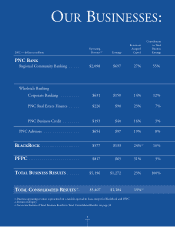

PNC Bank 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Q: How are PNC’s banking

businesses positioned?

Q:Will you change how PNC

reports its results?

A: We have made great strides

in our banking businesses.

Since 1998, Regional

Community Banking has

demonstrated consistent

growth with a significant

increase in its checking cus-

tomer base. Ongoing invest-

ments in that business have

given us the tools to sell more

PNC services — such as

home equity, brokerage, and

annuity products — to

more households.

Our Wholesale Banking

businesses enjoy an improved

credit risk profile and a strong

middle market presence in the

regions we serve. They also

contain key national businesses,

6

Q: What have you

learned about PNC

in your time here?

such as treasury management,

that are well-known and

positioned to attract larger

national customers.

PNC Advisors is address-

ing the significant transforma-

tion now taking place in the

wealth management business

with efforts to create a dis-

tinctive client experience,

strengthen its product set,

and improve retention.

In all of our banking

businesses, we continue to

look for opportunities to

improve efficiency as well.

— Guyaux

A: Yes. In fact, we’ve already

begun that process.

It was clear through some

of the feedback that we need-

ed to provide more clarity and

context in our results.

For example, we’re work-

ing to provide a clearer picture

of our business performance.

We’ve already increased the

level of detail included in our

quarterly results, and we plan

to continue making similar

enhancements.

To achieve more synergies

and efficiencies, in 2003 we’re

beginning to manage our cor-

porate banking, real estate

finance, and asset-based lending

activities as one business.

Moving forward, we’ll report

their results as one business —

Wholesale Banking.

— Demchak

A: I knew coming in that

this is a strong company with

great prospects.

I’m incredibly impressed

by our employees. Their

intense devotion to meeting

client needs and their empha-

sis on teamwork make a par-

ticularly powerful statement

about the PNC culture.

It’s also a company that

has built a very strong finan-

cial foundation. The diverse

revenue mix, the excellent

capital and liquidity posi-

tions…these characteristics

help differentiate PNC from

our peers and provide us with

a better opportunity to create

value over the long term.

I’m very excited to be here

and will do my best to help

further this progress.

— Demchak