Nokia 2011 Annual Report Download - page 266

Download and view the complete annual report

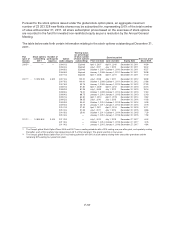

Please find page 266 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of 360 million Nokia shares. The proposed maximum number of shares that may be repurchased is the

same as the Board’s current share repurchase authorization and it corresponds to less than 10% of all

the shares of the company. The shares may be repurchased in order to develop the capital structure of

the Company, finance or carry out acquisitions or other arrangements, settle the company’s equity-

based incentive plans, be transferred for other purposes, or be cancelled. The shares may be

repurchased either through a tender offer made to all shareholders on equal terms, or through public

trading from the stock market. The authorization would be effective until June 30, 2013 and terminate

the current authorization for repurchasing of the Company’s shares resolved at the Annual General

Meeting on May 3, 2011.

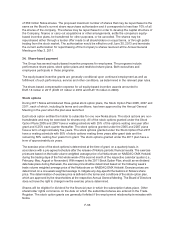

24. Share-based payment

The Group has several equity-based incentive programs for employees. The programs include

performance share plans, stock option plans and restricted share plans. Both executives and

employees participate in these programs.

The equity-based incentive grants are generally conditional upon continued employment as well as

fulfillment of such performance, service and other conditions, as determined in the relevant plan rules.

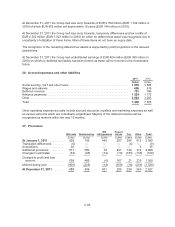

The share-based compensation expense for all equity-based incentive awards amounted to

EUR 18 million in 2011 (EUR 47 million in 2010 and EUR 16 million in 2009).

Stock options

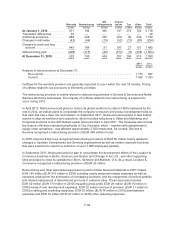

During 2011 Nokia administered three global stock option plans, the Stock Option Plan 2005, 2007 and

2011, each of which, including its terms and conditions, has been approved by the Annual General

Meeting in the year when the plan was launched.

Each stock option entitles the holder to subscribe for one new Nokia share. The stock options are non-

transferable and may be exercised for shares only. All of the stock options granted under the Stock

Option Plans 2005 and 2007 have a vesting schedule with 25% of the options vesting one year after

grant and 6.25% each quarter thereafter. The stock options granted under the 2005 and 2007 plans

have a term of approximately five years. The stock options granted under the Stock Option Plan 2011

have a vesting schedule with 50% of stock options vesting three years after grant date and the

remaining 50% vesting four years from grant. The stock options granted under the 2011 plan have a

term of approximately six years.

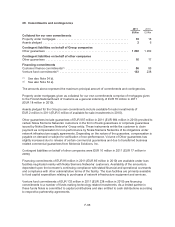

The exercise price of the stock options is determined at the time of grant, on a quarterly basis, in

accordance with a pre-agreed schedule after the release of Nokia’s periodic financial results. The exercise

prices are based on the trade volume weighted average price of a Nokia share on NASDAQ OMX Helsinki

during the trading days of the first whole week of the second month of the respective calendar quarter (i.e.,

February, May, August or November). With respect to the 2011 Stock Option Plan, should an ex-dividend

date take place during that week, the exercise price shall be determined based on the following week’s

trade volume weighted average price of the Nokia share on NASDAQ OMX Helsinki. Exercise prices are

determined on a one-week weighted average to mitigate any day-specific fluctuations in Nokia’s share

price. The determination of exercise price is defined in the terms and conditions of the stock option plan,

which are approved by the shareholders at the respective Annual General Meeting. The Board of Directors

does not have the right to change how the exercise price is determined.

Shares will be eligible for dividend for the financial year in which the subscription takes place. Other

shareholder rights commence on the date on which the subscribed shares are entered in the Trade

Register. The stock option grants are generally forfeited if the employment relationship terminates with

Nokia.

F-56