Kodak 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

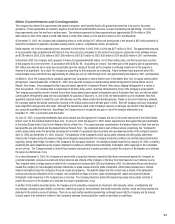

NOTE 12: GUARANTEES

The Company guarantees debt and other obligations under agreements with certain affi liated companies and customers to ensure that fi nancing is

obtained to facilitate ongoing business operations and selling activities, respectively. At December 31, 2005, these guarantees totaled a maximum of

$204 million, with outstanding guaranteed amounts of $134 million. The guarantees for the other unconsolidated affi liates and third party debt

mature between 2006 and 2011. The customer fi nancing agreements and related guarantees typically have a term of 90 days for product and

short-term equipment fi nancing arrangements, and up to fi ve years for long-term equipment fi nancing arrangements. These guarantees would require

payment from Kodak only in the event of default on payment by the respective debtor. In some cases, particularly for guarantees related to equipment

fi nancing, the Company has collateral or recourse provisions to recover and sell the equipment to reduce any losses that might be incurred in

connection with the guarantees.

Management believes the likelihood is remote that material payments will be required under any of the guarantees disclosed above. With respect to

the guarantees that the Company issued in the year ended December 31, 2005, the Company assessed the fair value of its obligation to stand ready to

perform under these guarantees by considering the likelihood of occurrence of the specifi ed triggering events or conditions requiring performance as

well as other assumptions and factors. The Company has determined that the fair value of the guarantees was not material to the Company’s fi nancial

position, results of operations or cash fl ows.

The Company also guarantees debt owed to banks for some of its consolidated subsidiaries. The maximum amount guaranteed is $740 million,

and the outstanding debt under those guarantees, which is recorded within the short-term borrowings and long-term debt, net of current portion

components in the accompanying Consolidated Statement of Financial Position, is $109 million. These guarantees expire in 2006 through 2012. As

of the closing of the $2.7 billion Secured Credit Facilities on October 18, 2005, a $160 million KPG credit facility was closed. Debt outstanding under

the KPG credit facility of $57 million was repaid and the guarantees of $160 million were terminated. Pursuant to the terms of the Company’s Senior

Secured Credit Agreement dated October 18, 2005, obligations under the Secured Credit Facilities and other obligations of the Company and its

subsidiaries to the Secured Credit Facilities lenders are guaranteed. This accounts for the majority of the increase in the Company’s guarantees to

banks for its consolidated subsidiaries.

Indemnifi cations

The Company issues indemnifi cations in certain instances when it sells businesses and real estate, and in the ordinary course of business with its

customers, suppliers, service providers and business partners. Further, the Company indemnifi es its directors and offi cers who are, or were, serving

at Kodak’s request in such capacities. Historically, costs incurred to settle claims related to these indemnifi cations have not been material to the

Company’s fi nancial position, results of operations or cash fl ows. Additionally, the fair value of the indemnifi cations that the Company issued during

the year ended December 31, 2005 was not material to the Company’s fi nancial position, results of operations or cash fl ows.

Warranty Costs

The Company has warranty obligations in connection with the sale of its equipment. The original warranty period for equipment products is

generally one year or less. The costs incurred to provide for these warranty obligations are estimated and recorded as an accrued liability at the time

of sale. The Company estimates its warranty cost at the point of sale for a given product based on historical warranty experience and related costs to

repair. The change in the Company’s accrued warranty obligations balance, which is refl ected in accounts payable and other current liabilities in the

accompanying Consolidated Statement of Financial Position, was as follows:

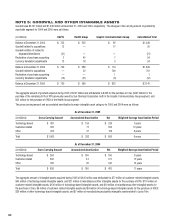

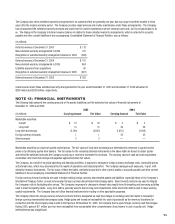

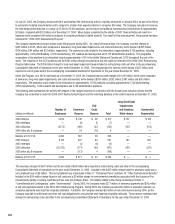

(in millions)

Accrued warranty obligations at December 31, 2003 $ 49

Actual warranty experience during 2004 (60)

2004 warranty provisions 75

Adjustments for changes in estimates (2)

Accrued warranty obligations at December 31, 2004 $ 62

Actual warranty experience during 2005 (79)

2005 warranty provisions 72

Liabilities assumed from acquisitions 7

Adjustments for changes in estimates (4)

Accrued warranty obligations at December 31, 2005 $ 58