Kodak 2005 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

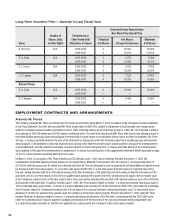

Daniel A. Carp

Mr. Carp retired from the Company on January 1, 2006. The Company employed Mr. Carp as President and CEO under a letter agreement dated

December 10, 1999. The letter agreement provided for a base salary of $1,000,000, and a target annual bonus of 105% of base salary. The

Compensation Committee approved an increase of Mr. Carp’s annual base salary to $1,100,000 effective May 5, 2003. Mr. Carp’s target award

under the Company’s variable pay plan was 155% of his base salary.

If the Company had terminated Mr. Carp’s employment without cause, Mr. Carp would have: 1) been permitted to retain his stock options and

restricted stock; 2) received severance pay equal to three times his base salary plus target annual bonus; 3) received prorated awards for the pending

periods under the Company’s bonus plans; and 4) been treated for pension purposes as if he were age 60. In the event of Mr. Carp’s disability while

employed with the Company, he would have received the same severance pay as he would have received upon termination without cause, except it

would have been reduced by the present value of any Company-provided disability benefi ts he received. The letter agreement also states that upon

Mr. Carp’s disability, he would have been permitted to retain all of his stock options.

On May 10, 2005, the Compensation Committee granted Mr. Carp “permitted and approved reason” status for all equity awards, including all stock

options, restricted stock and restricted stock units held by Mr. Carp upon his retirement, so that Mr. Carp would not forfeit any of his equity awards

as a result of his retirement on January 1, 2006. In addition, the Committee determined that any remaining restriction periods on restricted stock or

restricted stock units granted to Mr. Carp would lapse as of the date of his retirement.

Bernard V. Masson

Mr. Masson retired from the Company on January 2, 2006. The Company employed Mr. Masson under an offer letter dated November 7, 2002. The

Company entered into a subsequent letter agreement with Mr. Masson on August 13, 2003 as a result of his appointment as President, Digital & Film

Imaging Systems. Under this letter agreement, Mr. Masson was eligible to receive a severance allowance equal to one times his base salary plus

target annual bonus if he were terminated by the Company prior to August 13, 2008, for reasons other than cause or disability. The Company amended

Mr. Masson’s letter agreement effective May 5, 2005 to provide for certain enhanced retirement benefi ts through a phantom cash balance account

established on his behalf by the Company, as described on page 38. Under the terms of this amendment, if Mr. Masson’s employment were terminated

for other than cause, or voluntarily after June 1, 2008, he would be entitled to receive the then current balance in the phantom cash balance account.

Effective September 30, 2005, the Company entered into a letter agreement with Mr. Masson in connection with Mr. Masson’s termination of

employment with the Company effective January 2, 2006. Pursuant to the terms of the agreement, Mr. Masson will receive a severance allowance

equal to $1,646,040 payable in equal consecutive monthly payments over the 12-month period commencing on the six-month anniversary of the

date of his termination of employment. In addition, Mr. Masson’s termination of employment is being treated as an “approved reason” for purposes of

any stock options he holds and pursuant to the terms of the Company’s Leadership Stock Program described on page 31, so he did not forfeit these

awards as a result of his separation from service. Mr. Masson remained eligible for an award under the EXCEL plan described on page 28 for the 2005

performance period in accordance with the terms of EXCEL. In addition, he is receiving continuation of existing health, dental and basic life insurance

coverages, a retraining allowance and outplacement services, in accordance with the normal policies and practices of the Company. Also, Mr. Masson

will receive the current balance of $200,000 plus accrued interest in his phantom cash balance account pursuant to the terms of the May 5, 2005

letter agreement described above.

CHANGE IN CONTROL ARRANGEMENTS

Background

During 2005, the Compensation Committee reviewed the Company’s change in control program. Following its review, the Compensation Committee

presented its fi ndings to the Company’s Board of Directors. The Board determined that it was not appropriate at this time to take action regarding the

Company’s change in control program. The Board concluded that the Compensation Committee should re-address the topic at such later time as the

Board deems appropriate. Set forth below is a summary of the Company’s change in control program as it presently exists.

Program Description

The Company maintains a change in control program to provide severance pay and continuation of certain welfare benefi ts for virtually all U.S.

employees. A “change in control” is generally defi ned under the program as:

• the incumbent directors cease to constitute a majority of the Board, unless the election of the new directors was approved by at least

two-thirds of the incumbent directors then on the Board;

• the acquisition of 25% or more of the combined voting power of the Company’s then outstanding securities;

• a merger, consolidation, statutory share exchange or similar form of corporate transaction involving the Company or any of its subsidiaries that

requires the approval of the Company’s shareholders; or

• a vote by the shareholders to completely liquidate or dissolve the Company.