Kodak 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

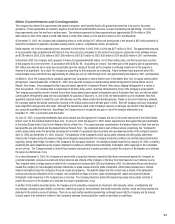

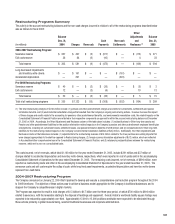

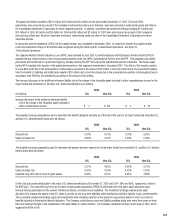

Restructuring Programs Summary

The activity in the accrued restructuring balances and the non-cash charges incurred in relation to all of the restructuring programs described below

was as follows for fi scal 2005:

Other

Balance Adjustments Balance

Dec. 31, Cash Non-cash and Dec. 31,

(in millions) 2004 Charges Reversals Payments Settlements Reclasses

(1) 2005

2004-2007 Restructuring Program:

Severance reserve $ 267 $ 497 $ (3) $ (377) $ — $ (113) $ 271

Exit costs reserve 36 84 (6) (95) — 4 2 3

Total reserve $ 303 $ 581 $ (9) $ (472) $ — $ (109) $ 294

Long-lived asset impairments

and inventory write-downs $ — $ 161 $ — $ — $ (161) $ — $ —

Accelerated depreciation — 391 — — (391) — —

Pre-2004 Restructuring Programs:

Severance reserve $ 40 $ — $ (3) $ (30) $ — $ (5) $ 2

Exit costs reserve 12 — (3) (6) — 10 13

Total reserve $ 52 $ — $ (6) $ (36) $ — $ 5 $ 15

Total of all restructuring programs $ 355 $ 1,133 $ (15) $ (508) $ (552) $ (104) $ 309

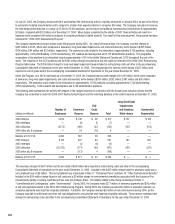

(1) The total restructuring charges of $1,133 million include: (1) pension and other postretirement charges and credits for curtailments, settlements and special

termination benefi ts, and (2) environmental remediation charges that resulted from the Company’s ongoing restructuring actions. However, because the impact

of these charges and credits relate to the accounting for pensions, other postretirement benefi ts, and environmental remediation costs, the related impacts on the

Consolidated Statement of Financial Position are refl ected in their respective components as opposed to within the accrued restructuring balances at December

31, 2005 or 2004. Accordingly, the Other Adjustments and Reclasses column of the table above includes: (1) reclassifi cations to Other long-term assets and

Pension and other postretirement liabilities for the position elimination-related impacts on the Company’s pension and other postretirement employee benefi t plan

arrangements, including net curtailment losses, settlement losses, and special termination benefi ts of $(98) million, and (2) reclassifi cations to Other long-term

liabilities for the restructuring-related impacts on the Company’s environmental remediation liabilities of $(8) million. Additionally, the Other Adjustments and

Reclasses column of the table above includes: (1) adjustments to the restructuring reserves of $14 million related to the Creo purchase accounting impacts that

were charged appropriately to Goodwill as opposed to Restructuring charges, (2) foreign currency translation adjustments of $(12) million, which are refl ected

in Accumulated other comprehensive loss in the Consolidated Statement of Financial Position, and (3) rebalancing reclassifi cations between the restructuring

reserves, which net to zero on a consolidated basis.

The costs incurred, net of reversals, which total $1,118 million for the year ended December 31, 2005, include $391 million and $37 million of

charges related to accelerated depreciation and inventory write-downs, respectively, which were reported in cost of goods sold in the accompanying

Consolidated Statement of Operations for the year ended December 31, 2005. The remaining costs incurred, net of reversals, of $690 million, were

reported as restructuring costs and other in the accompanying Consolidated Statement of Operations for the year ended December 31, 2005. The

severance costs and exit costs require the outlay of cash, while long-lived asset impairments, accelerated depreciation and inventory write-downs

represent non-cash items.

2004-2007 Restructuring Program

The Company announced on January 22, 2004 that it planned to develop and execute a comprehensive cost reduction program throughout the 2004

to 2006 timeframe. The objective of these actions was to achieve a business model appropriate for the Company’s traditional businesses, and to

sharpen the Company’s competitiveness in digital markets.

The Program was expected to result in total charges of $1.3 billion to $1.7 billion over the three-year period, of which $700 million to $900 million

related to severance, with the remainder relating to the disposal of buildings and equipment. Overall, Kodak’s worldwide facility square footage was

expected to be reduced by approximately one-third. Approximately 12,000 to 15,000 positions worldwide were expected to be eliminated through

these actions primarily in global manufacturing, selected traditional businesses and corporate administration.