Kodak 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

perform under these guarantees by considering the likelihood of occurrence of the specifi ed triggering events or conditions requiring performance as

well as other assumptions and factors. The Company has determined that the fair value of the guarantees was not material to the Company’s fi nancial

position, results of operations or cash fl ows.

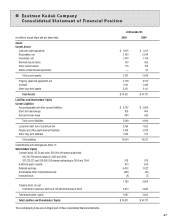

The Company also guarantees debt owed to banks for some of its consolidated subsidiaries. The maximum amount guaranteed is $740 million,

and the outstanding debt under those guarantees, which is recorded within the short-term borrowings and long-term debt, net of current portion

components in the accompanying Consolidated Statement of Financial Position, is $109 million. These guarantees expire in 2006 through 2012. As

of the closing of the $2.7 billion Secured Credit Facilities on October 18, 2005, a $160 million KPG credit facility was closed. Debt outstanding under

the KPG credit facility of $57 million was repaid and the guarantees of $160 million were terminated. Pursuant to the terms of the Company’s Senior

Secured Credit Agreement dated October 18, 2005, obligations under the Secured Credit Facilities and other obligations of the Company and its

subsidiaries to the Secured Credit Facilities lenders are guaranteed. This accounts for the majority of the increase in the Company’s guarantees to

banks for its consolidated subsidiaries.

The Company issues indemnifi cations in certain instances when it sells businesses and real estate, and in the ordinary course of business with its

customers, suppliers, service providers and business partners. Further, the Company indemnifi es its directors and offi cers who are, or were, serving

at Kodak’s request in such capacities. Historically, costs incurred to settle claims related to these indemnifi cations have not been material to the

Company’s fi nancial position, results of operations or cash fl ows. Additionally, the fair value of the indemnifi cations that the Company issued during

the year ended December 31, 2005 was not material to the Company’s fi nancial position, results of operations or cash fl ows.

2004

The Company’s cash and cash equivalents increased $5 million, from $1,250 million at December 31, 2003 to $1,255 million at December 31, 2004.

The increase resulted primarily from $1,168 million of net cash provided by operating activities. This was offset by $1,066 million of net cash used in

fi nancing activities, and $120 million of net cash used in investing activities.

The net cash provided by operating activities of $1,168 million was mainly attributable to the Company’s net earnings for the year ended

December 31, 2004, as adjusted for the earnings from discontinued operations, equity in earnings from unconsolidated affi liates, depreciation,

purchased research and development, restructuring costs, asset impairments and other non-cash charges, a benefi t from deferred taxes, and a gain

on sales of businesses/assets. This source of cash was partially offset by $481 million of restructuring payments and an increase in receivables of

$43 million. The increase in receivables is primarily attributable to increased sales of digital products. The net cash used in investing activities from

continuing operations of $828 million was utilized primarily for capital expenditures of $460 million and business acquisitions of $369 million. The

net cash used in fi nancing activities of $1,066 million was the result of net reduction of debt of $928 million as well as dividend payments for the year

ended December 31, 2004.

The Company has a dividend policy whereby it makes semi-annual payments which, when declared, will be paid on the Company’s 10th business

day each July and December to shareholders of record on the close of the fi rst business day of the preceding month. On May 12, 2004, the Board of

Directors declared a dividend of $.25 per share payable to shareholders of record at the close of business on June 1, 2004. This dividend was paid

on July 15, 2004. On October 19, 2004, the Board of Directors declared a dividend of $.25 per share payable to shareholders of record at the close of

business on November 1, 2004. This dividend was paid on December 14, 2004.

Capital additions were $460 million in the year ended December 31, 2004, with the majority of the spending supporting new products, manufacturing

productivity and quality improvements, infrastructure improvements, and ongoing environmental and safety initiatives.

During the year ended December 31, 2004, the Company expended $481 million against the related restructuring reserves, primarily for the payment

of severance benefi ts. Employees whose positions were eliminated could elect to receive their severance benefi ts over a period not to exceed two

years following their date of termination.

2003

The Company’s cash and cash equivalents increased $681 million during 2003 to $1,250 million at December 31, 2003. The increase resulted

primarily from $1,645 million of cash fl ows from operating activities and $270 million of cash provided by fi nancing activities, partially offset by

$1,267 million of cash fl ows used in investing activities.

The net cash provided by operating activities of $1,645 million for the year ended December 31, 2003 was partially attributable to net earnings of

$253 million which, when adjusted for earnings from discontinued operations, equity in losses from unconsolidated affi liates, gain on sale of assets,

depreciation and goodwill amortization, purchased research and development, benefi t for deferred income taxes and restructuring costs, asset

impairments and other charges, provided $1,233 million of operating cash. Also contributing to net cash provided by operating activities were a

decrease in inventories of $118 million, an increase in liabilities excluding borrowings of $103 million, the cash receipt of $19 million in connection with

the Sterling Winthrop settlement, a decrease in accounts receivable of $15 million, and the $98 million impact from the change in other items, net.

The net cash used in investing activities of $1,267 million was utilized primarily for business acquisitions of $697 million, of which $59 million