemed

preferred stock for $301 million. The regulatory capital ratios

were 6.8% for leverage, 7.8% for tier I risk-based and 11.8%

for total risk-based capital at December 31, 2001 compared

with 8.0% for leverage, 8.6% for tier I risk-based and 12.6%

for total risk-based capital at December 31, 2000.