Nokia 2011 Annual Report Download - page 272

Download and view the complete annual report

Please find page 272 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296

|

|

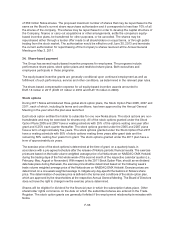

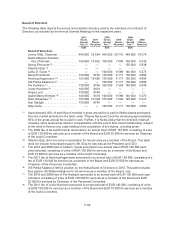

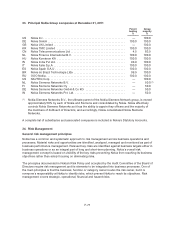

On the basis of these plans, the Group had 0.1 million stock options outstanding on December 31,

2011. The weighted average exercise price is USD 11.02.

In connection with the July 10, 2008 acquisition of NAVTEQ, the Group assumed NAVTEQ’s 2001 Stock

Incentive Plan (“NAVTEQ Plan”). All unvested NAVTEQ restricted stock units under the NAVTEQ Plan

were converted to an equivalent number of restricted stock units entitling their holders to Nokia shares.

The maximum number of Nokia shares to be delivered to NAVTEQ employees during the years 2008-

2012 is approximately 3 million, of which approximately 2.5 million shares have already been delivered by

December 31, 2011. The Group does not intend to make further awards under the NAVTEQ Plan.

The Group also has an Employee Share Purchase Plan in the United States, which permits all full-time Nokia

employees located in the United States to acquire Nokia ADSs at a 15% discount. The purchase of the ADSs

is funded through monthly payroll deductions from the salary of the participants, and the ADSs are purchased

on a monthly basis. As of December 31, 2011, approximately 800 000 ADSs had been purchased under this

plan during 2011, and there were a total of approximately 1 220 participants in the plan.

Nokia also has a one-time special CEO incentive program designed to align the CEO’s compensation

to increased shareholder value and links a meaningful portion of CEO’s compensation directly to the

performance of Nokia’s share price over the period of 2011-2012. Mr. Elop has the opportunity to earn

125 000 – 750 000 Nokia shares at the end of 2012 based on two independent criteria: Total

Shareholder Return (TSR) relative to a peer group of companies over the two-year period and Nokia’s

absolute share price at the end of 2012. If the minimum performance for neither of the two

performance criterion is reached, no share delivery will take place. Shares earned under this plan are

subject to an additional one-year vesting period.

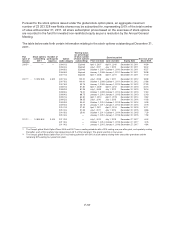

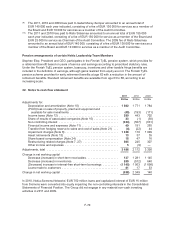

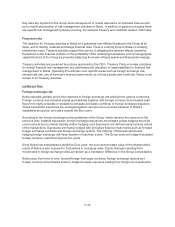

25. Deferred taxes

2011 2010

EURm EURm

Deferred tax assets:

Intercompany profit in inventory ................................... 66 76

Tax losses carried forward and unused tax credits .................... 715 488

Warranty provision .............................................. 63 82

Other provisions ................................................ 363 268

Depreciation differences and untaxed reserves ...................... 711 782

Share-based compensation ...................................... 11 21

Other temporary differences ...................................... 362 347

Reclassification due to netting of deferred taxes ...................... (443) (468)

Total deferred tax assets ................................................ 1848 1 596

Deferred tax liabilities:

Depreciation differences and untaxed reserves ...................... (500) (406)

Fair value gains/losses .......................................... (65) (13)

Undistributed earnings ........................................... (268) (353)

Other temporary differences (1) .................................... (410) (718)

Reclassification due to netting of deferred taxes ...................... 443 468

Total deferred tax liabilities ............................................... (800) (1 022)

Net deferred tax asset .................................................. 1 048 574

Tax charged to equity ................................................... (4) (1)

(1) In 2011 other temporary differences include a deferred tax liability of EUR 339 million

(EUR 542 million in 2010) arising from purchase price allocation related to Nokia Siemens

Networks and NAVTEQ.

F-62