Nokia 2011 Annual Report Download - page 164

Download and view the complete annual report

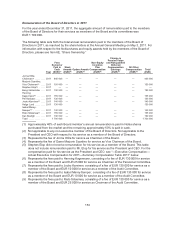

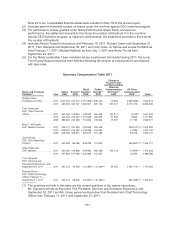

Please find page 164 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Bonus payments are part of Nokia’s short-term cash incentives. The amount consists of the

annual cash bonus earned and paid or payable by Nokia for the respective fiscal year.

(3) Amounts shown represent the grant date fair value of equity grants awarded for the respective

fiscal year. The fair value of stock options equals the estimated fair value on the grant date,

calculated using the Black-Scholes model. The fair value of performance shares and restricted

shares equals the estimated fair value on grant date. The estimated fair value is based on the

grant date market price of a Nokia share, less the present value of dividends expected to be paid

during the vesting period. The value of the performance shares is presented on the basis of

granted number of shares, which is two times the number of shares at threshold. The value of the

stock awards with performance shares valued at maximum (four times the number of shares at

threshold), for each of the named executive officers, is as follows: Mr. Elop EUR 4 671 337,

Mr. Ihamuotila EUR 736 797, Ms. McDowell EUR 736 797, Ms. DeVard EUR 775 199,

Mr. Savander EUR 736 797, Mr. Ojanperä EUR 322 753 and Mr. Green EUR 486 352.

(4) The value of stock awards for Mr. Elop includes EUR 2 033 572 as the fair value of the one-time

special CEO incentive program based on the estimated fair value on the grant date. It was

calculated using the Black-Scholes model, taking into consideration the two performance criteria,

Nokia’s share price on an absolute and relative basis to a peer group, as defined by the incentive

program rules. Based on the stock price at December 31, 2011, the actual value of this award

would be zero.

(5) The change in pension value represents the proportionate change in the liability related to the

individual executives. These executives are covered by the Finnish State employees’ pension act

(“TyEL”) that provides for a retirement benefit based on years of service and earnings according to

the prescribed statutory system. The TyEL system is a partly funded and a partly pooled “pay as

you go” system. Effective March 1, 2008, Nokia transferred its TyEL pension liability and assets to

an external Finnish insurance company and no longer carries the liability on its financial

statements. The figures shown represent only the change in liability for the funded portion. The

method used to derive the actuarial IFRS valuation is based upon available salary information at

the respective year end. Actuarial assumptions including salary increases and inflation have been

determined to arrive at the valuation at the respective year end.

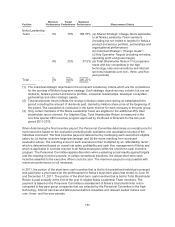

(6) All other compensation for Mr. Elop in 2011 includes: final one-time payment of EUR 2 080 444 as

compensation for lost income from his prior employer which resulted due to his move to Nokia and

EUR 5 504 taxable benefit for premiums paid under supplemental medical and disability insurance

and for mobile phone and driver.

(7) All other compensation for Mr. Ihamuotila in 2011 includes: EUR 7 020 for car allowance and EUR

1 723 taxable benefit for premiums paid under supplemental medical and disability insurance and

for mobile phone and driver.

(8) Salaries, benefits and perquisites for Ms. McDowell and Ms. DeVard were paid and denominated

in GBP and USD. Amounts were converted using year-end 2011 USD/EUR exchange rate of 1.35

and GPB/EUR rate of 0.86. For year 2010 disclosure, amounts were converted using year-end

2010 USD/EUR exchange rate of 1.32. For year 2009 disclosure, amounts were converted using

year-end 2009 USD/EUR exchange rate of 1.43.

(9) Ms. McDowell, Ms. DeVard and Mr. Green participated in Nokia’s U.S Retirement Savings and

Investment Plan. Under this 401(k) plan, participants elect to make voluntary pre-tax contributions

that are 100% matched by Nokia up to 8% of eligible earnings. 25% of the employer’s match vests

for the participants during each of the first four years of their employment. Participants earning in

excess of the Internal Revenue Service (IRS) eligible earning limits may participate in the Nokia

Restoration and Deferral Plan, which allows employees to defer up to 50% of their salary and

100% of their short-term cash incentive. Contributions to the Restoration and Deferral Plan are

matched 100% up to 8% of eligible earnings, less contributions made to the 401(k) plan. The

company’s contributions to the plan are included under “All Other Compensation” column and

noted hereafter.

162