Nokia 2011 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

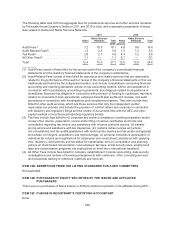

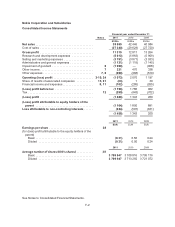

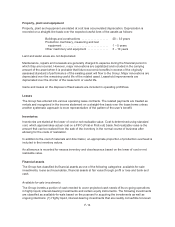

Nokia Corporation and Subsidiaries

Consolidated Statements of Financial Position

December 31

Notes 2011 2010

EURm EURm

ASSETS

Non-current assets

Capitalized development costs ........................................................ 13 6 40

Goodwill ........................................................................... 13 4 838 5 723

Other intangible assets ............................................................... 13 1 406 1 928

Property, plant and equipment ......................................................... 14 1 842 1 954

Investments in associated companies ................................................... 15 67 136

Available-for-sale investments ......................................................... 16 641 533

Deferred tax assets .................................................................. 25 1 848 1 596

Long-term loans receivable ........................................................... 16, 34 99 64

Other non-current assets ............................................................. 34

10 750 11 978

Current assets

Inventories ......................................................................... 18, 20 2 330 2 523

Accounts receivable, net of allowances for doubtful accounts (2011: EUR 284 million,

2010: EUR 363 million) ............................................................. 16, 20, 34 7 181 7 570

Prepaid expenses and accrued income ................................................. 19 4 488 4 360

Current portion of long-term loans receivable ............................................. 16, 34 54 39

Other financial assets ................................................................ 16, 17, 34 500 378

Investments at fair value through profit and loss, liquid assets ............................... 16, 34 433 911

Available-for-sale investments, liquid assets ............................................. 16, 34 1 233 3 772

Available-for-sale investments, cash equivalents .......................................... 16, 34 7 279 5 641

Bank and cash ...................................................................... 34 1 957 1 951

25 455 27 145

Total assets ........................................................................ 36 205 39 123

Notes

SHAREHOLDERS’ EQUITY AND LIABILITIES

Capital and reserves attributable to equity holders of the parent

Share capital ....................................................................... 23 246 246

Share issue premium ................................................................ 362 312

Treasury shares, at cost .............................................................. (644) (663)

Translation differences ............................................................... 22 771 825

Fair value and other reserves .......................................................... 21 154 3

Reserve for invested non-restricted equity ............................................... 3 148 3 161

Retained earnings ................................................................... 7 836 10 500

11 873 14 384

Non-controlling interests ............................................................ 2 043 1 847

Total equity ........................................................................ 13 916 16 231

Non-current liabilities

Long-term interest-bearing liabilities .................................................... 16, 34 3 969 4 242

Deferred tax liabilities ................................................................ 25 800 1 022

Other long-term liabilities ............................................................. 76 88

4 845 5 352

Current liabilities

Current portion of long-term loans ...................................................... 16, 34 357 116

Short-term borrowings ............................................................... 16, 34 995 921

Other financial liabilities .............................................................. 16, 17, 34 483 447

Accounts payable ................................................................... 16, 34 5 532 6 101

Accrued expenses and other liabilities .................................................. 26 7 450 7 365

Provisions ......................................................................... 27 2 627 2 590

17 444 17 540

Total shareholders’ equity and liabilities .............................................. 36 205 39 123

See Notes to Consolidated Financial Statements.

F-4