Kodak 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

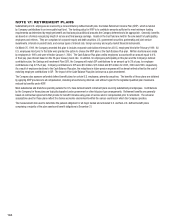

The prepaid pension cost asset amounts for the U.S. and Non-U.S. at December 31, 2005 and 2004 are included in other long-term assets. The

accrued benefi t liability and additional minimum pension liability amounts (net of the intangible asset amounts) for the U.S. and Non-U.S. at

December 31, 2005 and 2004 are included in pension and other postretirement liabilities. The accumulated other comprehensive income amounts for

the U.S. and Non-U.S. at December 31, 2005 and 2004 are included as a component of shareholders’ equity, net of taxes.

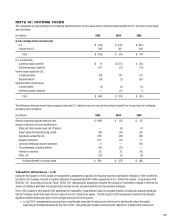

The accumulated benefi t obligations for all the major funded and unfunded U.S. and Non-U.S. defi ned benefi t plans are as follows:

2005 2004

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Accumulated benefi t obligation $ 5,719 $ 3,567 $ 5,738 $ 3,327

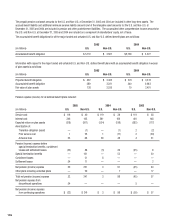

Information with respect to the major funded and unfunded U.S. and Non-U.S. defi ned benefi t plans with an accumulated benefi t obligation in excess

of plan assets is as follows:

2005 2004

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Projected benefi t obligation $ 422 $ 3,402 $ 374 $ 3,274

Accumulated benefi t obligation 389 3,221 340 2,983

Fair value of plan assets 126 2,526 79 2,491

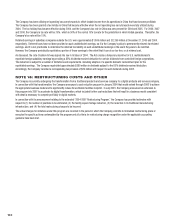

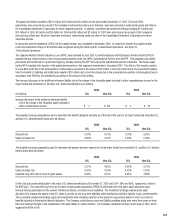

Pension expense (income) for all defi ned benefi t plans included:

2005 2004 2003

(in millions) U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Service cost $ 116 $ 40 $ 119 $ 38 $ 119 $ 38

Interest cost 346 165 381 169 410 148

Expected return on plan assets (518) (207) (534) (198) (582) (177)

Amortization of:

Transition obligation (asset) — (1) — (1) 2 (2)

Prior service cost 1 25 1 (17) 2 (30)

Actuarial loss 33 66 28 48 4 31

Pension (income) expense before

special termination benefi ts, curtailment

losses and settlement losses (22) 88 (5) 39 (45) 8

Special termination benefi ts — 101 — 52 — 30

Curtailment losses — 21 8 — — —

Settlement losses 54 11 — — — 2

Net pension (income) expense 32 221 3 91 (45) 40

Other plans including unfunded plans — 20 — 7 — 17

Total net pension (income) expense 32 241 3 98 (45) 57

Net pension expense from

discontinued operations 54 — — — 5 —

Net pension (income) expense

from continuing operations $ (22) $ 241 $ 3 $ 98 $ (50) $ 57