Kodak 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

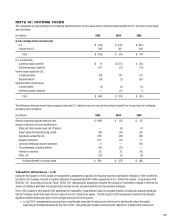

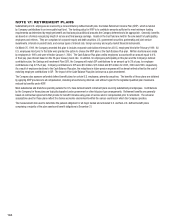

NOTE 15: INCOME TAXES

The components of (loss) earnings from continuing operations before income taxes and the related provision (benefi t) for U.S. and other income taxes

were as follows:

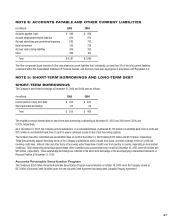

(in millions) 2005 2004 2003

(Loss) earnings before income taxes

U.S. $ (974) $ (581) $ (205)

Outside the U.S. 208 487 309

Total $ (766) $ (94) $ 104

U.S. income taxes

Current provision (benefi t) $ 19 $ (227) $ (88)

Deferred provision (benefi t) 627 (73) (41)

Income taxes outside the U.S.

Current provision 138 141 133

Deferred benefi t (93) (2) (87)

State and other income taxes

Current benefi t (2) (3) (6)

Deferred provision (benefi t) — (11) 4

Total $ 689 $ (175) $ (85)

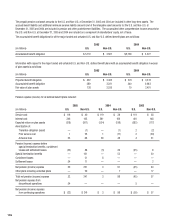

The differences between income taxes computed using the U.S. federal income tax rate and the provision (benefi t) for income taxes for continuing

operations were as follows:

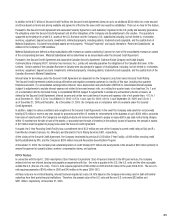

(in millions) 2005 2004 2003

Amount computed using the statutory rate $ (268) $ (33) $ 36

Increase (reduction) in taxes resulting from:

State and other income taxes, net of federal — (9) (3)

Export sales and manufacturing credits (28) (30) (25)

Operations outside the U.S. (101) (89) (69)

Valuation allowance 1,115 (10) 11

Land and intellectual property donations 6 — (13)

Tax settlements, including interest (44) (32) —

Interest on reserves 25 33 (16)

Other, net (16) (5) (6)

Provision (benefi t) for income taxes $ 689 $ (175) $ (85)

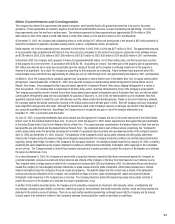

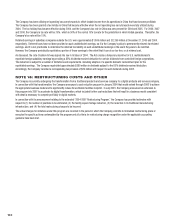

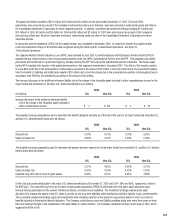

Valuation Allowance - U.S.

During the third quarter of 2005, based on management’s assessment of positive and negative evidence regarding the realization of the net deferred

tax assets, the Company recorded a valuation allowance of approximately $900 million against its net U.S. deferred tax assets. In accordance with

SFAS No. 109, “Accounting for Income Taxes” (SFAS 109), managements’ assessment included the evaluation of scheduled reversals of deferred tax

assets and liabilities, estimates of projected future taxable income, carryback potential and tax planning strategies.

Prior to the Company’s third quarter 2005 assessment of realizability, it was believed, based on available evidence including tax planning strategies,

that the Company would more likely than not realize its net U.S. deferred tax assets. The third quarter 2005 assessment considered the following

signifi cant matters based upon some recent changes that occurred in the quarter:

• In July 2005, management announced plans to signifi cantly accelerate its restructuring efforts and to signifi cantly reduce the assets

supporting its traditional business by the end of 2007. This global plan includes accelerating the reduction of traditional fi lm assets from