Kodak 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

Upon closing of an acquisition, the Company estimates the fair values of assets and liabilities acquired in order to consolidate the acquired balance

sheet. Given the time it takes to obtain pertinent information to fi nalize the acquired balance sheet, it is not uncommon for initial estimates to be

revised in subsequent quarters. The Company is currently in the process of fi nalizing the purchase price allocation with respect to the acquisition

of KPG and must complete (1) the fi nal review of the independent third party valuation prepared, and (2) the allocation of the purchase price to the

proper tax jurisdictions, which will allow the Company to complete the fi nal valuation of the deferred tax liability associated with the acquisition. The

purchase price allocation, including the allocation to the proper tax jurisdictions, will be completed in the fi rst quarter of 2006. A preliminary estimate

of the deferred tax liability has been calculated and is included in the preliminary purchase price allocation, which is as follows:

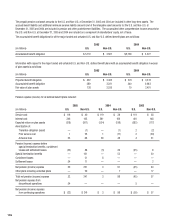

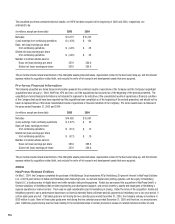

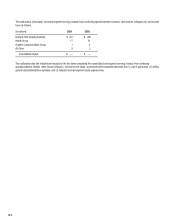

At April 1, 2005 — (in millions):

Current assets $ 485

Intangible assets (including in-process R&D) 159

Other non-current assets (including PP&E) 189

Goodwill 218

Total assets acquired $ 1,051

Current liabilities $ 260

Non-current liabilities 72

Total liabilities assumed $ 332

Net assets acquired $ 719

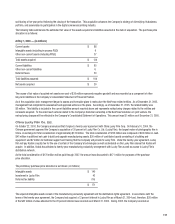

Of the $159 million of acquired intangible assets, approximately $16 million was assigned to research and development assets that were written off

at the date of acquisition. This amount was determined by identifying research and development projects that had not yet reached technological

feasibility and for which no alternative future uses exist. The value of the projects identifi ed to be in progress was determined by estimating the future

cash fl ows from the projects once commercialized, less costs to complete development and discounting these net cash fl ows back to their present

value. The discount rate used for these research and development projects was 22%. The charges for the write-off were included as research and

development costs in the Company’s Consolidated Statement of Operations for the year ended December 31, 2005.

The remaining $143 million of intangible assets, which relate to developed technology, trademarks and customer relationships, have useful lives

ranging from three to sixteen years. The $218 million of goodwill is assigned to the Company’s Graphic Communications Group segment. Because

the fi nal purchase price allocation has not been completed, the deductibility for tax purposes of the goodwill balance, or any portion of the goodwill

balance, has not been determined.

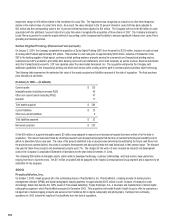

As of the acquisition date, management began to assess and formulate restructuring plans at KPG. As of December 31, 2005, management has

completed its assessment and approved actions on some of the plans. Accordingly, the Company recorded a related liability of approximately

$5 million on those approved actions. This liability is included in the current liabilities amount reported above and represents restructuring

charges related to the net assets acquired. To the extent such actions related to the Company’s historical ownership in the KPG joint venture, the

restructuring charges will be refl ected in the Company’s Consolidated Statement of Operations. As of December 31, 2005, management had not

approved all plans and actions to be taken and, therefore, the Company was not committed to specifi c actions. Accordingly, the amount related to

future actions is not estimable and has not been recorded. However, once management approves and commits the Company to the plans, the

accounting for the restructuring charges will be refl ected in the purchase accounting as an increase to goodwill to the extent the actions relate to the

net assets acquired. Refer to Note 16, “Restructuring Costs and Other,” for further discussion of these restructuring charges.