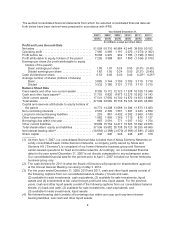

Nokia 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• There may be elements in the feature phone ecosystems that are not in other ecosystems we

support, such as the Windows Phone ecosystem, which may require additional resources and

duplicative investments by us.

• Our strategic choices regarding our Symbian platform and market perceptions of the Symbian

platform may have a negative effect on the attractiveness of our feature phones as

consumers may confuse the Symbian platform with our feature phone platforms.

We face intense competition in mobile products and in the digital map data and related

location-based content and services markets.

We experience intense competition in every aspect of our business and across all markets for our

mobile products. Mobile device markets are segmented, diversified and increasingly commoditized. We

face competition from a growing number of participants in different user segments, price points and

geographical markets, as well as layers of the mobile product using different competitive means in

each of them. In some of those layers, we may have more limited experience and scale than our

competitors. This makes it more difficult and less cost-efficient for us to compete successfully with

differentiated offerings across the whole mobile device market against more specialized competitors. It

also limits our ability to leverage effectively our scale and other traditional strengths, such as our brand,

hardware assets, manufacturing and logistics, distribution, strategic sourcing, research and

development, intellectual property and increasingly design, to achieve significant advantages

compared to our competitors. We have been historically more successful where our mobile devices are

sold to consumers in open distribution through non-operator parties. The increase in markets with

operator-driven distribution and business models where operator subsidies are prevalent may

adversely affect our ability to compete effectively in those markets. We are recently seeing such

developments taking place in markets where we have been traditionally strong, for instance in China.

Additionally, our scale benefits may be adversely affected as new regional or operator requirements

are introduced.

In the smartphone market, we face intense competition from traditional mobile device manufacturers

and companies in related industries, such as Internet-based product and service providers, mobile

operators, business device and solution providers and consumer electronics manufacturers. Some of

those competitors are currently viewed as more attractive partners for application developers, content

providers and other key industry participants, resulting in more robust global ecosystems and more

appealing smartphones; have more experience, skills, speed of product development and execution,

including software development, and scale in certain segments of the smartphone market; have a

stronger market presence and brand recognition for their smartphones; have created different business

models to tap into significant new sources of revenues, such as advertising and subscriptions; or

generally have been able to adjust their business models and operations in an effective and timely

manner to the developing smartphone and related ecosystem market requirements.

The availability and success of Google’s Android platform has made entry and expansion in the

smartphone market easier for a number of hardware manufacturers, which have chosen to join

Android’s ecosystem, especially at the mid-to-low range of the smartphone market. Additionally, this is

increasingly reducing the addressable market and lowering the price points for feature phones. Product

differentiation is more challenging, however, potentially leading to increased commoditization of

Android-based devices with the resulting downward pressure on pricing. On the other hand, the

significant momentum and market share gains of the global ecosystems around Apple’s iOS platform

and the Android platform have increased the competitive barriers to additional entrants looking to build

a competing global smartphone ecosystem, for instance Nokia using the Windows Phone platform. At

the same time, other ecosystems are being built which are attracting developers and consumers, and

may result in fragmentation among ecosystem participants and the inability of new ecosystems to gain

sufficient competitive scale.

19