Kodak 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

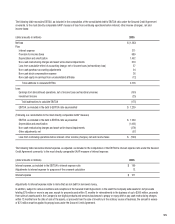

If unused, the 5-Year Revolving Credit Facility has a commitment fee of $5.0 million per year at the Company’s current credit rating of Ba3 and B+

from Moody’s Investor Services, Inc. (Moody’s) and Standard & Poor’s Rating Services (S&P), respectively.

At the closing of the Secured Credit Agreement, the Company terminated its previous $1.225 billion 5-Year Facility, a $160 million revolving credit

facility established by KPG, and the Company’s $200 million Accounts Receivable Securitization Program.

The Company has other committed and uncommitted lines of credit at December 31, 2005 totaling $132 million and $773 million, respectively. These

lines primarily support borrowing needs of the Company’s subsidiaries, which include term loans, overdraft coverage, letters of credit and revolving

credit lines. Interest rates and other terms of borrowing under these lines of credit vary from country to country, depending on local market

conditions. Total outstanding borrowings against these other committed and uncommitted lines of credit at December 31, 2005 were $34 million and

$65 million, respectively. These outstanding borrowings are refl ected in the short-term borrowings in the accompanying Consolidated Statement of

Financial Position at December 31, 2005.

At December 31, 2005, the Company had outstanding letters of credit totaling $117 million and surety bonds in the amount of $85 million primarily to

ensure the payment of casualty claims, workers’ compensation claims, and customs.

Debt Shelf Registration and Convertible Securities

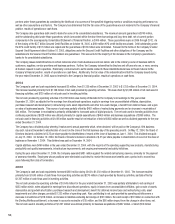

On September 5, 2003, the Company fi led a shelf registration statement on Form S-3 (the primary debt shelf registration) for the issuance of up to

$2.0 billion of new debt securities. Pursuant to Rule 429 under the Securities Act of 1933, $650 million of remaining unsold debt securities under a

prior shelf registration statement were included in the primary debt shelf registration, thus giving the Company the ability to issue up to $2.65 billion

in public debt. After issuance of $500 million in notes in October 2003, the remaining availability under the primary debt shelf registration was

$2.15 billion. The Company fi led its 2004 Form 10-K on April 6, 2005, which was late relative to the SEC required fi ling date (including extension) of

March 31, 2005. The Company also completed the fi ling of a Form 8-K/A related to the acquisition of KPG on July 1, 2005, which was late in relation

to the SEC required fi ling date of June 17, 2005. As a result of these late fi lings, the Company’s primary debt shelf registration statement on Form S-3

will not be available until the third quarter of 2006. In the event the Company wanted to issue registered securities, the Company could use Form S-1

or a Rule 144A transaction to issue such securities in the capital markets. However, the success of future debt issuances will be dependent on market

conditions at the time of such an offering.

The Company has $575 million aggregate principal amount of Convertible Senior Notes due 2033 (the Convertible Securities) on which interest

accrues at the rate of 3.375% per annum and is payable semiannually. The Convertible Securities are unsecured and rank equally with all of the

Company’s other unsecured and unsubordinated indebtedness. The Convertible Securities may be converted, at the option of the holders, to shares

of the Company’s common stock if the Company’s Senior Unsecured credit rating assigned to the Convertible Securities by either Moody’s or S&P

is lower than Ba2 or BB, respectively. At the Company’s current Senior Unsecured credit rating, the Convertible Securities may be converted by

their holders.

The recently completed $2.7 billion Secured Credit Facilities, along with other committed and uncommitted credit lines provide the Company with

adequate liquidity to meet its working capital and investing needs.

Credit Quality

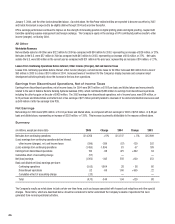

Moody’s and S&P’s ratings for the Company, including their outlooks, as of the fi ling date of this Form 10-K are as follows:

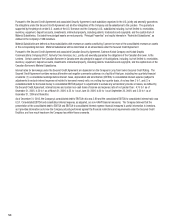

Senior Secured Rating Corporate Rating Senior Unsecured Rating Outlook

Moody’s Ba3 B1 B2 Negative

S&P B+ B+ B Negative

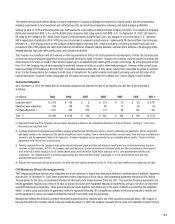

Starting on April 29, 2005 and through January 31, 2006, Moody’s downgraded its ratings on Kodak on four occasions, resulting in change of the

Corporate Rating from Baa3 to B1 and the Senior Unsecured Rating from Baa3 to B2. On September 21, 2005 Moody’s issued a Ba2 rating on

Kodak’s Senior Secured Debt, and subsequently lowered that rating to Ba3 on January 31, 2006. Moody’s outlook remains negative. On

November 1, 2005, Moody’s assigned an SGL-2 speculative grade liquidity rate to the Company.

Moody’s ratings refl ect their views regarding Kodak’s: (i) execution challenges to achieve digital profi tability as its business shifts into highly

competitive digital imaging markets, (ii) ongoing exposure to the accelerating secular decline of its consumer fi lm business and potential decline of its

entertainment imaging fi lm business, and (iii) variability in the utilization of its traditional manufacturing assets and potential for incremental

restructuring costs.

Moody’s Ba3 rating assigned to the Secured Credit Facilities refl ects the above factors as well as the security collateral and the secured cross

guarantee afforded to the Secured Credit Facilities.