PNC Bank 2002 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

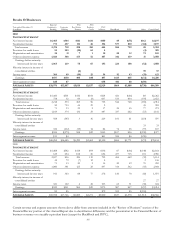

107

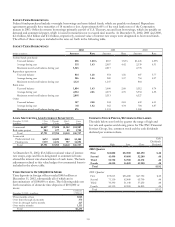

During 2002, 2001 and 2000, the parent company received

net income tax refunds of $36 million, $37 million and $36

million, respectively. Such refunds represent the parent

company’s portion of consolidated income taxes. During

2002, 2001 and 2000, the parent company paid interest of $45

million, $49 million and $56 million, respectively.

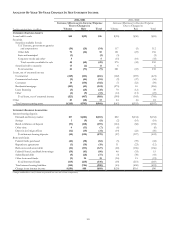

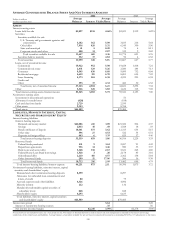

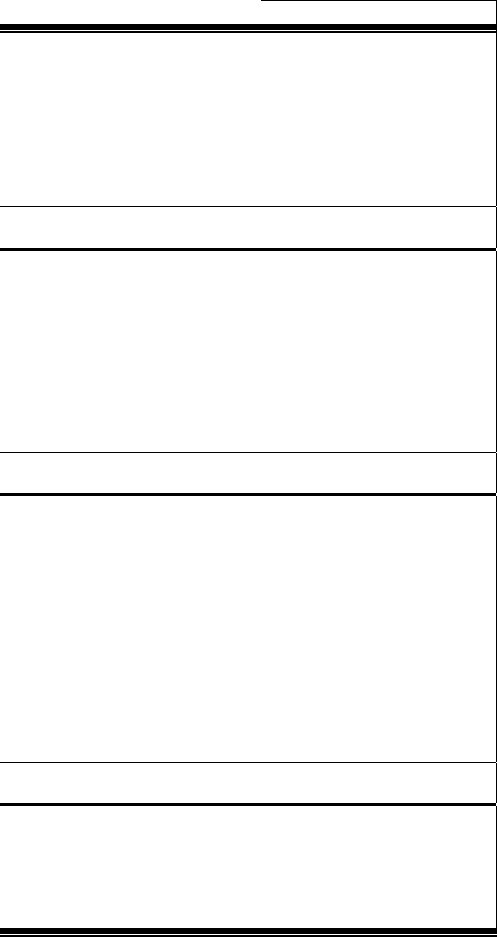

Statement Of Cash Flows

Year ended December 31 - in millions 2002 2001 2000

OPERATING ACTIVITIES

Net income $1,184 $377 $1,279

Adjustments to reconcile net

income to net cash provided

(used) by operating activities:

Equity in undistributed net

earnings of subsidiaries (659) 768 (551)

Other 10 44 (24)

Net cash provided by operating

activities 535 1,189 704

INVESTING ACTIVITIES

Net change in short-term

investments with subsidiary bank 16

Net capital (contributed to)

returned from subsidiaries (125) (237) 258

Securities available for sale

Sales and maturities 1,556 1,206 372

Purchases (1,655) (1,247) (425)

Other (1) (14) (13)

Net cash (used) provided by

investing activities (225) (292) 208

FINANCING ACTIVITIES

Borrowings from nonbank

subsidiary 393 763 314

Repayments on borrowings from

nonbank subsidiary (223) (190) (440)

Acquisition of treasury stock (62) (681) (428)

Cash dividends paid to

shareholders (546) (569) (546)

Issuance of stock 128 181 189

Series F preferred stock tender

offer/maturity (301)

Repayments on borrowings (100)

Net cash used by financing

activities (310) (897) (911)

Increase in cash and due from

banks 1

Cash and due from banks at

beginning of year 11

Cash and due from banks at end

of year $1 $1 $1

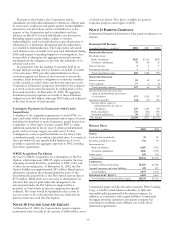

NOTE 32 SUBSEQUENT EVENT

In January 2003, PNC took actions to convert its preferred

shares and subsequently requested liquidation of the three

companies formed in 2001 in transactions with AIG. These

companies had been consolidated into the financial statements

of PNC since 2001.

Prior to the distribution of assets, the companies sold debt

securities previously classified as held to maturity in their

financial statements and incurred liquidation costs as required

by the operating agreements. Liquidating distributions of cash

and interests in subsidiaries of the three companies that held

loan and venture capital assets were made. These assets had

been transferred from PNC subsidiaries to the companies as

part of the original transactions in 2001. The net impact on

PNC’s consolidated financial condition or results of

operations was not material.