Kodak 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

Company acquired Sun Chemical Corporation’s 50% interest in KPG, which resulted in KPG becoming a wholly owned and fully consolidated

subsidiary of the Company, operating within the Graphic Communications Group segment. See Note 21, “Acquisitions” for further discussion

regarding the KPG acquisition.

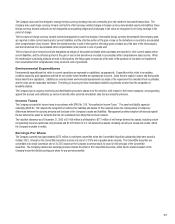

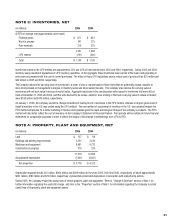

Summarized fi nancial information for KPG for 2004 and 2003 is as follows:

Condensed Statement of Operations

(dollar amounts in millions) 2004 2003

Net sales $ 1,715 $ 1,598

Gross profi t 563 511

Income from continuing operations 105 70

Net income 105 70

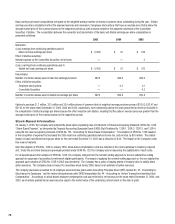

Condensed Balance Sheet

December 31,

(dollar amounts in millions) 2004 2003

Current assets $ 909 $ 794

Noncurrent assets 401 384

Current liabilities 458 403

Noncurrent liabilities 60 134

Full fi nancial statements for the years ended December 31, 2004, 2003 and 2002 and as of December 31, 2004 and 2003 for KPG have been included

as an exhibit to this Form 10-K. In addition, unaudited information for the interim periods ended March 31, 2005 and 2004 has also been included as

an exhibit to this Form 10-K.

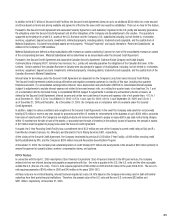

During the fourth quarter of 2005, the Company’s investment in Express Stop Financing (ESF), a joint venture partnership between the Company’s

Qualex subsidiary and a subsidiary of Dana Credit Corporation, was dissolved. During the fi rst quarter of 2005, the Company received a distribution

from the joint venture liquidating its investment balance. There was no material impact on the Company’s fi nancial position, results of operations or

cash fl ows from the dissolution of the ESF investment.

In January 2006, Kodak terminated the SK Display joint venture arrangement with Sanyo Electric Company pursuant to terms of the original

agreement. This termination will not have a material impact on the Company’s fi nancial position, results of operations or cash fl ows. Kodak will

continue as exclusive licensing agent on behalf of Kodak and Sanyo for certain OLED intellectual property.

Kodak has no other material activities with its equity method investees.

Cost Method –

The Company also has certain investments with less than a 20% ownership interest in various private companies whereby the Company does not

have the ability to exercise signifi cant infl uence. These investments are accounted for under the cost method. The remaining carrying value of the

Company’s investments accounted for under the cost method at December 31, 2005 and 2004 of $22 million and $19 million, respectively, is included

in other long-term assets in the accompanying Consolidated Statement of Financial Position.