PNC Bank 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.77

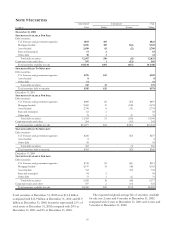

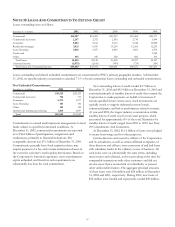

Net adjustments to the allowance for unfunded loan

commitments and letters of credit are included in the

provision for credit losses.

COMMERCIAL MORTGAGE SERVICING RIGHTS

PNC provides servicing under various commercial loan

servicing contracts. These contracts are either purchased in the

market place or retained as part of a commercial mortgage

loan securitization. If a contract is purchased, it is recorded at

cost. If a contract is retained, the servicing right is recorded

based on its relative fair value to all of the assets securitized.

Fair value is based on the present value of the future cash

flows, including assumptions as to prepayment speeds,

discount rate, interest rates, cost to service and other factors.

The asset is amortized over its estimated life in proportion to

estimated net servicing income. On a quarterly basis, the asset

is tested for impairment. If the estimated fair value of the asset

is less than the carrying value, an impairment loss is

recognized. The asset is recorded as an Other Intangible Asset.

Servicing fees are recognized as they are earned and are

reported in Corporate Services as part of noninterest income.

The related amortization expense is also classified in

Corporate Services.

GOODWILL AND OTHER INTANGIBLE ASSETS

With the adoption of SFAS No. 142, “Goodwill and Other

Intangible Assets” (“SFAS 142”), on January 1, 2002, goodwill

is no longer amortized to expense, but rather is tested for

impairment periodically. Certain other intangible assets are

amortized to expense using accelerated or straight-line

methods over their respective estimated useful lives. At least

annually, management reviews goodwill and other intangible

assets and evaluates events or changes in circumstances that

may indicate impairment in the carrying amount of such

assets. If the sum of the expected undiscounted future cash

flows, excluding interest charges, is less than the carrying

amount of the asset, an impairment loss is recognized.

Impairment, if any, is measured on a discounted future cash

flow basis.

DEPRECIATION AND AMORTIZATION

For financial reporting purposes, premises and equipment are

depreciated principally using the straight-line method over

their estimated useful lives.

The estimated useful lives used for furniture and

equipment range from one to 10 years, while buildings are

depreciated over an estimated useful life of 39 years.

Leasehold improvements are amortized over their estimated

useful lives of up to 10 years, or the respective lease terms,

whichever is shorter.

REPURCHASE AND RESALE AGREEMENTS

Repurchase and resale agreements are treated as collateralized

financing transactions and are carried at the amounts at which

the securities will be subsequently reacquired or resold,

including accrued interest, as specified in the respective

agreements. The Corporation’s policy is to take possession of

securities purchased under agreements to resell. The market

value of securities to be repurchased and resold is monitored,

and additional collateral may be obtained where considered

appropriate to protect against credit exposure.

TREASURY STOCK

The Corporation records common stock purchased for

treasury at cost. At the date of subsequent reissue, the treasury

stock account is reduced by the cost of such stock on the first-

in, first-out basis.

DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Corporation uses a variety of financial derivatives as part

of the overall asset and liability risk management process to

manage interest rate, market and credit risk inherent in the

Corporation’s business activities. Substantially all such

instruments are used to manage risk related to changes in

interest rates. Interest rate and total rate of return swaps,

purchased interest rate caps and floors and futures contracts

are the primary instruments used by the Corporation for

interest rate risk management.

Interest rate swaps are agreements with a counterparty to

exchange periodic fixed and floating interest payments

calculated on a notional amount. The floating rate is based on

a money market index, primarily short-term LIBOR. Total rate

of return swaps are agreements with a counterparty to

exchange an interest rate payment for the total rate of return

on a specified reference index calculated on a notional

amount. Purchased interest rate caps and floors are

agreements where, for a fee, the counterparty agrees to pay the

Corporation the amount, if any, by which a specified market

interest rate exceeds or is less than a defined rate applied to a

notional amount, respectively. Interest rate futures contracts

are exchange-traded agreements to make or take delivery of a

financial instrument at an agreed upon price and are settled in

cash daily.

Financial derivatives involve, to varying degrees, interest

rate, market and credit risk. The Corporation manages these

risks as part of its asset and liability management process and

through credit policies and procedures. The Corporation seeks

to minimize counterparty credit risk by entering into

transactions with only a select number of high-quality

institutions, establishing credit limits, and generally requiring

bilateral netting and collateral agreements.