Kodak 2005 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

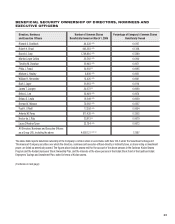

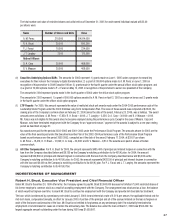

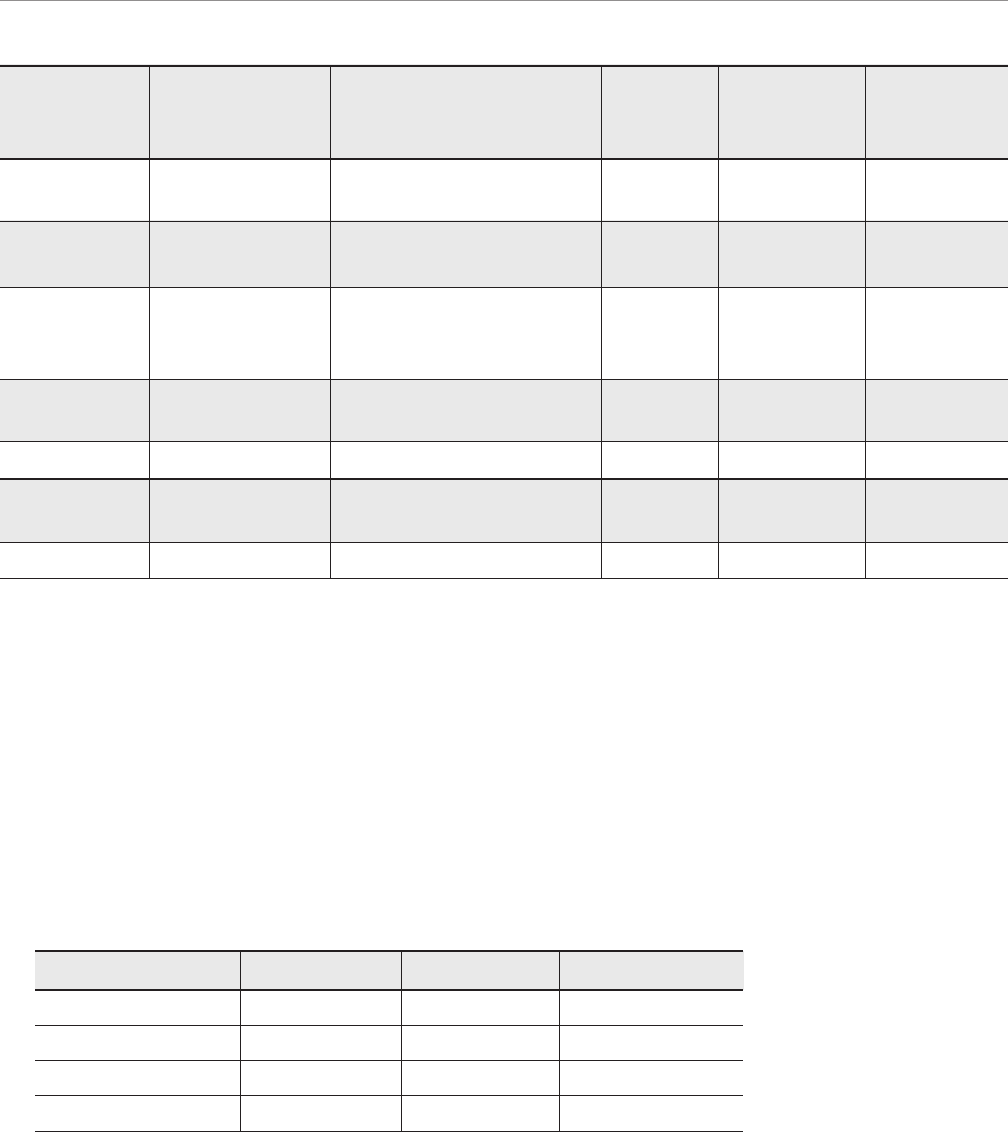

OPTION/SAR GRANTS IN LAST FISCAL YEAR

Individual Grants

Number of Securities Percentage of Total Options/SARs Exercise or

Underlying Options/ Granted to Employees Base Price Grant Date

Name SARs Granted(a) in Fiscal Year Per Share Expiration Date Present Value(f)

A. M. Perez 300,000 (b) 16.20% $ 26.47 05/31/2012 $ 2,238,000

135,000

(c) 7.29 24.75 12/06/2012 1,201,500

R. H. Brust 62,333 (d) 3.37 26.47 05/31/2012 465,004

18,000

(c) 0.10 24.75 12/06/2012 160,200

P. J. Faraci 10,000 (e) 0.05 26.46 05/11/2012 74,600

52,500

(d) 2.84 26.47 05/31/2012 391,650

20,940

(c) 1.13 24.75 12/06/2012 186,366

J. T. Langley 62,500 (d) 3.38 26.47 05/31/2012 488,630

20,940

(c) 1.13 24.75 12/06/2012 186,366

Retired Offi cers

D. A. Carp 91,667 (d) 4.95 26.47 05/31/2012 683,836

108,000

(c) 5.83 24.75 12/06/2012 961,200

B. V. Masson 79,750 (b) 4.31 26.47 05/31/2012 594,935

(a) Termination of employment results in forfeiture of the options unless the termination is due to retirement, death, disability or an approved reason.

In these circumstances, the options generally expire on the third anniversary of the date of termination of employment. Vesting accelerates upon

death, disability or termination of employment as a result of divestiture or transfer to an entity in which the Company has an ownership interest,

but which is not considered a controlled entity for fi nancial reporting purposes. One-third of the options vest on each of the fi rst three

anniversaries of the date of grant. Pursuant to the terms of Mr. Perez’s offer letter dated March 3, 2003, described on page 32, upon certain

termination of employment circumstances, Mr. Perez will be permitted to retain his stock options for their full original term.

(b) These options were granted to A. M. Perez on June 1, 2005 in connection with Mr. Perez’s promotion to CEO.

(c) These options were granted on December 7, 2005 under the annual offi cer stock option program.

(d) These options were granted on June 1, 2005 under a program to reward key executives for their roles in the Company’s digital transformation.

(e) These options were granted to P. J. Faraci on May 12, 2005 in connection with Mr. Faraci’s promotion to senior vice president of the Company.

(f) The fair value of these options was determined using the Black-Scholes model of option valuation in a manner consistent with the requirements

of Statement of Financial Accounting Standards No. 123-R (revised 2004), “Share-Based Payment,” using the following assumptions:

May 12, 2005 Grant June 1, 2005 Grant December 7, 2005 Grant

Risk-Free Interest Rate 3.6% 3.6% 4.5%

Expected Option Life 4 years 4 years 6.7 years

Expected Volatility 35.2% 35.2% 34.7%

Expected Dividend Yield 1.8% 1.8% 1.9%