PNC Bank 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

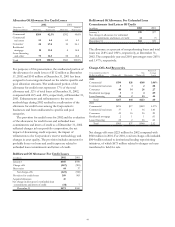

BLACKROCK

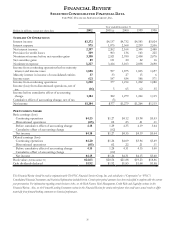

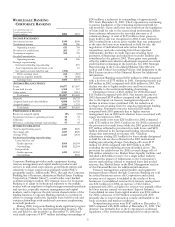

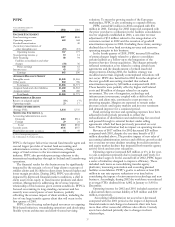

Year ended December 31

Dollars in millions 2002 2001

INCOME STATEMENT

Investment advisory and

administrative fees $519 $495

Other income 58 38

Total revenue 577 533

Operating expense 321 292

Fund administration

and servicing costs – affiliates 40 61

Amortization of goodwill and other

intangible assets 110

Total expense 362 363

Operating income 215 170

Nonoperating income 911

Pretax earnings 224 181

Income taxes 91 74

Earnings $133 $107

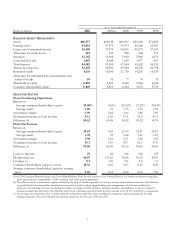

PERIOD-END BALANCE SHEET

Intangible assets $183 $182

Other assets 681 502

Total assets $864 $684

Liabilities $229 $198

Stockholders’ equity 635 486

Total liabilities and

stockholders’ equity $864 $684

PERFORMANCE DATA

Return on equity 24% 25%

Operating margin (a) 40 36

Diluted earnings per share $2.04 $1.65

OTHER INFORMATION

Average FTEs 823 758

ASSETS UNDER MANAGEMENT(b)

Separate accounts

Fixed income $157 $119

Liquidity 67

Liquidity – securities lending 611

Equity 10 10

Alternative investment products 55

Total separate accounts 184 152

Mutual funds (c)

Fixed income 19 16

Liquidity 66 62

Equity 49

Total mutual funds 89 87

Total assets under management $273 $239

(a) Excludes the impact of fund administration and servicing costs - affiliates.

(b) December 31 – in billions.

(c) Includes BlackRock Funds, BlackRock Provident Institutional Funds, BlackRock Closed

End Funds, Short Term Investment Fund and BlackRock Global Series Funds.

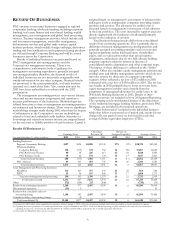

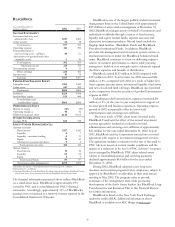

The financial information presented above reflects BlackRock

on a stand-alone basis. BlackRock is approximately 69%

owned by PNC and is consolidated into PNC’s financial

statements. Accordingly, approximately 31% of BlackRock’s

earnings were recognized as a minority interest expense in the

Consolidated Statement Of Income.

BlackRock is one of the largest publicly traded investment

management firms in the United States with approximately

$273 billion of assets under management at December 31,

2002. BlackRock manages assets on behalf of institutions and

individuals worldwide through a variety of fixed income,

liquidity and equity mutual funds, separate accounts and

alternative investment products. Mutual funds include the

flagship fund families - BlackRock Funds and BlackRock

Provident Institutional Funds. In addition, BlackRock

provides risk management and investment system services to

institutional investors under the BlackRock Solutions brand

name. BlackRock continues to focus on delivering superior

relative investment performance to clients while pursuing

strategies to build on core strengths and to selectively expand

the firm’s expertise and breadth of distribution.

BlackRock earned $133 million in 2002 compared with

$107 million in 2001. Total revenue for 2002 increased $44

million, or 8%, compared with 2001 as a result of higher fees

from separate account assets, institutional liquidity fund assets

and new closed-end fund offerings. BlackRock also benefited

in the comparison from the cessation of goodwill amortization

expense in 2002.

Excluding goodwill amortization, expenses increased $8

million, or 2%, in the year-to-year comparison in support of

revenue growth and business expansion. Operating expense

growth in 2002 was partially offset by lower fund

administration and servicing costs-affiliates.

The lower levels of PNC client assets invested in the

BlackRock Funds and the effect of the revised investment

services agreement resulted in a reduction in fund

administration and servicing costs-affiliates of approximately

$21 million for the year ended December 31, 2002. In July

2002, BlackRock and the Corporation entered into a revised

agreement with respect to investment management services.

The agreement includes a reduction in the rate of fees paid to

PNC Advisors based on current market conditions and the

impact of a reduction in the level of PNC Advisors’ customer

assets managed by BlackRock. PNC client-related assets

subject to fund administration and servicing payments

declined approximately $4.8 billion for the year ended

December 31, 2002.

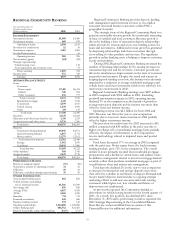

During 2002, BlackRock adopted a new long-term

incentive and retention program for key employees, subject to

approval by BlackRock’s stockholders at their next annual

meeting in May 2003. The program seeks to provide

continuity of the management team while promoting

development of the firm's future leaders. See BlackRock Long-

Term Incentive and Retention Plan in this Financial Review

for further information.

BlackRock is listed on the New York Stock Exchange

under the symbol BLK. Additional information about

BlackRock is available in its SEC filings at www.sec.gov.