Nokia 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Distribution of Earnings

We distribute retained earnings, if any, within the limits set by the Finnish Companies Act. We make

and calculate the distribution, if any, either in the form of cash dividends, share buy-backs, or in some

other form or a combination of these. There is no specific formula by which the amount of a distribution

is determined, although some limits set by law are discussed below. The timing and amount of future

distributions of retained earnings, if any, will depend on our future results and financial condition.

Under the Finnish Companies Act, we may distribute retained earnings on our shares only upon a

shareholders’ resolution and subject to limited exceptions in the amount proposed by our Board of

Directors. The amount of any distribution is limited to the amount of distributable earnings of the parent

company pursuant to the last accounts approved by our shareholders, taking into account the material

changes in the financial situation of the company after the end of the last financial period and a

statutory requirement that the distribution of earnings must not result in insolvency of the company.

Subject to exceptions relating to the right of minority shareholders to request for a certain minimum

distribution, the distribution may not exceed the amount proposed by the Board of Directors.

Share Buy-backs

Under the Finnish Companies Act, Nokia Corporation may repurchase its own shares pursuant to

either a shareholders’ resolution or an authorization to the Board of Directors approved by the

company’s shareholders. The authorization may amount to a maximum of 10% of all the shares of the

company and its maximum duration is 18 months. The Board of Directors has been regularly

authorized by our shareholders at the Annual General Meetings to repurchase Nokia’s own shares,

and during the past three years the authorization covered 360 million shares in 2009, 2010 and 2011.

The amount authorized each year has been at or slightly under the maximum limit provided by the

Finnish Companies Act. Nokia has not repurchased any of its own shares since September 2008.

On January 26, 2012, we announced that the Board of Directors will propose that the Annual General

Meeting convening on May 3, 2012 authorize the Board to resolve to repurchase a maximum of 360 million

Nokia shares. The proposed maximum number of shares that may be repurchased is the same as the

Board’s current share repurchase authorization, and it corresponds to less than 10% of all the shares of the

company. The shares may be repurchased in order to develop the capital structure of the company, finance

or carry out acquisitions or other arrangements, settle the company’s equity-based incentive plans, be

transferred for other purposes, or be cancelled. The shares may be repurchased either through a tender

offer made to all shareholders on equal terms, or through public trading from the stock market. The

authorization would be effective until June 30, 2013 and terminate the current authorization for repurchasing

of the company’s shares resolved at the Annual General Meeting on May 3, 2011.

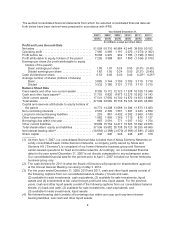

The table below sets forth actual share buy-backs by Nokia in respect of each fiscal year indicated.

Number of shares

EUR millions

(in total)

2007 ............................... 180590000 3884

2008 ............................... 157390000 3123

2009 ............................... — —

2010 ............................... — —

2011 ............................... — —

Cash Dividends

On January 26, 2012, we announced that the Board of Directors will propose for shareholders’

approval at the Annual General Meeting convening on May 3, 2012 a dividend of EUR 0.20 per share

in respect of 2011.

10