Nokia 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

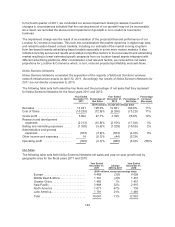

Gross Margin

Our Devices & Services gross margin in 2011 was 27.7%, compared to 29.9% in 2010. On a

year-on-year basis, the decline in our Devices & Services gross margin in 2011 was driven primarily by

gross margin declines in both Smart Devices and, to a lesser extent, in Mobile Phones, as discussed

below, which was partially offset by higher IPR royalty income.

Operating Expenses

Devices & Services research and development expenses in 2011 decreased 9% to EUR 2 441 million,

compared with EUR 2 694 million in 2010. In 2011, research and development expenses represented

10.2% of Devices & Services net sales, compared with 9.2% in 2010. The decrease in Devices &

Services research and development expenses was primarily due to declines in Smart Devices and

Devices & Services Other research and development expenses, partially offset by an increase in

Mobile Phones research and development expenses. The decreases in Smart Devices and Devices &

Services Other research and development expenses were due primarily to a focus on priority projects

and cost controls. The increase in Mobile Phones research and development expenses was due

primarily to investments to accelerate product development to bring new innovations to the market

faster and at lower price-points, consistent with the Mobile Phones “internet for the next billion”

strategy. This increase was partially offset by a focus on priority projects and cost controls.

Devices & Services R&D expenses included amortization of acquired intangible assets of

EUR 8 million and EUR 10 million in 2011 and 2010, respectively.

In 2011, Devices & Services selling and marketing expenses decreased 4% to EUR 2 180 million,

compared with EUR 2 270 million in 2010. The decrease was primarily due to lower Smart Devices

sales and marketing expenses. In 2011, selling and marketing expenses represented 9.1% of

Devices & Services net sales, compared with 7.8% of its net sales in 2010.

Devices & Services administrative and general expenses in 2011 decreased 7% to EUR 362 million,

compared with EUR 388 million in 2010. The decrease in Devices & Services administrative and

general expenses was primarily driven by lower Smart Devices administrative and general expenses

which more than offset an increase in Devices & Services Other administrative and general expenses.

In 2011, administrative and general expenses represented 1.5% of Devices & Services net sales,

compared with 1.3% in 2010.

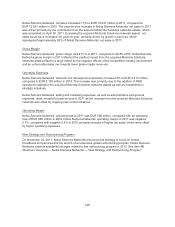

Other operating income and expenses were expense of EUR 773 million in 2011 and included

restructuring charges of 456 million, impairment of assets of EUR 90 million, Accenture deal

consideration related to the Accenture transaction of EUR 251 million, impairment of shares in an

associated company of EUR 41 million and a benefit from a cartel claim settlement of EUR 49 million.

In 2010, other operating income and expenses were EUR 170 million and included restructuring

charges of EUR 85 million, a prior year-related refund of customs duties of EUR 61 million, a gain on

sale of assets and business of EUR 29 million and a gain on sale of the wireless modem business of

EUR 147 million.

Cost Reduction Activities and Planned Operational Adjustments

We are targeting to reduce our Devices & Services operating expenses by more than EUR 1 billion for

the full year 2013, compared to Devices & Services operating expenses of EUR 5.35 billion for the full

year 2010, excluding special items and purchase price accounting related items. This reduction is

expected to come from a variety of different sources and initiatives, including a planned reduction in

the number of employees and normal personnel attrition, a reduction in the use of outsourced

professionals, reductions in facility costs, and various improvements in efficiencies. See “—Principal

Factors & Trends Affecting our Results of Operations—Devices & Services—Operational Efficiency

and Cost Control” in this Item 5 for a discussion of our restructuring actions.

119