Nokia 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

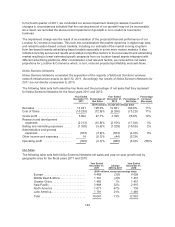

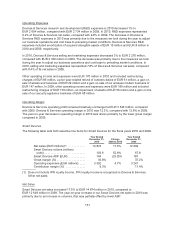

Operating Expenses

Location & Commerce R&D expenses in 2010 were EUR 1 011 million, compared with EUR 902 million

in 2009. Location & Commerce R&D expenses included amortization of intangible assets recorded as

part of Nokia’s acquisition of NAVTEQ totaling EUR 366 million and EUR 346 million in 2010 and 2009,

respectively. R&D expenses in 2010 were also driven by increased investment in Location &

Commerce map database related to geographic expansion and quality improvements during the year.

R&D expenses represented 116.3% of Location & Commerce net sales in 2010, compared to 119.3%

of Location & Commerce net sales in 2009.

Location & Commerce selling and marketing expenses in 2010 were EUR 274 million, compared with

EUR 253 million in 2009. Location & Commerce selling and marketing expenses primarily consisted of

amortization of intangible assets recorded as part of Nokia’s acquisition of NAVTEQ totaling

EUR 121 million and EUR 115 million in 2010 and 2009, respectively. Selling and marketing expenses

in 2010 were also driven by investments to grow Location & Commerce’s worldwide sales force and

expand the breadth of its product offerings. Selling and marketing expenses represented 31.5% of

Location & Commerce net sales in 2010, compared to 33.5% of Location & Commerce net sales in

2009.

Operating Margin

Location & Commerce operating loss was EUR 663 million in 2010, compared to a loss of

EUR 594 million in 2009. Location & Commerce operating margin was negative 76.3% in 2010,

compared to negative 78.6% in 2009. The year-on-year increase in operating margin was primarily due

to lower operating expenses as a percentage of net sales offset to some extent by a lower gross

margin.

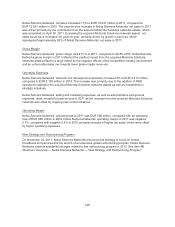

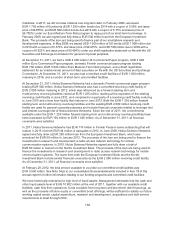

Nokia Siemens Networks

According to our estimates, the mobile infrastructure market remained flat in euro terms in 2010

compared to 2009 with the trend varying, depending on region. In the first half of 2010 there was some

easing of the difficult market conditions experienced in 2009—when the deterioration in global

economic conditions caused many operators to delay investments in network infrastructure—but this

improvement was offset by two industry specific factors that caused the overall market to continue to

decline. First, a global component shortage restricted deliveries of certain products. Second, the

introduction of new security clearance processes for telecommunications in India, prevented the

completion of product sales to customers during the second and third quarters of the year. These

issues continued to impact, but were less influential in the second half of the year, when the market

was more buoyant overall.

In 2010, in regional terms there was significant growth in North America as operators invested heavily

in upgrading both fixed and wireless networks. The Latin American market also recovered from the

severe downturn it experienced in 2009 and saw renewed operator investment. In Europe there was

slight growth. The Asia Pacific market was varied with growth in Japan and China,while India

contracted year-on-year as a result of the security clearance issue, despite 3G investment in the

second half. The Middle East and Africa region remained difficult as continued financial restraints and

a wave of consolidation in the market delayed investment.

In segment terms, the managed services market grew and there was continued strong investment in

mobile broadband infrastructure in 2010.

Globally in 2010, the network infrastructure equipment segment continued to be affected by significant

price erosion of the equipment, largely as a result of maturing technologies and intense price

competition, especially from Asian vendors.

134