Kodak 2005 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

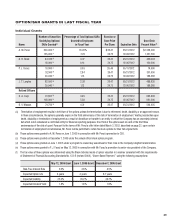

32

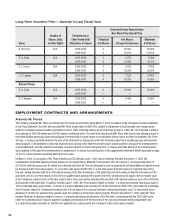

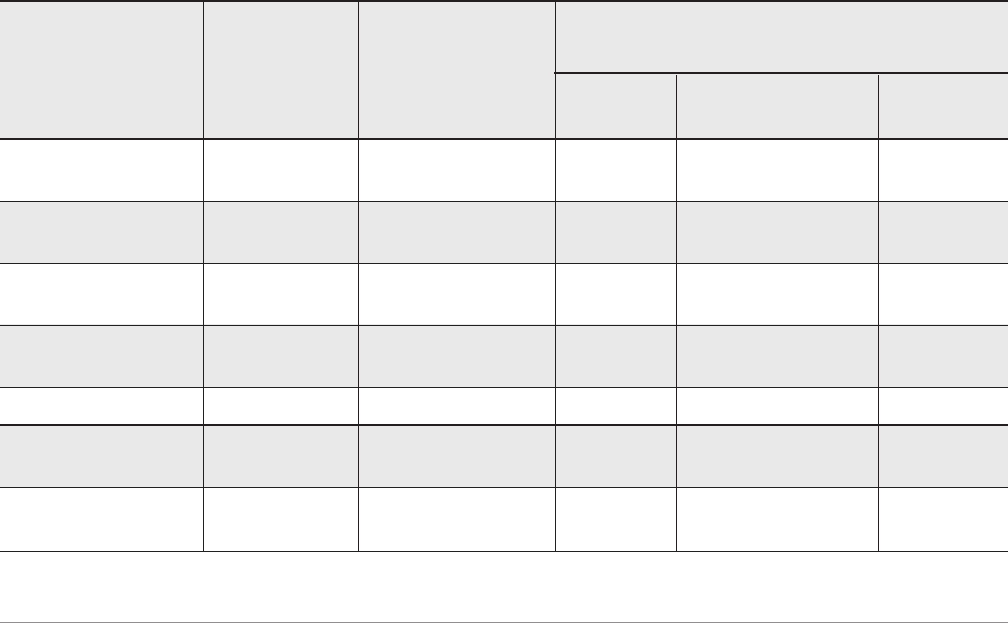

Long-Term Incentive Plan — Awards in Last Fiscal Year

Estimated Future Payouts Under

Non-Stock Price-Based Plans

Number of Performance or

Shares, Units Other Period Until Threshold # of Shares Maximum

Name or Other Rights Maturation or Payout # of Shares at Target Performance # of Shares

A. M. Perez N/A 2005-2006 0 32,500 65,000

2006-2007 0 63,750 127,500

R. H. Brust N/A 2005-2006 0 8,750 17,500

2006-2007 0 10,050 20,100

P. J. Faraci N/A 2005-2006 0 5,925 11,850

2006-2007 0 10,250 20,500

J. T. Langley N/A 2005-2006 0 7,230 14,460

2006-2007 0 10,250 20,500

Retired Offi cers

D. A. Carp N/A 2005-2006 0 41,000 82,000

2006-2007 — — —

B. V. Masson N/A 2005-2006 0 9,450 18,900

2006-2007 — — —

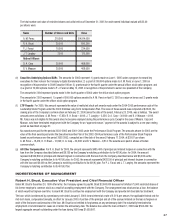

EMPLOYMENT CONTRACTS AND ARRANGEMENTS

Antonio M. Perez

The Company employed Mr. Perez as President and COO under an offer letter dated March 3, 2003. In addition to the information provided elsewhere

in this Proxy Statement, the offer letter provided Mr. Perez a base salary of $900,000, subject to adjustment at least annually, and a target award

under the Company’s annual variable compensation plan of 100% of his base salary. As a hiring bonus on April 2, 2003, Mr. Perez received a grant of

stock options for 500,000 shares and 100,000 shares of restricted stock. The offer letter also provides Mr. Perez with a severance allowance equal to

two times his base salary plus target annual bonus if he terminates for good reason or is terminated without cause. In either circumstance, Mr. Perez

will also: 1) receive a prorated award for the year of his termination of employment under the Company’s short-term variable pay plan and long-term

award program; 2) be permitted to retain his restricted stock awards (other than the restricted stock award granted to him upon the commencement

of his employment), and the restrictions will lapse, and stock options, for their full original term; 3) receive a prorated portion of the restricted stock

award granted to him upon his commencement of employment; 4) receive a prorated portion of the supplemental retirement benefi t described on page

37; and 5) receive fi nancial counseling benefi ts for two years.

On May 10, 2005, in recognition of Mr. Perez’s election as CEO effective June 1, 2005 and as Chairman effective December 31, 2005, the

Compensation Committee approved various changes to his compensation. When Mr. Perez became CEO, he received: 1) an annual base salary of

$1,100,000 (with the excess over $1 million to be deferred until after Mr. Perez’s retirement in order to preserve the full deductibility for federal income

tax purposes of Mr. Perez’s base salary); 2) a one-time cash award of $150,000; 3) a one-time award of 60,000 shares of restricted stock with a

fi ve-year vesting schedule with 50% of the shares vesting on the third anniversary of the grant date and 50% vesting on the fi fth anniversary of the

grant date; and 4) a one-time award of 300,000 non-qualifi ed stock options with a seven-year term, an exercise price equal to the fair market value

of the Company’s common stock on the date of grant and a three-year vesting schedule with one-third of the options vesting on each of the fi rst three

anniversaries of the grant date. In addition, effective June 1, 2005, Mr. Perez became eligible to receive: 1) a target performance cash bonus equal to

155% of his base salary under EXCEL, if earned; 2) a target leadership stock allocation of 34,000 units for the 2006-2007 cycle under the Leadership

Stock Program, subject to Company performance over the two years of the cycle and minimum vesting requirements; and 3) a target stock option

allocation of 72,000 non-qualifi ed stock options under the Company’s offi cer stock option program. Effective December 31, 2005, when Mr. Perez

became Chairman, he became eligible to receive: 1) a target leadership stock allocation of 50,000 units, commencing with the 2007-2008 cycle,

under the Leadership Stock Program, subject to Company performance over the two years of the cycle and minimum vesting requirement; and

2) a target stock option allocation of 100,000 non-qualifi ed stock options under the Company’s offi cer stock option program.