Nokia 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

into consideration the market dynamics in digital map data and related location-based content markets,

including the Group’s long-term view that the market will move from fee-based models towards

advertising-based models especially in some more mature markets. It also reflects recently announced

results and related competitive factors in local search and advertising market resulting in lower

estimated growth prospects from location-based assets integrated with different advertising platforms.

After consideration of all relevant factors, the Group reduced the net sales projections for the Location

& Commerce CGU which, in turn, reduced projected profitability and cash flows.

The Group has concluded that the recoverable amount for the Location & Commerce CGU is most

sensitive to the valuation assumptions for discount rate and long-term growth rate. A reasonably

possible increase in the discount rate or decrease in long-term growth rate would give rise to an

additional material impairment loss.

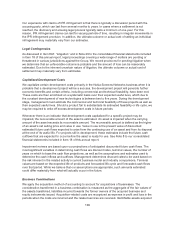

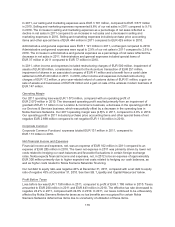

The key assumptions applied in the impairment testing for each CGU in the annual goodwill

impairment testing for each year indicated are presented in the table below:

Cash generating units

Smart

Devices

%

Mobile

Phones

%

Devices &

Services

%

Nokia Siemens

Networks

%

Location &

Commerce

%

2011 2011 2011 2010 2009 2011 2010 2009 2011 2010 2009

Terminal growth rate .... 1.9 1.5 — 2.0 2.0 1.0 — 1.0 3.1 4.0 5.0

Post-tax discount rate . . . 9.0 9.0 — 8.7 — 10.4 — — 9.7 9.6 —

Pre-tax discount rate .... 12.2 13.1 — 11.1 11.5 13.8 — 13.2 13.1 12.8 12.6

Both value in use of Smart Devices CGU and Mobile Phones CGU and fair value less costs to sell for

Location & Commerce CGU and Nokia Siemens Networks CGU are determined on a pre-tax value

basis using pre-tax valuation assumptions including pre-tax cash flows and pre-tax discount rate. As

market-based rates of return for the Group’s CGUs are available only on a post-tax basis, the pre-tax

discount rates are derived by adjusting the post-tax discount rates to reflect the specific amount and

timing of future tax cash flows. The discount rates applied in the impairment testing for each CGU have

been determined independently of capital structure reflecting current assessments of the time value of

money and relevant market risk premiums. Risk premiums included in the determination of the

discount rate reflect risks and uncertainties for which the future cash flow estimates have not been

adjusted.

In 2009, the Group recorded an impairment loss of EUR 908 million to reduce the carrying amount of

the Nokia Siemens Networks CGU to its recoverable amount. The impairment loss was allocated in its

entirety to the carrying amount of goodwill arising from the formation of Nokia Siemens Networks and

from subsequent acquisitions completed by Nokia Siemens Networks. As a result of the impairment

loss, the amount of goodwill allocated to the Nokia Siemens Networks CGU in the year ended

December 31, 2009, was reduced to zero. Goodwill allocated to the Nokia Siemens Networks CGU

has subsequently increased during 2011, primarily as a result of the acquisition of Motorola Solutions’

Networks business.

The goodwill impairment testing conducted for each of the Group’s CGUs for the year ended

December 31, 2010 did not result in any impairment charges. See also Note 8 to our consolidated

financial statements included in Item 18 of this annual report for further information regarding

“Valuation of long-lived and intangible assets and goodwill.”

Fair Value of Derivatives and Other Financial Instruments

The fair value of financial instruments that are not traded in an active market (for example, unlisted

equities, currency options and embedded derivatives) are determined using valuation techniques. We

use judgment to select an appropriate valuation methodology and underlying assumptions based

112