Nokia 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 20-F 2011

Copyright © 2012. Nokia Corporation. All rights reserved.

Nokia and Nokia Connecting People are registered trademarks of Nokia Corporation.

Nokia Form 20-F 2011

Table of contents

-

Page 1

Form 20-F 2011 Nokia Form 20-F 2011 -

Page 2

-

Page 3

... (Address of principal executive offices) Riikka Tieaho, Director, Corporate Legal, Telephone: +358 (0)7 1800-8000, Facsimile: +358 (0) 7 1803-8503 Keilalahdentie 4, P.O. Box 226, FI-00045 NOKIA GROUP, Espoo, Finland (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact... -

Page 4

... Shareholders ...Related Party Transactions ...Interests of Experts and Counsel ...FINANCIAL INFORMATION ...Consolidated Statements and Other Financial Information ...Significant Changes ...THE OFFER AND LISTING ...Offer and Listing Details ...Plan of Distribution ...Markets ...Selling Shareholders... -

Page 5

...LISTING STANDARDS FOR AUDIT COMMITTEES . . PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS ...CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT ...CORPORATE GOVERNANCE ...MINE SAFETY DISCLOSURE ...PART III ... ITEM 17. ITEM 18. ITEM 19. FINANCIAL STATEMENTS ...FINANCIAL STATEMENTS... -

Page 6

... is located at Keilalahdentie 4, P.O. Box 226, FI-00045 Nokia Group, Espoo, Finland and our telephone number is +358 (0) 7 1800-8000. Nokia Corporation furnishes Citibank, N.A., as Depositary, with consolidated financial statements and a related audit opinion of our independent auditors annually... -

Page 7

...forward-looking statements, including, without limitation, those regarding the expected plans and benefits of our partnership with Microsoft to bring together complementary assets and expertise to form a global mobile ecosystem for smartphones; the timing and expected benefits of our new strategies... -

Page 8

... of our Location & Commerce strategy, including our ability to maintain current sources of revenue, provide support for our Devices & Services business and create new sources of revenue from our location-based services and commerce assets; 7. 8. 9. 10. our success in collaboration and partnering... -

Page 9

...to timely introduce new competitive products, services, upgrades and technologies; 35. Nokia Siemens Networks' ability to execute successfully its strategy for the acquired Motorola Solutions wireless network infrastructure assets; 36. developments under large, multi-year contracts or in relation to... -

Page 10

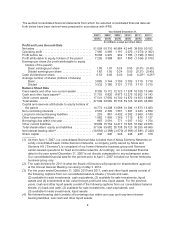

... 3. KEY INFORMATION 3A. Selected Financial Data The financial data set forth below at December 31, 2010 and 2011 and for each of the years in the three-year period ended December 31, 2011 have been derived from our audited consolidated financial statements included in Item 18 of this annual report... -

Page 11

... a fully consolidated basis. Nokia Siemens Networks, a company jointly owned by Nokia and Siemens AG ("Siemens"), is comprised of our former Networks business group and Siemens' carrier-related operations for fixed and mobile networks. Accordingly, our consolidated financial data for the year ended... -

Page 12

... trading from the stock market. The authorization would be effective until June 30, 2013 and terminate the current authorization for repurchasing of the company's shares resolved at the Annual General Meeting on May 3, 2011. The table below sets forth actual share buy-backs by Nokia in respect of... -

Page 13

... US dollars at the noon buying rate in New York City for cable transfers in euro as certified for customs purposes by the Federal Reserve Bank of New York on the respective dividend payment dates. EUR per share USD per ADS EUR millions (in total) 2007 2008 2009 2010 2011 ... 0.53 0.40 0.40 0.40... -

Page 14

3B. Capitalization and Indebtedness Not applicable. 3C. Reasons for the Offer and Use of Proceeds Not applicable. 12 -

Page 15

...bring together our respective complementary assets and expertise to build a new global mobile ecosystem for smartphones (the "Microsoft partnership"). Under the Microsoft partnership, formalized in April 2011, we are adopting, and are licensing from Microsoft, Windows Phone as our primary smartphone... -

Page 16

.... Microsoft may not be able to provide the software innovations and features we rely on for the Windows Phone operating system in a timely manner, if at all. Our competitors may provide incentives to operators, retailers or developers that may make it unattractive for them to support Nokia products... -

Page 17

...and screen sizes, such as mobile devices, tablets, computers and televisions. • We may not be able to make Nokia products with Windows Phone a competitive choice for consumers unless, together with Microsoft, we successfully encourage and support a competitive and profitable global ecosystem for... -

Page 18

... in our Symbian smartphone volume market share and pressure on pricing as competitors aggressively capitalized on our platform and product transition. Towards the end of 2011, the competitiveness of our Symbian devices continued to deteriorate as changing market conditions created increased pressure... -

Page 19

... support for our employees working on Symbian related matters and business during the transition to Windows Phone. We may not be able to efficiently manage the phase-out over time of our investment in Symbian while maintaining accepted profitability of those products. Our strategic partnership... -

Page 20

... processes. Speed to market and attractive pricing are critical factors for success. In particular, the availability of complete mobile solutions chipsets and software from low-cost reference design chipset manufacturers has enabled the very rapid and low-cost production of feature phones... -

Page 21

... device manufacturers and companies in related industries, such as Internet-based product and service providers, mobile operators, business device and solution providers and consumer electronics manufacturers. Some of those competitors are currently viewed as more attractive partners for application... -

Page 22

...different form factors and screen sizes, such as mobile devices, tablets and televisions and software which make them compatible and support their smooth interaction with one another. As consumers acquire different devices, some may choose to purchase products and services from only one ecosystem or... -

Page 23

... competitive business models for our customers. We may not be able to retain, motivate, develop and recruit appropriately skilled employees, which may hamper our ability to implement our strategies, particularly our current mobile products strategy and location-based services and commerce strategy... -

Page 24

... of our current and future businesses, technologies, software and products. This is particularly important for the successful implementation of our mobile products strategy and the Microsoft partnership and our location-based services and commerce strategy where we need highly-skilled, innovative... -

Page 25

... products with Windows Phone, or support our efforts to connect the next billion people to the Internet and information, which would negatively affect our ability to offer compelling and differentiated mobile products. The Microsoft partnership business model to integrate our location-based assets... -

Page 26

..., retain and motivate appropriately skilled employees to implement successfully our strategies in relation to the Windows Phone platform and to work effectively and efficiently with Microsoft and the related ecosystem. New business models require access and sometimes possession of consumer data... -

Page 27

...business unit and in bringing products and location-based or other services to market in a timely manner. In addition to the factors described above, delays in innovation, product development and execution may result from the added complexity of working in partnership with Microsoft to produce Nokia... -

Page 28

...and related services. If we and the other market participants are not successful in our attempts to increase subscriber numbers, stimulate increased usage or drive upgrade and replacement sales of mobile devices and develop and increase demand for value-added services, or if mobile network operators... -

Page 29

... or reduce investment in their network infrastructure and related services. The demand for digital map information and other location-based content by automotive and mobile device manufacturers may decline in relation to any further contraction of sales in the automotive and consumer electronics... -

Page 30

.... "Liquidity and Capital Resources" and Note 34 of our consolidated financial statements included in Item 18 of this annual report. Our products include numerous patented standardized or proprietary technologies on which we depend. Third parties may use without a license and unlawfully infringe our... -

Page 31

... impair our competitiveness in the mobile products market and our ability to execute successfully our new strategy and to realize fully the expected benefits of the Microsoft partnership. Also, as result of market developments, competitors' actions or other factors within or out of our control, we... -

Page 32

...to time extend lead times, limit supplies, change their partner preferences, increase prices, have poor quality or be unable to increase supplies to meet increased demand due to capacity constraints or other factors, which could adversely affect our ability to deliver our mobile products on a timely... -

Page 33

... demand for our products, both ramping up and down production at our facilities as needed on a timely basis; maintaining an optimal inventory level; adopting new manufacturing processes; finding the most timely way to develop the best technical solutions for new products; managing the increasingly... -

Page 34

... of the services to numerous markets and to the integration of our services with, for example, billing systems of network operators. We have from time to time outsourced manufacturing of certain products and components to adjust our production to demand fluctuations as well as to benefit from... -

Page 35

... third parties where the development and manufacturing process is not fully in our control. Prior to shipment, quality issues may cause failures in ramping up the production of our products and shipping them to customers in a timely manner as well as related additional costs or even cancellation of... -

Page 36

... and timely manner and manage proactively the costs and cost development related to our portfolio of products, including component sourcing, manufacturing, logistics and other operations. Historically, our market position and scale provided a significant cost advantage in many areas of our business... -

Page 37

... 34 of our consolidated financial statements included in Item 18 of this annual report. Our products include increasingly complex technologies, some of which have been developed by us or licensed to us by certain third parties. As a result, evaluating the rights related to the technologies we use or... -

Page 38

... and costly disputes whenever there are changes in our corporate structure or in companies under our control, or whenever we enter new businesses or acquire new businesses. Nokia Siemens Networks has access to certain licenses through cross-licensing arrangements with its current shareholders, Nokia... -

Page 39

.... "Business Overview-Devices & Services and Location & Commerce-Patents and Licenses" and "-Nokia Siemens Networks-Patents and Licenses" for a more detailed discussion of our intellectual property activities. Our sales derived from, and manufacturing facilities and assets located in, emerging market... -

Page 40

...trade policies applicable to current or new technologies or products may adversely affect our business and results of operations. For example, changes in regulation affecting the construction of base stations and other network infrastructure could adversely affect the timing and costs of new network... -

Page 41

... we fail to successfully use our information technology systems and networks, our operational efficiency or competitiveness could be impaired which could have a material adverse effect on our business and results of operations. A disruption, for instance, in our mail, music and maps services, could... -

Page 42

... the use of mobile devices. A substantial amount of scientific research conducted to date by various independent research bodies has indicated that these radio signals, at levels within the limits prescribed by safety standards set by, and recommendations of, public health authorities, present no... -

Page 43

... a new strategy, including changes to its organizational structure and an extensive global restructuring program, aimed at maintaining and developing Nokia Siemens Networks' position as one of the leaders in mobile broadband and services and improving its competitiveness and profitability. Planned... -

Page 44

...sales and profitability. Nokia Siemens Networks' success in the services market is dependent on a number of factors, including adapting its policies and procedures to the additional emphasis on a services business model, recruiting and retaining skilled personnel, its ability to successfully develop... -

Page 45

...respond successfully to the competitive requirements in the mobile infrastructure and related services market, our business and results of operations, particularly profitability, may be materially adversely affected. Nokia Siemens Networks seeks to increase sales in geographic markets in which price... -

Page 46

... 2011, Nokia Siemens Networks acquired the majority of the wireless network infrastructure assets of Motorola Solutions which expanded its operations by adding new products and services, new customer relationships and approximately 6 900 employees. The integration of the acquired Motorola Solutions... -

Page 47

... base or successfully cross-sell its products and services to customers of the acquired Motorola Solutions assets. Nokia Siemens Networks may lose key employees of the acquired Motorola Solutions assets. There may be delays in the full implementation of Nokia Siemens Networks policies, controls... -

Page 48

... customers in 2011 remained at approximately the same level as in 2010, as a strategic market requirement Nokia Siemens Networks primarily arranged and facilitated, and plans to continue to arrange and facilitate, financing to a number of customers, typically supported by export credit or guarantee... -

Page 49

... Siemens Networks' business, including its relationships with customers. ITEM 4. INFORMATION ON THE COMPANY 4A. History and Development of the Company Nokia is a global leader in mobile communications whose products have become an integral part of the lives of people around the world. Every day... -

Page 50

... and software development facilities, with key sites in China, Finland, Germany and the United States. History During our 147 year history, Nokia has evolved from its origins in the paper industry to become a world leader in mobile communications. Today, Nokia brings mobile products and services to... -

Page 51

... 2011, Nokia Siemens Networks announced and began implementing a new strategy and restructuring plan to focus on mobile broadband and services. • • • • • Organizational Structure and Reportable Segments We have three businesses: Devices & Services, Location & Commerce and Nokia... -

Page 52

... Demand has also grown for larger handheld Internet-centric computing devices, such as tablets and e-readers, which trade off pocketability for larger screen sizes. Such devices offer access to the Internet over WiFi and cellular networks and, like more conventional mobile products, are increasingly... -

Page 53

... as open source software, which has made entry and expansion in the smartphone market easier for a number of hardware manufacturers which have chosen to join Android's ecosystem. Users of Android-based devices can access and download applications from the Android Market application store run... -

Page 54

... and Cost Control." Smart Devices Our Smart Devices business unit focuses on the area of smartphones and smart devices and has profit-and-loss responsibility and end-to-end accountability for the full consumer experience, including product development, product management and product marketing. Nokia... -

Page 55

...transition to Windows Phone, we expect to continue to ship Symbian devices in specific regions and distribution channels, as well as to continue to provide software support to our Symbian customers, through 2016. During 2011, we made significant changes to our research and development operations for... -

Page 56

... Windows Phone engineering team, is based at our research and development sites in Finland. Mobile Phones Our Mobile Phones business unit focuses on the area of mass market feature phones and related services and applications and has profit-and-loss responsibility and end-to-end accountability for... -

Page 57

... map information and related location-based content and services for mobile navigation devices, automotive navigation systems, Internet-based mapping applications and government and business solutions. Importantly, our Location & Commerce business is developing location-based offerings in support of... -

Page 58

... by the Microsoft-run Windows Marketplace, which in March 2012 was offering more than 65 000 applications. Vertu In addition to our Nokia-branded feature phones and smartphones, we also manufacture and sell luxury mobile devices under the Vertu brand. Vertu has more than 450 points of sale globally... -

Page 59

... 000 points of sale globally alongside our own growing online retailing presence. Compared to our competitors, we have a substantially larger distribution and care network, particularly in China, India, and the Middle East and Africa. In 2011, we announced planned changes to our sales and marketing... -

Page 60

...mobile technologies. For certain of our devices, we use contract manufacturers to produce the entire product. During 2011, the vast majority of our manufacturing needs were met by our own production network. Strategic Sourcing and Partnering In line with industry practice, Devices & Services sources... -

Page 61

... Music, our digital music store, and content from travel guide publishers to expand and enhance Nokia Maps. Patents and Licenses A high level of investment by Devices & Services in research and development and rapid technological development has meant that the role of intellectual property rights... -

Page 62

... sale of content. The increasing demand for wireless access to the Internet has had a significant impact on the competitive landscape of the market for mobile products and digital content. Companies with roots in the mobile devices, computing, Internet and other industries are increasingly competing... -

Page 63

.... Nokia currently offers smartphones based on the Symbian, MeeGo and Windows Phone operating systems, and we are transitioning to using Windows Phone as our primary smartphone platform. Users of Symbian-based Nokia products can access digital content and third-party applications through Nokia Store... -

Page 64

... its market position in key geographic markets with 50 customers in 52 countries, including some of the largest network operators globally, such as Verizon Wireless, KDDI and China Mobile. In addition to bolstering Nokia Siemens Networks' research and development, with facilities including sites in... -

Page 65

... company and therefore intends to focus its resources on those areas, where it already has the benefit of a strong market share and technological leadership. Nokia Siemens Networks plans to realign its business to focus on mobile broadband, including optical networks, customer experience management... -

Page 66

... Siemens Networks' business units will be Mobile Broadband, Customer Experience Management, and Optical Networks. Business units will focus on research and development, roadmaps, quality, strategy and technological competitiveness. Global Services (GS) will focus on portfolio, strategy, competence... -

Page 67

... employees will transfer to NewNet. The transaction is expected to be completed during the first quarter of 2012. In December 2011, Nokia Siemens Networks announced that it planned to sell its fixed line broadband access business and associated professional services and network management solutions... -

Page 68

...-users and multi-vendor systems integration. Global Services consists of four businesses: • Managed Services offers services that include network planning, optimization and the management of network operations. Managed Services has a leading market share position, measured by net sales, in India... -

Page 69

...pricing models, bundles and payment methods, and to leverage existing network assets and new-IP capabilities to deliver next-generation services and accelerate time-to-market. Service Enablement and Delivery includes products for mobile browsing, messaging, multiscreen TV and location-based services... -

Page 70

... works in close collaboration with the regional marketing teams, sales, the business units, the corporate strategy team and human resources. Production Nokia Siemens Networks' operations unit handles the supply chain management of all Nokia Siemens Networks' hardware, software and original equipment... -

Page 71

...), and fiber-based next generation optical access, or NGOA. Nokia Siemens Networks also develops the software, solutions and services that drive all these technologies, as well as the end-user analytics and insight to ensure that new services operate as intended. In the transport and aggregation... -

Page 72

... to standards. Nokia Siemens Networks receives and pays certain patent license royalties in the ordinary course of its business based on existing agreements with telecommunication vendors. Competition Conditions in the market for mobile and fixed network infrastructure and related services improved... -

Page 73

... and Nokia Siemens Networks We are a global company and have sales in most countries of the world. We sold mobile devices and services through our Devices & Services and Location & Commerce businesses and network equipment through Nokia Siemens Networks to customers in Iran, Sudan and Syria in 2011... -

Page 74

...refer to our Devices & Services and Location & Commerce businesses. Corporate responsibility matters relating to Nokia Siemens Networks are discussed below under heading "Corporate Responsibility: Nokia Siemens Networks." Nokia strives to be a leader in sustainability. We have a long track record of... -

Page 75

... 30 schools at the end of 2010. • Health. We believe mobile technology has a critical role to play in preventing outbreaks of diseases and improving human health and well-being. We offer applications and services, and work with partners to conduct research. Nokia Data Gathering, a platform which... -

Page 76

... can, for example, use the text-based service to check crop prices at markets nearby to find the best market for their products without incurring the time and money that would have otherwise been spent travelling to markets to check prices. Nokia values. Nokia's new strategy, announced in February... -

Page 77

...Our broad-based equity compensation plans include stock options and performance shares, which are linked to the company's performance over a number of years. There are several other plans including cash incentive plans for all employees as well as cash and recognition awards. Health, safety and well... -

Page 78

... advantage with customers who demand high ethical standards in their supply chain. For these reasons, we have a Code of Conduct in place across Nokia. In 2011, we created the position of "Chief Ethics & Compliance Officer", who plays a key role in the support and development of the Code of Conduct... -

Page 79

...a global business, we have a disaster response plan in place and we evaluate every crisis situation separately. We are increasingly focusing on disaster preparedness and rehabilitation, including the development of mobile-based tools and applications. In 2011, we gave financial or in-kind support in... -

Page 80

...3D game and the renewed People & Planet pages on our website, we help raise awareness about sustainable lifestyles, health, well-being and social responsibility. In addition, we have launched a Nokia Public Transport application which offers public transportation route planning in hundreds of cities... -

Page 81

... related to health, safety and labor issues were also implemented in 2011 and 97% of our strategically important hardware suppliers reported on these. Over 50% of the energy consumption and greenhouse gas emissions a Nokia mobile product generates during its life cycle occur in the supply chain... -

Page 82

... maintained a high level of certification since 2008. Ethical sourcing. We take continuous action to ensure that our mobile products are manufactured with ethically-sourced materials. During 2011, we focused on further development of an industrywide approach to ensure an accountable supply chain and... -

Page 83

... by increasing access to information and communications technology (ICT)-and the benefits this can bring-and using its technical expertise to contribute to disaster relief efforts. In 2011, Nokia Siemens Networks' support focused on three areas: • Education related to ICT. Nokia Siemens Networks... -

Page 84

... supported by risk assessment processes relating to labor conditions and human rights. Nokia Siemens Networks Code of Conduct. Nokia Siemens Networks launched an updated ethical business training program in October 2011, mandatory to all employees. By the end of 2011, 90% of employees had completed... -

Page 85

... information relating to compliant operation and the research into the effects of radio wave exposure on humans. Nokia Siemens Networks also engages openly in public discussions on the topic around the world and monitors the latest scientific studies on radio waves and health. Human rights. In 2011... -

Page 86

... that information technology solutions can have in other industry sectors. Nokia Siemens Networks is offering solutions for the utilities sector with smart grids and improved energy management solutions. Environmental management systems. During August 2011, Nokia Siemens Networks completed its drive... -

Page 87

... officers and the majority of the members of its Board of Directors and, accordingly, Nokia consolidates Nokia Siemens Networks. 4D. Property, Plants and Equipment At December 31, 2011, we operated eight manufacturing facilities in seven countries for the production of Nokia-branded mobile devices... -

Page 88

... the location, use and capacity of major manufacturing facilities for Nokia mobile devices and Nokia Siemens Networks infrastructure equipment at December 31, 2011. In connection with the implementation of our new strategy for our Devices & Services business, we have announced a number of changes to... -

Page 89

.... Devices & Services also manages our supply chains, sales channels, brand and marketing activities and explores corporate strategic and future growth opportunities for Nokia. In 2011, the global mobile device market benefited from continued strength in key growth markets, such as the Middle East... -

Page 90

... complementary assets and expertise to build a new global mobile ecosystem for smartphones. Under the partnership, formalized in April 2011, we are adopting and licensing Windows Phone from Microsoft as our primary smartphone platform. We launched our first Nokia products with Windows Phone under... -

Page 91

...support to the Microsoft partnership, and plan to bring Nokia products with Windows Phone to a broad range of price points, market segments and geographies. We and Microsoft are closely collaborating on joint marketing initiatives and on a shared development roadmap on the future evolution of mobile... -

Page 92

... Nokia developers. Planning towards opening a new Nokia-branded global application store that leverages the Windows Marketplace infrastructure. Developers would be able to publish and distribute applications to hundreds of millions of consumers that use Windows Phone, Symbian and Series 40 devices... -

Page 93

... our profitability, as we need to price our smartphones competitively. We currently partially address this with our Symbian device offering in specific regions and distribution channels, and we plan to introduce and bring to markets new and more affordable Nokia products with Windows Phone in 2012... -

Page 94

... products from our Lumia product family in multiple markets throughout 2012. In the Mobile Phones business, we believe our competitive advantages - including our scale, brand, quality, manufacturing and logistics, strategic sourcing and partnering, distribution, research and development and software... -

Page 95

... and increase our speed to market for our mobile products. In 2011 and in February 2012, we announced our plans to adjust our manufacturing capacity and renew our manufacturing strategy to focus product assembly primarily in Asia to better reflect how our global networks of customers, partners and... -

Page 96

... innovation, product development and execution of both our Smart Devices and Mobile Phones business units. More Active Licensing Strategies of Patents and Intellectual Property Success in our industry requires significant research and development investments, with intellectual property rights filed... -

Page 97

... full year 2010, excluding special items and purchase price accounting related items. We have announced a number of planned changes to our operations during 2011 and 2012 in connection with the implementation of our new strategy in our Devices & Services business and the creation of our new Location... -

Page 98

... manufacturers, application developers, Internet services providers, merchants, and advertisers. The business was formed during 2011 by the combination of our Devices & Services social location services operations and our NAVTEQ business. Beginning October 1, 2011, this new business assumed profit... -

Page 99

...2011 came from the licensing of digital map data and related location-based content and services for use in mobile devices, in-vehicle navigation systems, Internet applications, geographical information system applications and other location-based products and services. Location & Commerce's success... -

Page 100

...with the real world. Price Pressure for Navigable Map Data Increasing Location & Commerce's net sales are also affected by the highly competitive pricing environment. Google is offering turn-by-turn navigation in many countries to its business customers and consumers on certain mobile handsets at no... -

Page 101

... location-based content and services industry, for instance through research and development, licensing arrangements, acquiring businesses and technologies, recruiting specialized expertise and partnering with third parties. Nokia Siemens Networks Nokia Siemens Networks is one of the leading global... -

Page 102

... to companies that provide extensive telecommunications expertise and strong managed service offerings. In the following sections we describe the factors and trends that we believe are currently driving Nokia Siemens Network net sales and profitability. Mobility and Data Usage Over recent years the... -

Page 103

...fixed line telephones. The widespread availability of devices has been matched by a proliferation of products and services in the market that both meet and feed end-user demand. These continue to drive dramatic increases in data traffic and signaling through both mobile access and transport networks... -

Page 104

... of its global delivery model, with its global network solution centers in Portugal and India which offer the benefits of scale and efficiencies both to Nokia Siemens Networks and its customers. Customer Experience Management As operators in many markets see the growth of net new subscribers slowing... -

Page 105

...services that make it all work seamlessly. In November 2011, Nokia Siemens Networks announced a new strategy, including changes to its organizational structure and an extensive restructuring program, aimed at maintaining and developing Nokia Siemens Networks, position as one of the leaders in mobile... -

Page 106

...-end rate to previous year-end rate). To mitigate the impact to shareholders' equity, we hedge selected net investment exposures from time to time. During 2011, the volatility of the currency market remained broadly around the same level as in 2010. Overall hedging costs remained relatively low in... -

Page 107

... map data and related location-based content and services for use in mobile devices compared to in-vehicle navigation systems has increased during the last few years, Location & Commerce sales have been increasingly affected by the same seasonality as mobile device sales. Nokia Siemens Networks also... -

Page 108

... the stage of completion. Devices & Services and Location & Commerce license fees from usage are recognized in the period when they are reliably measurable which is normally when the customer reports them to the Group. Devices & Services, Location & Commerce and Nokia Siemens Networks may enter into... -

Page 109

... past three fiscal years the Group has not had any write-offs or impairments regarding customer financing. The financial impact of the customer financing related assumptions mainly affects the Nokia Siemens Networks business. See also Note 34(b) to our consolidated financial statements included in... -

Page 110

...end of 2011 (EUR 301 million at the end of 2010). The financial impact of the assumptions regarding this allowance affects mainly the cost of sales of the Devices & Services and Nokia Siemens Networks businesses. Warranty Provisions We provide for the estimated cost of product warranties at the time... -

Page 111

... our consolidated financial statements included in Item 18 of this annual report. Impairment reviews are based upon our projections of anticipated discounted future cash flows. The most significant variables in determining cash flows are discount rates, terminal values, the number of years on which... -

Page 112

... to benefit from the synergies arising from each of our acquisitions. Accordingly, goodwill has been allocated to the Group's reportable segments; Smart Devices CGU, Mobile Phones CGU, Location & Commerce CGU and Nokia Siemens Networks CGU. For the purposes of the Group's 2011 annual impairment... -

Page 113

... with external sources of information, wherever available. The goodwill impairment testing conducted for the Smart Devices CGU, Mobile Phones CGU and Nokia Siemens Networks CGU did not result in any impairment charges for the year ended December 31, 2011. A charge to operating profit of EUR... -

Page 114

...Smart Devices CGU and Mobile Phones CGU and fair value less costs to sell for Location & Commerce CGU and Nokia Siemens Networks CGU are determined on a pre-tax value basis using pre-tax valuation assumptions including pre-tax cash flows and pre-tax discount rate. As market-based rates of return for... -

Page 115

...5 to our consolidated financial statements included in Item 18 of this annual report and include, among others, the discount rate, expected long-term rate of return on plan assets and annual rate of increase in future compensation levels. A portion of our plan assets is invested in equity securities... -

Page 116

... 2011 and 2010. Year Ended Year Ended Percentage December 31, Percentage of December 31, Percentage of Increase/ 2011 Net Sales 2010 Net Sales (Decrease) (EUR millions, except percentage data) Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing... -

Page 117

... lack of dual SIM products, which continued to be a growing part of the market. For Nokia Siemens Networks, net sales growth was driven primarily by the contribution from the acquired Motorola Solutions network infrastructure assets, which was completed on April 29, 2011. On a year-on-year basis the... -

Page 118

... in the operating profit in our Devices & Services business, which was partially offset by a decrease in the operating loss in Nokia Siemens Networks. Our 2011 operating margin was (2.8)% in 2011, compared to 4.9% in 2010. Our operating profit in 2011 included purchase price accounting items and... -

Page 119

.... Net Sales The following table sets forth our Devices & Services net sales and year-on-year growth rate by geographic area for the fiscal years 2011 and 2010. Year Ended Year Ended December 31, Change December 31, 2011 2010 to 2011 2010 (EUR millions, except percentage data) Europe ...Middle East... -

Page 120

... margins. Our actions enabled us to create healthier sales channel dynamics during the latter weeks of the second quarter 2011. Devices & Services net sales increased sequentially in the fourth quarter 2011, supported by broader product renewal in both Mobile Phones, for example dual SIM devices... -

Page 121

... and cost controls. The increase in Mobile Phones research and development expenses was due primarily to investments to accelerate product development to bring new innovations to the market faster and at lower price-points, consistent with the Mobile Phones "internet for the next billion" strategy... -

Page 122

...Smart Devices and Mobile Phones as well as higher restructuring charges and Accenture transaction related consideration. Smart Devices The following table sets forth selective line items for Smart Devices for the fiscal years 2011 and 2010. Year Ended December 31, 2011 Change 2010 to 2011 Year Ended... -

Page 123

... table sets forth selective line items for Mobile Phones for the fiscal years 2011 and 2010. Year Ended December 31, 2011 Change 2010 to 2011 Year Ended December 31, 2010 Net sales (EUR millions)(1) ...Mobile Phones volume (millions units) ...Mobile Phones ASP (EUR) ...Gross margin (%) ...Operating... -

Page 124

... our first dual SIM devices and the ongoing product renewal across the feature phones portfolio, which more than offset our reduced portfolio of higher priced feature phones. Average Selling Price Mobile Phones ASP decreased 10% to EUR 35 in 2011, compared to EUR 39 in 2010. The year-on-year decline... -

Page 125

... 869 Location & Commerce net sales increased 26% to EUR 1 091 million in 2011, compared to EUR 869 million in 2010. The year-on-year increase in net sales in 2011 was primarily driven by higher sales of map content licenses to vehicle customers due to increased consumer uptake of navigation systems... -

Page 126

...our location-based assets integrated with different advertising platforms. After consideration of all relevant factors, we reduced the net sales projections for Location & Commerce which, in turn, reduced projected profitability and cash flows. Nokia Siemens Networks Nokia Siemens Networks completed... -

Page 127

...strategic initiatives. Nokia Siemens Networks' selling and marketing expenses, as well as administrative and general expenses, were virtually flat year-on-year in 2011 as the increase from the acquired Motorola Solutions networks was offset by ongoing cost control initiatives. Operating Margin Nokia... -

Page 128

...business during the first quarter 2011. For Location & Commerce and Nokia Siemens Networks, the demand environment improved in 2010. The overall appreciation of certain currencies relative to the euro during 2010 had a positive effect on our net sales. The following table sets forth the distribution... -

Page 129

...in the operating losses at Nokia Siemens Networks and Location & Commerce, which were partially offset by a lower operating profit in Devices & Services. Our operating margin was 4.9% in 2010, compared with 2.9% in 2009. Our operating profit in 2010 included purchase price accounting items and other... -

Page 130

... to a decrease in Nokia Siemens Networks' losses. Profit Attributable to Equity Holders of the Parent and Earnings per Share Profit attributable to equity holders of the parent in 2010 totaled EUR 1 850 million, compared with EUR 891 million in 2009, representing a year-on-year increase of 108% in... -

Page 131

... Net Sales The following table sets forth our Devices & Services net sales and year-on-year growth rate by geographic area for the fiscal years 2010 and 2009. Year Ended Year Ended December 31, Change December 31, 2010 2009 to 2010 2009 (EUR millions, except percentage data) Europe ...Middle East... -

Page 132

... second half of the year. During 2010, we gained device market share in Latin America. Our device market share decreased in Asia-Pacific, Middle East & Africa, Europe and North America. Our device market share was flat in Greater China. Average Selling Price Our mobile device ASP in 2010 was EUR 64... -

Page 133

... table sets forth selective line items for Smart Devices for the fiscal years 2010 and 2009. Year Ended December 31, 2010 Change 2009 to 2010 Year Ended December 31, 2009 Net sales (EUR millions)(1) ...Smart Devices volume (millions units) ...Smart Devices ASP (EUR) ...Gross margin (%) ...Operating... -

Page 134

... margin in 2010 was driven primarily by general price pressure and product material cost erosion being less than general product price erosion. Mobile Phones The following table sets forth selective line items for Mobile Phones for the fiscal years 2010 and 2009. Year Ended December 31, 2010 Change... -

Page 135

...The year-on-year decline in our Mobile Phones gross margin in 2011 was due primarily to general price pressure and product material cost erosion being less than general product price erosion. Location & Commerce The following table sets forth selective line items and the percentage of net sales that... -

Page 136

... Middle East and Africa region remained difficult as continued financial restraints and a wave of consolidation in the market delayed investment. In segment terms, the managed services market grew and there was continued strong investment in mobile broadband infrastructure in 2010. Globally in 2010... -

Page 137

...services business, largely offset by challenging competitive factors, as well as industry-wide shortages of certain components and security clearances issues in India preventing the completion of product sales to customers during the second and third quarters of 2010. Of total Nokia Siemens Networks... -

Page 138

... charges and other items of EUR 19 million (EUR 30 million in 2009) and purchase price accounting related items of EUR 180 million (EUR 180 million in 2009). In 2010, Nokia Siemens Networks' selling and marketing expenses decreased to EUR 1 328 million, compared with EUR 1 349 million in 2009... -

Page 139

... million in 2010 and EUR 531 million in 2009. Major items of capital expenditure included production lines, test equipment and computer hardware used primarily in research and development, office and manufacturing facilities as well as services and software related intangible assets. Proceeds from... -

Page 140

... which was amortized for EUR 50 million in January 2012. The proceeds of the loan are being used to finance the investments in research and development in radio access network technology for mobile communication systems. In 2010, Nokia Siemens Networks signed and fully drew a total of EUR 80 million... -

Page 141

... from site consolidation and increased efficiency. Principal capital expenditures during the three years included production lines, test equipment and computer hardware used primarily in research and development, office and manufacturing facilities as well as services and software related intangible... -

Page 142

... consolidated financial statements included in Item 18 of this annual report for further information regarding commitments and contingencies. 5C. Research and Development, Patents and Licenses Success in the mobile communications industry requires continuous introduction of new products and services... -

Page 143

...by an increase in Nokia Siemens Networks. R&D expenses in 2009 were EUR 5 909 million. These expenses represented 14.5%, 13.8% and 14.4% of Nokia net sales in 2011, 2010 and 2009, respectively. In 2011, Devices & Services R&D expenses included EUR 8 million of purchase price accounting related items... -

Page 144

.... President of Nokia Mobile Phones 1990-1992. Senior Vice President, Finance of Nokia 1986-1989. Holder of various managerial positions at Citibank within corporate banking 19781985. Vice Chairman of the Board of Directors of Otava Ltd. Member of the Board of Directors of the University of Helsinki... -

Page 145

... 3, 2011. Bachelor of Computer Engineering and Management (McMaster University, Hamilton, Canada). Doctor of Laws, honorary (McMaster University, Hamilton, Canada). President of Microsoft Business Division and member of senior membership team of Microsoft Corporation 2008-2010. COO, Juniper Networks... -

Page 146

... positions at ABB Group Limited from 1987, including Executive Vice President, Head of Automation Technology Products Division and Member of Group Executive Committee 2000-2002, Senior Vice President, Business Area Automation Power Products 1998-2000, Vice President, Business Unit Drives Products... -

Page 147

...nieurs, Paris). Director of Shared Services of L'Oréal Group 2010-2011. Chief Financial Officer, Executive Vice President in charge of strategy of PSA Peugeot Citroën 2007-2009. COO, Intellectual Property and Licensing Business Unit of Thomson 2006-2007. Vice President Corporate Planning at Saint... -

Page 148

... Articles of Association, the Nokia Leadership Team is responsible for the operative management of the company. The Chairman and members of the Nokia Leadership Team are appointed by the Board of Directors. Only the Chairman of the Nokia Leadership Team, the Chief Executive Officer, can be a member... -

Page 149

...formerly Executive Vice President of Services and Developer Experience resigned from the Nokia Leadership Team and left Nokia effective as from October 1, 2011. The current members of the Nokia Leadership Team are set forth below. Stephen Elop, b. 1963 President and CEO of Nokia Corporation. Member... -

Page 150

...-2011. President and Senior Vice President for Greater China, Japan and Korea, Nokia 2009-2010. Senior Vice President, Sales, Distribution East, Nokia 2008-2009. Senior Vice President, CMO, Greater China, Nokia 2002-2008. Vice President Sales and Marketing, China, Nokia 2001-2002. General Manager... -

Page 151

... Symbian Smartphones, Mobile Solutions, Nokia 2010-2011. Senior Vice President, Smartphones Product Management, Nokia 2009. Vice President, Live Category, Nokia 2008-2009. Senior Vice President, Marketing, Mobile Phones, Nokia 2006-2007. Vice President, Marketing, North America, Mobile Phones, Nokia... -

Page 152

..., Helsinki). Executive Vice President, Services, Nokia 2007-2010. Executive Vice President, Technology Platforms, Nokia 20062007. Senior Vice President and General Manager of Nokia Enterprise Solutions, Mobile Devices Business Unit 2003-2006. Senior Vice President, Nokia Mobile Software, Market... -

Page 153

..., Nokia Mobile Phones 1999-2002. Vice President, TDMA Product Line 1997-1999. Various technical and managerial positions in Nokia Consumer Electronics and Nokia Mobile Phones 1991-1997. Member of the Board of Directors of Sanoma Corporation. Chairman of the Board of The Funding Agency for Technology... -

Page 154

... seven named executive officers and describes our compensation policies and actual compensation for the Nokia Leadership Team as well as our use of equity-based incentives. Board of Directors The following table sets forth the annual remuneration of the members of the Board of Directors for service... -

Page 155

... on May 3, 2011. For information with respect to the Nokia shares and equity awards held by the members of the Board of Directors, please see Item 6E. "Share Ownership." Change in Pension Value Fees Non-Equity and Nonqualified Earned or Incentive Deferred Paid in Stock Plan Compensation All Other... -

Page 156

...in Nokia shares purchased from the market, which shares shall be retained until the end of the board membership in line with the Nokia policy (except for those shares needed to offset any costs relating to the acquisition of the shares, including taxes). Executive Compensation Executive Compensation... -

Page 157

... position, revenues, number of employees, global responsibility and reporting relationships) in relevant comparison companies; the performance demonstrated by the executive officer during the last year; the size and impact of the particular officer's role on Nokia's overall performance and strategic... -

Page 158

... Base Salary in 2011 Position Minimum Target Maximum Performance Performance Performance Measurement Criteria President and CEO ... 0% 100% 225% (a) Shared Strategic Change Goals applicable to all Nokia Leadership Team members (including but not limited to targets for Nokia's product and service... -

Page 159

... success of Nokia's long-term strategy. Such strategic objectives may include, but are not limited to, Nokia's product and service portfolio, consumer relationships, developer ecosystem, partnerships and other strategic assets. (2) Total shareholder return reflects the change in Nokia's share price... -

Page 160

... targets under the Nokia short-term cash incentive plan are 100% of annual base salary as at December 31, 2011 (description of a separate plan approved by the Board of Directors for 2011-2012 is below). Mr. Elop is entitled to the customary benefits in line with our policies applicable to the top... -

Page 161

... group consists of a number of relevant companies in the high technology/mobility, telecommunications and Internet services industries. (2) Nokia's absolute share price at the end of 2012: Minimum payout if the Nokia share price is EUR 9, with maximum payout if the Nokia share price is EUR 17. Nokia... -

Page 162

...The members of the Nokia Leadership Team participate in the local retirement programs applicable to employees in the country where they reside. Executives in Finland, including Mr. Elop, participate in the Finnish TyEL pension system, which provides for a retirement benefit based on years of service... -

Page 163

... 904 (1) The positions set forth in this table are the current positions of the named executives. Mr. Ojanperä served as Executive Vice President, Services and Developer Experience until September 30, 2011 and Mr. Green served as Executive Vice President and Chief Technology Officer from February... -

Page 164

... benefit based on years of service and earnings according to the prescribed statutory system. The TyEL system is a partly funded and a partly pooled "pay as you go" system. Effective March 1, 2008, Nokia transferred its TyEL pension liability and assets to an external Finnish insurance company... -

Page 165

... for mobile phone and driver, EUR 370 for medical-related benefits and EUR 150 for service award. (14) All other compensation for Mr. Green in 2011 includes: EUR 652 438 for severance compensation, EUR 26 495 for accrued vacation time and EUR 5 435 for company contributions to the 401(k) Plan. (15... -

Page 166

... promoting the long-term financial success of the company. The equity-based compensation programs are intended to align the potential value received by participants directly with the performance of Nokia. We have also granted restricted shares to a small selected number of key employees considered... -

Page 167

... share plans, the Performance Share Plans of 2008, 2009, 2010 and 2011, each of which, including its terms and conditions, has been approved by the Board of Directors. The performance shares represent a commitment by Nokia Corporation to deliver Nokia shares to employees at a future point in time... -

Page 168

... of the stock option plan, which are approved by the shareholders at the respective Annual General Meeting. The Board of Directors does not have the right to change how the exercise price is determined. Shares will be eligible for dividend for the financial year in which the share subscription takes... -

Page 169

... rights associated with these performance shares. Stock Options The stock options to be granted in 2012 are out of the Stock Option Plan 2011 approved by the Annual General Meeting in 2011. For more information about the Stock Option Plan 2011 see "Equity-Based Incentive Programs - Stock Options... -

Page 170

... rights associated with these restricted shares. Maximum Planned Grants under the Nokia Equity-Based Incentive Program 2012 in Year 2012 The approximate maximum number of planned grants under the Nokia Equity Program 2012 (i.e. performance shares, stock options and restricted shares) in 2012 are set... -

Page 171

..., performance of the Board Chairman was evaluated in a process led by the Vice Chairman. Pursuant to the Articles of Association, Nokia Corporation has a Board of Directors composed of a minimum of seven and a maximum of 12 members. The members of the Board are elected for a one-year term at each... -

Page 172

... with an executive officer of a Nokia supplier whose consolidated gross revenue from Nokia accounts for an amount that exceeds the limit provided in the New York Stock Exchange corporate governance standards, but that is less than 4%. The Board has determined that all of the members of the... -

Page 173

... Executive Officers and the Senior Financial Officers. For more information about our Code of Ethics, see Item 16B. "Code of Ethics". At December 31, 2011, Mr. Elop, the President and CEO, was the only Board member who had a service contract with Nokia. For discussion of the service contract... -

Page 174

... of the company, properly motivate management, support overall corporate strategies and are aligned with shareholders' interests. The Committee is responsible for the review of senior management development and succession plans. The Personnel Committee had five meetings in 2011. The average... -

Page 175

... according to their activity and geographical location as follows: 2011 2010(1) 2009(1) Devices & Services ...Location & Commerce ...Nokia Siemens Networks ...Corporate Common Functions ...Nokia Group ...Finland ...Other European countries ...Middle-East & Africa ...China ...Asia-Pacific ...North... -

Page 176

... Board of Directors in 2011." The Nokia Leadership Team members receive equity based compensation in the form of performance shares, stock options and restricted shares. For a description of our equity-based compensation programs for employees and executives, see Item 6B. "Compensation-Equity-Based... -

Page 177

... 983 500 0.100 0.053 12.27 11.96 (1) Includes 13 Nokia Leadership Team members at year end. Figures do not include those former Nokia Leadership Team members who left during 2011. (2) The percentage is calculated in relation to the outstanding number of shares and total voting rights of the company... -

Page 178

..., the number of shares deliverable equals three times the number of shares at threshold. The following table sets forth the number of shares and ADSs in Nokia held by members of the Nokia Leadership Team as of December 31, 2011. Name(1) Shares(2) ADSs(2) Became Nokia Leadership Team member (Year... -

Page 179

... issued pursuant to Nokia Stock Option Plans 2005, 2007 and 2011. For a description of our stock option plans, please see Note 24 to our consolidated financial statements in Item 18 of this annual report. Total Intrinsic Value of Exercise Stock Options, Price Number of Stock December 30, 2011 per... -

Page 180

... 2007 2Q 2008 2Q 2009 2Q 2010 2Q 2011 2Q 2011 3Q Stock options held by the members of the Nokia Leadership Team as at December 31, 2011, Total(4) ...All outstanding stock option plans (global plans), Total ... December 31, 2011 December 31, 2012 December 31, 2013 December 31, 2014 December 31, 2015... -

Page 181

... value of the stock options is based on the difference between the exercise price of the options and the closing market price of Nokia shares on NASDAQ OMX Helsinki as at December 30, 2011 of EUR 3.77. (3) For gains realized upon exercise of stock options for the members of the Nokia Leadership Team... -

Page 182

...2010 and 2011. For Stephen Elop the table also includes the one-time special CEO incentive program. For a description of our performance share and restricted share plans, please see Note 24 to the consolidated financial statements in Item 18 of this annual report. Performance Shares Number of Number... -

Page 183

... Total Shareholder Return relative to a peer group and Nokia's absolute share price as of December 31, 2011. Nokia share price is a 20-day trade volume weighted average on NASDAQ OMX Helsinki as at December 30, 2011 of EUR 3.85. (7) Under the Restricted Share Plans 2008, 2009, 2010 and 2011, awards... -

Page 184

... were forfeited and cancelled upon their respective terminations of employment in accordance with the plan rules. (12) The intrinsic value is based on the closing market price of a Nokia share on NASDAQ OMX Helsinki as at February 10, 2011 of EUR 8.16 in respect of Mr. Torres, as at September 21... -

Page 185

...provides certain information relating to stock option exercises and share deliveries upon settlement during the year 2011 for our Nokia Leadership Team members. Stock Options Awards(1) Number of Value Shares Realized on Acquired on Exercise Exercise (EUR) Performance Shares Awards(2) Number of Value... -

Page 186

... time and provide training for compliance with the policy. Nokia's insider policy is in line with the NASDAQ OMX Helsinki Guidelines for Insiders and also sets requirements beyond those guidelines. ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS 7A. Major Shareholders At December 31, 2011... -

Page 187

... under common control with Nokia or associates of Nokia. See Note 31 to our consolidated financial statements included in Item 18 of this annual report. 7C. Interests of Experts and Counsel Not applicable. ITEM 8. FINANCIAL INFORMATION 8A. Consolidated Statements and Other Financial Information 8A1... -

Page 188

...first instance, and a number are on appeal. Nokia has responded by filing nullity actions in the German Patents Court and oppositions before the German and European Patent Office ("EPO") in relation to these patents, utility models, and other patents included in IPCom's list of patents. To date, all... -

Page 189

... as certain other patents. The financial structure of the license agreement consists of a one-time payment payable by Apple and on-going royalties to be paid by Apple to Nokia for the term of the agreement. The specific terms of the contract are confidential. Digitude On December 2, 2011, Digitude... -

Page 190

... software-related problems with the development of its Symbian operating system, which were delaying scheduled product launch dates; (ii) Nokia was allegedly losing market share because of intense price cuts by its competitors; and (iii) the dynamics of the emerging Chinese market for mobile phones... -

Page 191

... reducing any potential health risk associated with the telephone's use. As of October 3, 2011 all of these cases have been withdrawn or dismissed in relation to Nokia. We have also been named as a defendant along with several other mobile device manufacturers and network operators in nine lawsuits... -

Page 192

...of our consolidated financial statements included in this annual report. See Item 5A. "Operating Results-Principal Factors and Trends Affecting our Results of Operations" for information on material trends affecting our business and results of operations. ITEM 9. THE OFFER AND LISTING 9A. Offer and... -

Page 193

... prices for the shares, in the form of ADSs, on the New York Stock Exchange. NASDAQ OMX Helsinki Price per share High Low (EUR) New York Stock Exchange Price per ADS High Low (USD) 2007 ...2008 ...2009 ...2010 First Quarter ...Second Quarter ...Third Quarter ...Fourth Quarter ...Full Year ...2011... -

Page 194

...current Articles of Association, Nokia's corporate purpose is to engage in the telecommunications industry and other sectors of the electronics industry as well as the related service businesses, including the development, manufacture, marketing and sales of mobile devices, other electronic products... -

Page 195

...rights, stock options or convertible bonds issued by the company if so requested by the holder. The purchase price of the shares under our Articles of Association is the higher of (a) the weighted average trading price of the shares on NASDAQ OMX Helsinki during the 10 business days prior to the day... -

Page 196

...rights in a company shall, within one month, offer to purchase the remaining shares of the company, as well as any other rights entitling to the shares issued by the company, such as subscription rights, convertible bonds or stock options issued by the company. The purchase price shall be the market... -

Page 197

...to be a complete analysis or listing of all potential tax effects relevant to ownership of our shares represented by ADSs. The statements of United States and Finnish tax laws set out below are based on the laws in force as of the date of this annual report and may be subject to any changes in US or... -

Page 198

... company (a "PFIC"). Nokia currently believes that dividends paid with respect to its shares and ADSs will constitute qualified dividend income for US federal income tax purposes, however, this is a factual matter and is subject to change. Nokia anticipates that its dividends will be reported... -

Page 199

...the payer prior to the dividend payment: name, date of birth or business ID (if applicable) and address in the country of residence. US and Finnish Tax on Sale or Other Disposition A US Holder generally will recognize taxable capital gain or loss on the sale or other disposition of ADSs in an amount... -

Page 200

...taxable year of the disposition and other conditions are met. US Information Reporting and Backup Withholding Dividend payments with respect to shares or ADSs and proceeds from the sale or other disposition of shares or ADSs may be subject to information reporting to the Internal Revenue Service and... -

Page 201

... AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK See Note 34 to our consolidated financial statements included in Item 18 of this annual report for information on market risk. ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES 12D. American Depositary Shares 12D.3 Depositary Fees and... -

Page 202

...in relation to our ADR program. Category Payment (USD) New York Stock Exchange listing fees ...Settlement infrastructure fees (including the Depositary Trust Company fees) ...Proxy process expenses (including printing, postage and distribution) ...ADS holder identification expenses ...Total ... 500... -

Page 203

... members of the Audit Committee is an "independent director" as defined in Section 303A.02 of the New York Stock Exchange's Listed Company Manual. ITEM 16B. CODE OF ETHICS We have adopted a code of ethics that applies to our Chief Executive Officer, President, Chief Financial Officer and Corporate... -

Page 204

... and services. ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES Not applicable. ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS There were no purchases of Nokia shares or ADSs by Nokia Corporation or its affiliates during 2011. ITEM 16F. CHANGE IN... -

Page 205

...Share Plans also promote employee share ownership, and are used in conjunction with the Performance Share and Stock Option Plans. Further, in 2011 Nokia did not fully comply with recommendation 4 of the Finnish Corporate Governance Code as Helge Lund, who was proposed for the first time to the Board... -

Page 206

... Articles of Association of Nokia Corporation. See Note 28 to our consolidated financial statements included in Item 18 of this annual report for information on how earnings per share information was calculated. List of significant subsidiaries. Certification of Stephen Elop, Chief Executive Officer... -

Page 207

...high-speed data communication over existing twisted pair telephone lines and supports a downstream data rate of 1.5-8 Mbps and an upstream data rate of 16 kbps-1 Mbps. ASP (average selling price): Mobile device ASP represents total Devices & Services net sales (Smart Devices net sales, Mobile Phones... -

Page 208

... to market. At the heart of the major ecosystems in the mobile devices and related services industry is the operating system and the development platform upon which services are built. EDGE (Enhanced Data Rates for Global Evolution): A technology to boost cellular network capacity and increase data... -

Page 209

...radio technology evolution architecture. MeeGo: A Linux-based, open source software platform. Under our new strategy, MeeGo has become an open-source, mobile operating system project with an emphasis on longer-term market exploration of next-generation devices, platforms and user experiences. Mobile... -

Page 210

...Wideband Code Division Multiple Access): A third-generation mobile wireless technology that offers high data speeds to mobile and portable wireless devices. Windows Phone: A software platform developed by Microsoft that Nokia is deploying as its principal smartphone operating system. Our partnership... -

Page 211

... Public Accounting Firm To the Board of Directors and Shareholders of Nokia Corporation In our opinion, the accompanying consolidated statements of financial position and the related consolidated income statements, consolidated statements of comprehensive income, consolidated statements of changes... -

Page 212

Nokia Corporation and Subsidiaries Consolidated Income Statements Notes Financial year ended December 31 2011 2010 2009 EURm EURm EURm Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses ...Administrative and general expenses ...... -

Page 213

... Consolidated Statements of Comprehensive Income Notes Financial year ended December 31 2011 2010 2009 EURm EURm EURm (Loss) profit ...Other comprehensive income Translation differences ...Net investment hedge gains (losses) ...Cash flow hedges ...Available-for-sale investments ...Other increase... -

Page 214

Nokia Corporation and Subsidiaries Consolidated Statements of Financial Position Notes ASSETS Non-current assets Capitalized development costs ...Goodwill ...Other intangible assets ...Property, plant and equipment ...Investments in associated companies ...Available-for-sale investments ...Deferred ... -

Page 215

Nokia Corporation and Subsidiaries Consolidated Statements of Cash Flows Financial year ended December 31 2011 2010 2009 EURm EURm EURm Notes Cash flow from operating activities (Loss) profit attributable to equity holders of the parent ...Adjustments, total ...Change in net working capital ...... -

Page 216

Nokia Corporation and Subsidiaries Consolidated Statements of Cash Flows (Continued) Notes Financial year ended December 31 2011 2010 2009 EURm EURm EURm Cash and cash equivalents comprise of: Bank and cash ...Current available-for-sale investments, cash equivalents ... 1 957 16, 34 7 279 9 236 1 ... -

Page 217

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity Reserve for Before Number of Share Fair value invested nonNonshares Share issue Treasury Translation and other non-restrict. Retained controlling controlling (000's) capital premium shares differences ... -

Page 218

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity Reserve for Before Number of Share Fair value invested nonNonshares Share issue Treasury Translation and other non-restrict. Retained controlling controlling (000's) capital premium shares differences ... -

Page 219

.... Nokia's Board of Directors authorized the financial statements for 2011 for issuance and filing on March 8, 2012. As of April 1, 2011, the Group's operational structure featured two new operating and reportable segments: Smart Devices and Mobile Phones, which combined with Devices & Services Other... -

Page 220

... and financial policies of the entity through agreement or the Group has the power to appoint or remove the majority of the members of the board of the entity. The Group's share of profits and losses of associates is included in the consolidated income statement in accordance with the equity method... -

Page 221

...in fair value in the related hedging instruments, are reported in financial income and expenses. For non-monetary items, such as shares, the unrealized foreign exchange gains and losses are recognized in other comprehensive income. Foreign Group companies In the consolidated accounts, all income and... -

Page 222

... reliably. Losses on projects in progress are recognized in the period they become probable and can be estimated reliably. Shipping and handling costs The costs of shipping and distributing products are included in cost of sales. Research and development Research and development costs are expensed... -

Page 223

... expensed immediately. Other intangible assets Acquired patents, trademarks, licenses, software licenses for internal use, customer relationships and developed technology are capitalized and amortized using the straight-line method over their useful lives, generally 3 to 7 years. Where an indication... -

Page 224

... inventory and obsolescence based on the lower of cost or net realizable value. Financial assets The Group has classified its financial assets as one of the following categories: available-for-sale investments, loans and receivables, financial assets at fair value through profit or loss and bank and... -

Page 225

... business driven. All purchases and sales of investments are recorded on the trade date, which is the date that the Group commits to purchase or sell the asset. The changes in fair value of available-for-sale investments are recognized in fair value and other reserves as part of shareholders' equity... -

Page 226

...statement of financial position under long-term interest-bearing liabilities and the current portion under current portion of long-term loans. Accounts payable Accounts payable are carried at the original invoiced amount, which is considered to be fair value due to the short-term nature of the Group... -

Page 227

... discounted cash flow analysis using assumptions that are based on market conditions existing at each balance sheet date. Changes in fair value are recognized in the income statement. Hedge accounting Cash flow hedges: Hedging of anticipated foreign currency denominated sales and purchases The Group... -

Page 228

...the statement of financial position, the gains and losses previously deferred in equity are transferred from equity and included in the initial acquisition cost of the asset. The deferred amounts are ultimately recognized in the profit and loss as a result of goodwill assessments in case of business... -

Page 229

... from shareholders' equity into the income statement only if the legal entity in the given country is sold, liquidated, repays its share capital or is abandoned. Income taxes The tax expense comprises current tax and deferred tax. Current taxes are based on the results of the Group companies and... -

Page 230

... at the time revenue is recognized. The provision is an estimate calculated based on historical experience of the level of volumes, product mix and repair and replacement cost. Intellectual property rights (IPR) provisions The Group provides for the estimated future settlements related to asserted... -

Page 231

Share-based compensation The Group offers three types of global equity settled share-based compensation schemes for employees: stock options, performance shares and restricted shares. Employee services received, and the corresponding increase in equity, are measured by reference to the fair value of... -

Page 232

.... Current sales and profit estimates for projects may materially change due to the early stage of a longterm project, new technology, changes in the project scope, changes in costs, changes in timing, changes in customers' plans, realization of penalties, and other corresponding factors, which... -

Page 233

... Group are measured separately at their fair value as of the acquisition date. Non-controlling interests in the acquired business are measured separately based on their proportionate share of the identifiable net assets of the acquired business. The excess of the cost of the acquisition over Nokia... -

Page 234

... include, among others, the discount rate, expected long-term rate of return on plan assets and annual rate of increase in future compensation levels. A portion of plan assets is invested in equity securities, which are subject to equity market volatility. Changes in assumptions and actuarial... -

Page 235

... date. The Group is currently evaluating potential impact of the new standards on its accounts. 2. Segment information Nokia has three businesses: Devices & Services, Location & Commerce and Nokia Siemens Networks, and four operating and reportable segments for financial reporting purposes: Smart... -

Page 236

... assets and expertise of both parties to build a new global mobile ecosystem for smartphones. The partnership, under which Nokia is adopting and licensing Windows Phone from Microsoft as its primary smartphone platform, was formalized in April 2011. The Group is paying Microsoft a software... -

Page 237

... Group revenues. Corporate Common Devices & Nokia Functions and Smart Mobile Services Devices & Location & Siemens Corporate EliminaDevices Phones Other Services Commerce Networks unallocated(4)(6) tions Group EURm EURm EURm EURm EURm EURm EURm EURm EURm 2011 Profit and Loss Information Net sales... -

Page 238

2010 Corporate Common Devices & Nokia Functions and Smart Mobile Services Devices & Location & Siemens Corporate EliminaDevices Phones Other Services Commerce Networks unallocated(4)(6) tions Group EURm EURm EURm EURm EURm EURm EURm EURm EURm Profit and Loss Information Net sales to external ... -

Page 239

... to Location & Commerce and Nokia Siemens Networks. Unallocated liabilities include non-current liabilities and short-term borrowings as well as interest and tax related prepaid income, accrued expenses and provisions related to Devices & Services and Corporate Common Functions. 2011 EURm 2010 EURm... -

Page 240

... and EUR 377 million in 2009). The remainder consists of expenses related to defined benefit plans. Average personnel 2011 2010 2009 Devices & Services ...Location & Commerce ...Nokia Siemens Networks ...Group Common Functions ...Nokia Group ... 54 850 7 187 71 825 309 134 171 56 896 6 766 65 379... -

Page 241

... Group's consolidated statement of financial position at December 31: 2011 EURm 2010 EURm Present value of defined benefit obligations at beginning of year ...Foreign exchange ...Current service cost ...Interest cost ...Plan participants' contributions ...Past service cost ...Actuarial gain (loss... -

Page 242

...) pension costs recognized in the statement of financial position are as follows: 2011 EURm 2010 EURm Prepaid (accrued) pension costs at beginning of year ...Net income (expense) recognized in the profit and loss account ...Contributions paid ...Benefits paid ...Business combinations ...Foreign... -

Page 243

...long-term historical returns, current market conditions and strategic asset allocation. The Group's pension plan weighted average asset allocation as a percentage of Plan Assets at December 31, 2011, and 2010, by asset category are as follows: 2011 % 2010 % Asset category: Equity securities ...Debt... -

Page 244

... million, a gain on sale of assets and a business of EUR 29 million and a gain on sale of the wireless modem business of EUR 147 million impacting Devices & Services operating profit. The wireless modem business was responsible for development of Nokia's wireless modem technologies for LTE, HSPA and... -

Page 245

... correspond to the Group's reportable segments: Smart Devices CGU, Mobile Phones CGU, Location & Commerce CGU and Nokia Siemens Networks CGU. For the purposes of the Group's 2011 annual impairment testing, the amount of goodwill previously allocated in 2010 to the Devices & Services CGU has been... -

Page 246