Nokia 2011 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296

|

|

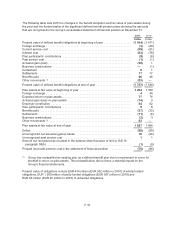

Warranty provisions

The Group provides for the estimated cost of product warranties at the time revenue is recognized. The

Group’s warranty provision is established based upon best estimates of the amounts necessary to

settle future and existing claims on products sold as of each balance sheet date. As new products

incorporating complex technologies are continuously introduced, and as local laws, regulations and

practices may change, changes in these estimates could result in additional allowances or changes to

recorded allowances being required in future periods.

Provision for intellectual property rights, or IPR, infringements

The Group provides for the estimated future settlements related to asserted and unasserted past

alleged IPR infringements based on the probable outcome of potential infringement. IPR infringement

claims can last for varying periods of time, resulting in irregular movements in the IPR infringement

provision. The ultimate outcome or actual cost of settling an individual infringement may materially vary

from estimates.

Legal contingencies

Legal proceedings covering a wide range of matters are pending or threatened in various jurisdictions

against the Group. Provisions are recorded for pending litigation when it is determined that an unfavorable

outcome is probable and the amount of loss can be reasonably estimated. Due to the inherent uncertain

nature of litigation, the ultimate outcome or actual cost of settlement may materially vary from estimates.

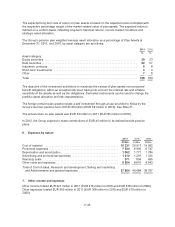

Capitalized development costs

The Group capitalizes certain development costs when it is probable that a development project will

generate future economic benefits and certain criteria, including commercial and technological

feasibility, have been met. Should a product fail to substantiate its estimated feasibility or life cycle,

material development costs may be required to be written-off in future periods.

Business combinations

The Group applies the acquisition method of accounting to account for acquisitions of businesses. The

consideration transferred in a business combination is measured as the aggregate of the fair values of

the assets transferred, liabilities incurred towards the former owners of the acquired business and

equity instruments issued. Identifiable assets acquired, and liabilities assumed by the Group are

measured separately at their fair value as of the acquisition date. Non-controlling interests in the

acquired business are measured separately based on their proportionate share of the identifiable net

assets of the acquired business. The excess of the cost of the acquisition over Nokia’s interest in the

fair value of the identifiable net assets acquired is recorded as goodwill.

The allocation of fair values to the identifiable assets acquired and liabilities assumed is based on

various valuation assumptions requiring management judgment. Actual results may differ from the

forecasted amounts and the difference could be material. See also Note 9.

Assessment of the recoverability of long-lived assets, intangible assets and goodwill

The recoverable amounts for long-lived assets, intangible assets and goodwill have been determined

based on the expected future cash flows attributable to the asset or cash-generating unit discounted to

present value. The key assumptions applied in the determination of recoverable amount include

discount rate, length of an explicit forecast period, estimated growth rates, profit margins and level of

operational and capital investment. Amounts estimated could differ materially from what will actually

occur in the future. See also Note 8.

F-23