Nokia 2011 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296

|

|

IFRS 10 Consolidated Financial Statements establishes principles for the presentation and preparation

of consolidated financial statements when an entity controls one or more other entities.

IFRS 11 Joint Arrangements establishes that the legal form of an arrangement should not be the

primary factor in the determination of the appropriate accounting for the arrangement. Party to a joint

arrangement determines the type of joint arrangement in which it is involved by assessing its rights and

obligations and then accounting for those rights and obligations in accordance with that type of joint

arrangement.

IFRS 12 Disclosure of Interests in Other Entities requires disclosure of information that enables users

of financial statements to evaluate nature of, and risks associated with, its interests in other entities

and the effects of those interests on its financial position, financial performance and cash flows.

IFRS 13 Fair Value Measurement replaces fair value measurement guidance contained within

individual IFRSs with a single, unified definition of fair value in a single new IFRS standard. The new

standard provides a framework for measuring fair value, related disclosure requirements about fair

value measurements and further authoritative guidance on the application of fair value measurement in

inactive markets.

Amendments to IAS 1 Presentation of Financial Statements retains the ‘one or two statement’

approach at the option of the entity and only revises the way other comprehensive income is

presented: Requiring separate subtotals for those elements which may be ‘recycled’ and those

elements that will not.

Amendment to IAS 12 Income Taxes provides clarification for measurement of deferred taxes in

situations where an asset is measured using the fair value model in IAS 40 Investment Property by

introducing a presumption that the carrying amount of the underlying asset will be recovered through

sale.

Amended IAS 19 Employee Benefits discontinues the use of the ‘corridor’ approach and

re-measurement impacts will be recognized in other comprehensive income (with the remainder in

profit or loss). Other long-term benefits are required to be measured in the same way even though

changes in the recognized amount are fully reflected in profit or loss. Treatment for termination

benefits, specifically the point in time when an entity would recognize a liability for termination benefits

is also revised.

Amendments to IAS 1 and IAS 12 will be adopted on January 1, 2012. The Group expects to adopt the

new standards IFRS 10, IFRS 11, IFRS 12 and IFRS 13 as well as the amended IAS 19 on their

effective date, January 1, 2013.

On 16 December 2011, the IASB amended the effective date of IFRS 9 to annual periods beginning on

or after 1 January 2015, and modified the relief from restating comparative periods and the associated

disclosures in IFRS 7. The Group will adopt the standard on the revised effective date.

The Group is currently evaluating potential impact of the new standards on its accounts.

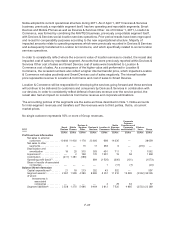

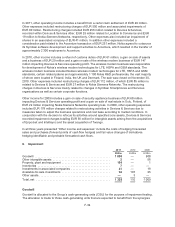

2. Segment information

Nokia has three businesses: Devices & Services, Location & Commerce and Nokia Siemens Networks,

and four operating and reportable segments for financial reporting purposes: Smart Devices and

Mobile Phones within our Devices & Services business, Location & Commerce and Nokia Siemens

Networks.

F-25