Kodak 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

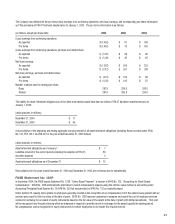

85

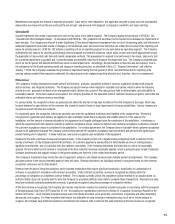

Amortization expense related to intangible assets was $125 million, $67 million and $28 million in 2005, 2004 and 2003, respectively.

Estimated future amortization expense related to purchased intangible assets at December 31, 2005 is as follows (in millions):

2006 $ 141

2007 131

2008 126

2009 114

2010 90

2011+ 198

Total $ 800

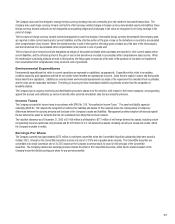

NOTE 6: OTHER LONG-TERM ASSETS

(in millions) 2005 2004

Prepaid pension costs $ 1,144 $ 1,203

Investments in unconsolidated affi liates 40 513

Deferred income taxes, net of valuation allowance 450 521

Intangible assets other than goodwill 800 478

Other non-current receivables 328 163

Miscellaneous other long-term assets 459 253

Total $ 3,221 $ 3,131

The miscellaneous component above consists of other miscellaneous long-term assets that, individually, are less than 5% of the Company’s total

long-term assets, and therefore, have been aggregated in accordance with Regulation S-X.

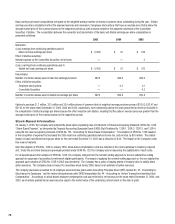

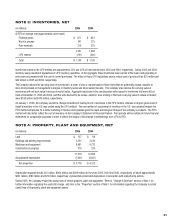

NOTE 7: INVESTMENTS

Equity Method –

At December 31, 2005 and 2004, the Company’s signifi cant equity method investees and the Company’s approximate ownership interest in each

investee were as follows:

2005 2004

SK Display Corporation 34% 34%

Matsushita-Ultra Technologies

Battery Corporation 30% 30%

Lucky Film Co. Ltd (Lucky Film) 13% 13%

KJ Imaging 34% 34%

J League Photo 25% 25%

Kodak Polychrome Graphics (KPG) N/A 50%

Express Stop Financing (ESF) N/A 50%

At December 31, 2005 and 2004, the carrying value of the Company’s equity investment in these signifi cant unconsolidated affi liates was $26 million

and $488 million, respectively, and is reported within other long-term assets in the accompanying Consolidated Statement of Financial Position. The

Company records its equity in the income or losses of these investees and reports such amounts in other income (charges), net, in the accompanying

Consolidated Statement of Operations. See Note 14, “Other Income (Charges), Net.” Other than KPG, these investments do not meet the Regulation

S-X signifi cance test requiring the inclusion of the separate investee fi nancial statements.

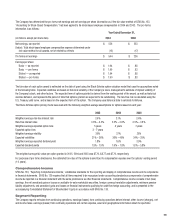

Through April 1, 2005, the Company held a 50% interest in Kodak Polychrome Graphics (KPG). This joint venture between the Company and Sun

Chemical Corporation was accounted for using the equity method of accounting. Therefore, the acquisition of KPG in 2005 is the primary reason for

the year-over-year decrease in the carrying value of the Company’s equity investment in its unconsolidated affi liates. On April 1, 2005, the