PNC Bank 2002 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

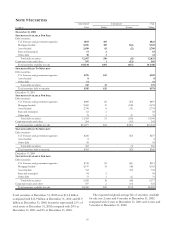

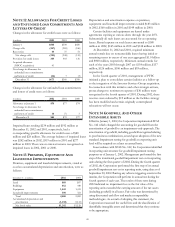

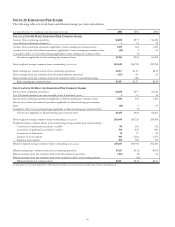

Series A through D are cumulative and, except for Series B,

are redeemable at the option of the Corporation. Annual

dividends on Series A, B and D preferred stock total $1.80 per

share and on Series C preferred stock total $1.60 per share.

Holders of Series A through D preferred stock are entitled to

a number of votes equal to the number of full shares of

common stock into which such preferred stock is convertible.

Series A through D preferred stock have the following

conversion privileges: (i) one share of Series A or Series B is

convertible into eight shares of common stock; and (ii) 2.4

shares of Series C or Series D are convertible into four shares

of common stock.

During 2000, the Board of Directors adopted a

shareholder rights plan providing for issuance of share

purchase rights. Except as provided in the plan, if a person or

group becomes beneficial owner of 10% or more of PNC’s

outstanding common stock, all holders of the rights, other

than such person or group, may purchase PNC common stock

or equivalent preferred stock at half of market value.

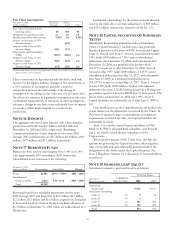

The Corporation has a dividend reinvestment and stock

purchase plan. Holders of preferred stock and common stock

may participate in the plan, which provides that additional

shares of common stock may be purchased at market value

with reinvested dividends and voluntary cash payments.

Common shares issued pursuant to this plan were: 796,140

shares in 2002, 472,015 shares in 2001, and 649,334 shares in

2000.

At December 31, 2002, the Corporation had reserved

approximately 30.7 million common shares to be issued in

connection with certain stock plans and the conversion of

certain debt and equity securities.

In January 2002, the Board of Directors authorized the

Corporation to purchase up to 35 million shares of its

common stock through February 29, 2004. These shares may

be purchased in the open market or in privately negotiated

transactions. This authorization terminated any prior

authorization. During 2002, a total of 320,000 shares were

repurchased under this program, all in the first quarter. Under

this program, the Corporation currently expects to purchase

between $250 million and $1 billion of its common stock

during 2003. The extent and timing of any future share

repurchases will depend on a number of factors including,

among others, market and general economic conditions,

regulatory capital considerations, alternative uses of capital and

the potential impact on PNC’s credit rating. Under applicable

regulations, as long as PNC remains subject to its written

agreement with the Federal Reserve, it must obtain prior

regulatory approval to repurchase its common stock in

amounts that exceed 10 percent of consolidated net worth in

any 12-month period.

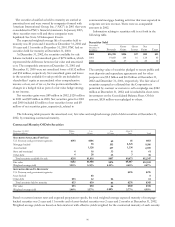

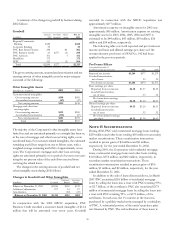

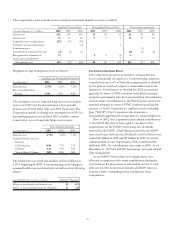

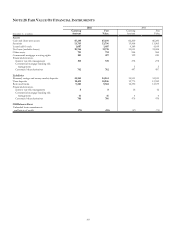

NOTE 20 FINANCIAL DERIVATIVES

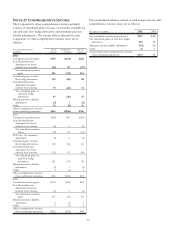

Effective January 1, 2001, the Corporation implemented SFAS

No. 133. As a result of the adoption of this statement, the

Corporation recognized, in the first quarter of 2001, an after-

tax loss from the cumulative effect of a change in accounting

principle of $5 million reported in the consolidated income

statement and an after-tax accumulated other comprehensive

loss of $4 million. The impact of the adoption of this standard

related to the residential mortgage banking business is

reflected in the results of discontinued operations.

Earnings adjustments resulting from cash flow and fair

value hedge ineffectiveness were not significant to the results

of operations of the Corporation during 2002 or 2001.

During the next twelve months, the Corporation expects

to reclassify to earnings $138 million of pretax net gains, or

$90 million after tax, on cash flow hedge derivatives currently

reported in accumulated other comprehensive income. These

net gains are anticipated to result from net cash flows on

receive fixed interest rate swaps and would mitigate reductions

in interest income recognized on the related floating rate

commercial loans.

The Corporation generally has established agreements with

its major derivative dealer counterparties that provide for

exchanges of marketable securities or cash to collateralize

either party’s positions. At December 31, 2002 the

Corporation held cash and U.S. government securities with a

fair value of $377 million and pledged mortgage-backed

securities with a fair value of $149 million under these

agreements.

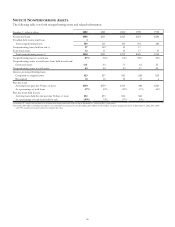

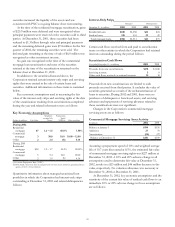

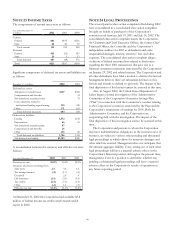

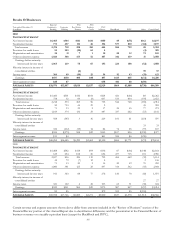

NOTE 21 EMPLOYEE BENEFIT PLANS

PENSION AND POST-RETIREMENT PLANS

The Corporation has a noncontributory, qualified defined

benefit pension plan covering most employees. Retirement

benefits are derived from a cash balance formula based on

compensation levels, age and length of service. Pension

contributions are based on an actuarially determined amount

necessary to fund total benefits payable to plan participants.

The Corporation also maintains nonqualified supplemental

retirement plans for certain employees. All retirement benefits

provided under these plans are unfunded and any payments to

plan participants are made by the Corporation. The

Corporation also provides certain health care and life

insurance benefits for retired employees (“post-retirement

benefits”) through various plans.