Nokia 2011 Annual Report Download - page 97

Download and view the complete annual report

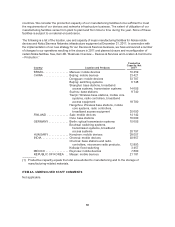

Please find page 97 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.families in a series of transactions to non-manufacturing patent licensing entities. Despite such

divestments, we have maintained the strength and size of our patent portfolio on a stable level of

approximately 10 000 patent families.

Uncertain Global Macroeconomic Environment

We are currently experiencing a time of great global macroeconomic uncertainty. This uncertainty can

cause unprecedented and dramatic shifts in consumer behavior, which can have significant effects on

the mobile device industry. These effects could include, for example, consumers reducing the amount

they are willing to spend on mobile products, which would negatively affect industry average selling

prices, or consumers postponing purchases of new products, which would negatively affect device

replacement cycles. These types of shifts in consumer behavior could potentially have a material

adverse effect on our net sales and profitability in 2012.

While negative to the industry overall, we believe that the impact of any dramatic shifts in consumer

behavior could be mitigated to a certain extent by our global distribution network, geographically well

diversified supply-chain, relatively fragmented customer space and the breadth of our offering, which

covers a wide range of price points. Furthermore, during our ongoing transition to Windows Phone as

our primary smartphone platform our financial position has continued to be relatively strong. We

continuously monitor the strength of our financial position and assess its adequacy in different net

sales and profitability scenarios.

Additionally, we have identified and implemented certain precautionary measures designed to limit the

possible immediate direct negative consequences resulting from the potential deterioration of the

economic situation within the eurozone.

Operational Efficiency and Cost Control

The factors and trends discussed above influence our net sales and gross profit potential. In addition,

operational efficiency and cost control are important factors affecting our profitability and

competitiveness. We continuously assess our cost structure and prioritize our investments. Our

objective remains to maintain our strong capital structure, focus on profitability and cash flow and

invest appropriately to innovate and grow in key strategic areas.

We expect that the adoption of Windows Phone as our primary smartphone platform will enable us to

reduce significantly our operating expenses. For example, the Microsoft partnership allows us to

eliminate certain research and development investments, particularly in operating systems and

services, which we expect will result in lower overall research and development expenditures over the

longer-term in our Devices & Services business.

We announced in 2011 that we are targeting to reduce our Devices & Services operating expenses by

more than EUR 1 billion for the full year 2013, compared to the Devices & Services operating

expenses of EUR 5.35 billion for the full year 2010, excluding special items and purchase price

accounting related items.

We have announced a number of planned changes to our operations during 2011 and 2012 in

connection with the implementation of our new strategy in our Devices & Services business and the

creation of our new Location & Commerce business. The planned changes include substantial

personnel reductions, site and facility closures and reconfiguration of certain facilities.

Initially, we announced that we are focusing our restructuring work primarily on the research and

development teams to ensure that we correctly allocate resources for the new strategy at appropriate

cost levels. In addition, we agreed to outsource our Symbian software development and support

activities to Accenture, which resulted in the transfer of approximately 2 300 employees to Accenture.

We later announced that we are accelerating structural change in other parts of the organization in

order to ensure that we are responsive to the changing dynamics in our industry. This phase includes

95