Kodak 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

impairment charge of $19 million related to the investment in Lucky Film. The impairment was recognized as a result of an other-than-temporary

decline in the market value of Lucky Film’s stock. As a result, the value allocated to the 20 percent interest in Lucky Film has been adjusted to

$23 million and the corresponding value of the 13 percent interest has been adjusted to $14 million. The Company will record the $9 million of value

associated with the additional 7 percent interest in Lucky Film when it completes the acquisition of those shares in 2007. The Company’s interest in

Lucky Film is accounted for under the equity method of accounting, as the Company has the ability to exercise signifi cant infl uence over Lucky Film’s

operating and fi nancial policies.

Scitex Digital Printing (Renamed Versamark)

On January 5, 2004, the Company completed its acquisition of Scitex Digital Printing (SDP) from its parent for $252 million, inclusive of cash on hand

at closing which totaled approximately $13 million. This resulted in a net cash price of approximately $239 million, inclusive of transaction costs.

SDP is the leading supplier of high-speed, continuous inkjet printing systems, primarily serving the commercial and transactional printing sectors.

Customers use SDP’s products to print utility bills, banking and credit card statements, direct mail materials, as well as invoices, fi nancial statements

and other transactional documents. SDP now operates under the name Kodak Versamark, Inc. The acquisition will provide the Company with

additional capabilities in the transactional printing and direct mail sectors while creating another path to commercialize proprietary inkjet technology.

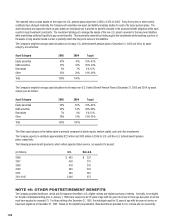

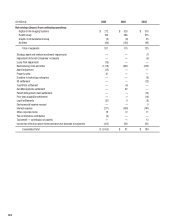

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition. The fi nal purchase

price allocation is as follows:

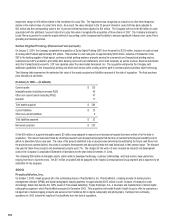

At January 5, 2004 — (in millions)

Current assets $ 125

Intangible assets (including in-process R&D) 95

Other non-current assets (including PP&E) 47

Goodwill 17

Total assets acquired $ 284

Current liabilities $ 23

Other non-current liabilities 9

Total liabilities assumed $ 32

Net assets acquired $ 252

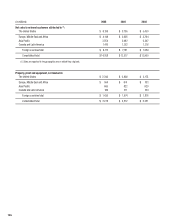

Of the $95 million of acquired intangible assets, $9 million was assigned to research and development assets that were written off at the date of

acquisition. This amount was determined by identifying research and development projects that had not yet reached technological feasibility and for

which no alternative future uses exist. The value of the projects identifi ed to be in progress was determined by estimating the future cash fl ows from

the projects once commercialized, less costs to complete development and discounting these net cash fl ows back to their present value. The discount

rate used for these three research and development projects was 17%. The charges for the write-off were included as research and development

costs in the Company’s Consolidated Statement of Operations for the year ended December 31, 2004.

The remaining $86 million of intangible assets, which relate to developed technology, customer relationships, and trade names, have useful lives

ranging from two to fourteen years. The $17 million of goodwill will be assigned to the Graphic Communications Group segment and is expected to be

deductible for tax purposes.

2003

PracticeWorks, Inc.

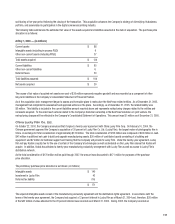

On October 7, 2003, Kodak acquired all of the outstanding shares of PracticeWorks, Inc. (PracticeWorks), a leading provider of dental practice

management software (DPMS) and digital radiographic imaging systems, for approximately $475 million in cash, inclusive of transaction costs.

Accordingly, Kodak also became the 100% owner of Paris-based subsidiary, Trophy Radiologie, S.A., a developer and manufacturer of dental digital

radiography equipment, which PracticeWorks acquired in December 2002. This acquisition will enable Kodak’s Health Group to offer its customers a

full spectrum of dental imaging products and services from traditional fi lm to digital radiography and photography. Earnings from continuing

operations for 2003 include the results of PracticeWorks from the date of acquisition.