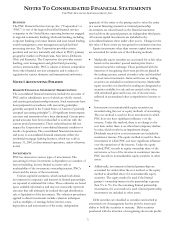

PNC Bank 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

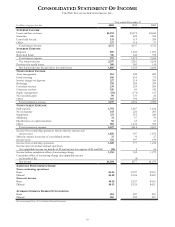

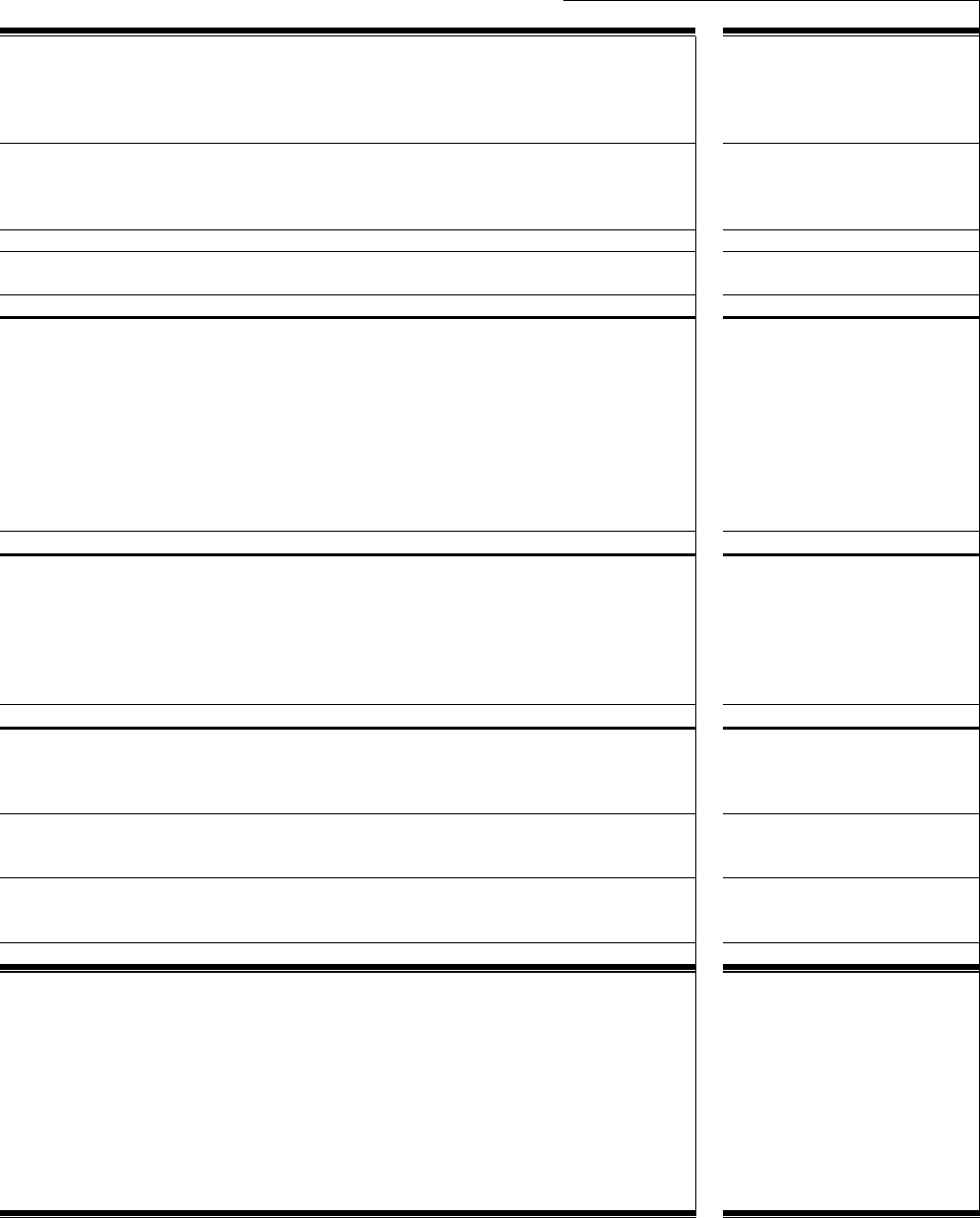

CONSOLIDATED STATEMENT OF INCOME

THE PNC FINANCIAL SERVICES GROUP, INC.

68

Year ended December 31

In millions, except per share data 2002 2001 2000

INTEREST INCOME

Loans and fees on loans $2,294 $3,279 $4,045

Securities 616 625 386

Loans held for sale 135 119 204

Other 127 114 97

Total interest income 3,172 4,137 4,732

INTEREST EXPENSE

Deposits 659 1,229 1,653

Borrowed funds 316 646 915

Total interest expense 975 1,875 2,568

Net interest income 2,197 2,262 2,164

Provision for credit losses 309 903 136

Net interest income less provision for credit losses 1,888 1,359 2,028

NONINTEREST INCOME

Asset management 853 848 809

Fund servicing 816 833 713

Service charges on deposits 227 218 206

Brokerage 195 206 249

Consumer services 239 229 209

Corporate services 526 60 342

Equity management (51) (179) 133

Net securities gains 89 131 20

Other 303 306 269

Total noninterest income 3,197 2,652 2,950

NONINTEREST EXPENSE

Staff expense 1,701 1,667 1,616

Net occupancy 243 220 203

Equipment 271 255 224

Marketing 51 57 70

Distributions on capital securities 58 63 67

Other 903 1,152 923

Total noninterest expense 3,227 3,414 3,103

Income from continuing operations before minority interest and

income taxes 1,858 597 1,875

Minority interest in income of consolidated entities 37 33 27

Income taxes 621 187 634

Income from continuing operations 1,200 377 1,214

Income (loss) from discontinued operations

(less applicable income tax benefit of $9 and income tax expense of $0 and $44) (16) 565

Income before cumulative effect of accounting change 1,184 382 1,279

Cumulative effect of accounting change (less applicable income

tax benefit of $2) (5)

Net income $1,184 $377 $1,279

EARNINGS PER COMMON SHARE

From continuing operations

Basic $4.23 $1.27 $4.12

Diluted $4.20 $1.26 $4.09

From net income

Basic $4.18 $1.27 $4.35

Diluted $4.15 $1.26 $4.31

AVERAGE COMMON SHARES OUTSTANDING

Basic 283 287 290

Diluted 285 290 293

See accompanying Notes To Consolidated Financial Statements.