Kodak 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.98

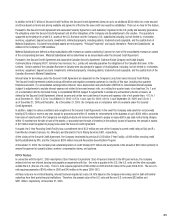

$2.9 billion in January 2004 to approximately $1 billion by 2007 and terminating approximately 10,000 employees. These actions will have a

negative impact on Kodak’s ability to generate taxable income in the U.S.

• On October 18, 2005, the Company entered into a new secured credit facility pursuant to which the borrowings in the U.S. are collateralized

by certain U.S. assets, including the Company’s intellectual property assets. Thus, management determined that the previous tax planning

strategy to sell the U.S. intellectual property to a foreign subsidiary to generate taxable income in the U.S. was no longer prudent nor feasible

and should not be relied upon as part of the third quarter assessment of realizability of the Company’s U.S. deferred tax assets.

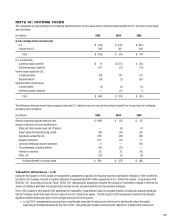

Based upon management’s above-mentioned September 30, 2005 assessment of realizability, management concluded that it was no longer more

likely than not that the U.S. net deferred tax assets would be realized and, as such, recorded a valuation allowance of approximately $900 million.

In the fourth quarter of 2005, management updated its assessment of the realizability of its net deferred tax assets. As a result of management’s

assessment of positive and negative evidence regarding the realization of the net deferred tax assets, which included the evaluation of scheduled

reversals of deferred tax assets and liabilities, estimates of projected future taxable income, carryback potential and tax planning strategies, the

Company maintained that it was still no longer more likely than not that the U.S. net deferred tax assets would be realized and, as such, increased the

valuation allowance by approximately $181 million relating to deferred tax benefi ts generated in the fourth quarter. In addition, the Company expects

to record a valuation allowance on all U.S. tax benefi ts generated in the future until an appropriate level of profi tability in the U.S. is sustained or until

the Company is able to generate enough taxable income through other tax planning strategies and transactions. Both the net deferred tax asset

balances and the offsetting valuation allowance include estimates attributable to the recent acquisitions of KPG and Creo. Deferred tax amounts

attributable to these businesses are expected to be fi nalized during 2006 with the completion of the Company’s purchase accounting for these

acquired entities.

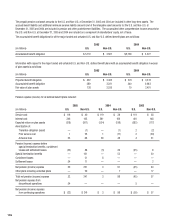

As of December 31, 2005, the Company had a valuation allowance of $1,229 million relating to its net deferred tax assets in the U.S. of $1,308 million.

The valuation allowance of $1,229 million is attributable to: (i) the charges totaling $1,081 million that were recorded in the third and fourth quarters

of 2005 and (ii) a valuation allowance of $148 million recorded in a prior year for certain state tax carryforward deferred tax assets relating to which

management believes it is not more likely than not that the assets will be realized. The remaining net deferred tax assets in excess of the valuation

allowance of $79 million relate to certain foreign tax credit deferred tax assets relating to which management believes it is more likely than not that

the assets will be realized.

Valuation Allowance – Outside the U.S.

As of December 31, 2005, the Company had a valuation allowance of approximately $177 million relating to its deferred tax assets outside of the U.S.

of $534 million. The valuation allowance of $177 million is attributable to certain net operating loss and capital loss carryforwards relating to which

management believes it is not more likely than not that the assets will be realized.

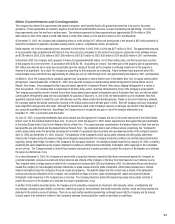

Tax Settlements, Including Interest

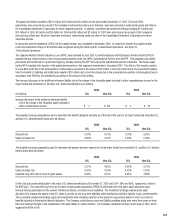

During 2005, the Company reached a settlement with the Internal Revenue Service covering tax years 1993-1998. As a result, the Company

recognized a tax benefi t from continuing operations of $44 million, including interest. Net income from discontinued operations for 2005 was

$150 million, which was net of a $203 million tax benefi t. The $203 million tax benefi t for 2005 results from the Company’s audit settlement with

the Internal Revenue Service for tax years covering 1993 through 1998.

During 2004, the Company reached a settlement with the Internal Revenue Service covering tax years 1982-1992. As a result, the Company

recognized a tax benefi t of $37 million in 2004, which consisted of benefi ts of $32 million related to a formal concession concerning the taxation of

certain intercompany royalties that could not legally be distributed to the parent entity and $9 million related to the income tax treatment of a patent

infringement litigation settlement, and a $4 million charge related to other tax items. The Company also reached a favorable resolution of interest

calculations for these years, and recorded a benefi t of $8 million. Finally, the Company recorded net charges of $13 million for adjustments for audit

years 1993 and thereafter. Net income from discontinued operations for 2004 was $475 million, which was net of a tax provision of $275 million.

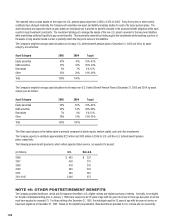

The Company and its subsidiaries’ income tax returns are routinely examined by various authorities. In management’s opinion, adequate provision

for income taxes has been made for all open years in accordance with SFAS No. 5, “Accounting for Contingencies.” A degree of judgment is required

in determining our effective tax rate and in evaluating our tax position. The Company establishes reserves when, despite signifi cant support for the

Company’s fi ling position, a belief exists that these positions may be challenged by the respective tax jurisdiction. The reserves are adjusted upon the

occurrence of external, identifi able events, including the settlement of the related tax audit year with the Internal Revenue Service. A change in our

tax reserves could have a signifi cant impact on our effective tax rate and our operating results.