Kodak 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

The expected return on plan assets for the major non-U.S. pension plans range from 4.38% to 9.0% for 2005. Every three years or when market

conditions have changed materially, the Company will undertake new asset and liability modeling studies for each of its larger pension plans. The

asset allocations and expected return on plan assets are individually set to provide for benefi ts included in the projected benefi t obligation within each

country’s legal investment constraints. The investment strategy is to manage the assets of the non-U.S. plans to provide for the long-term liabilities

while maintaining suffi cient liquidity to pay current benefi ts. This is primarily achieved by holding equity-like investments while investing a portion of

the assets in long duration bonds in order to partially match the long-term nature of the liabilities.

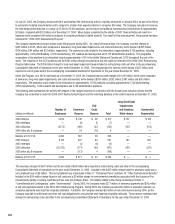

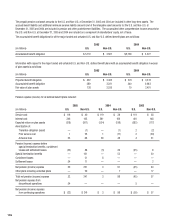

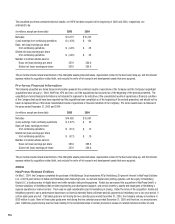

The Company’s weighted-average asset allocations for its major U.S. defi ned benefi t pension plans at December 31, 2005 and 2004, by asset

category, are as follows:

Asset Category 2005 2004 Target

Equity securities 42% 41% 32%-42%

Debt securities 31% 32% 29%-34%

Real estate 5% 7% 3%-13%

Other 22% 20% 19%-29%

Total 100% 100%

The Company’s weighted-average asset allocations for its major non-U.S. Defi ned Benefi t Pension Plans at December 31, 2005 and 2004, by asset

category are as follows:

Asset Category 2005 2004 Target

Equity securities 35% 39% 32%-42%

Debt securities 32% 33% 28%-34%

Real estate 7% 9% 3%-13%

Other 26% 19% 19%-29%

Total 100% 100%

The Other asset category in the tables above is primarily composed of private equity, venture capital, cash and other investments.

The Company expects to contribute approximately $22 million and $103 million in 2006 for U.S. and Non-U.S. defi ned benefi t pension

plans, respectively.

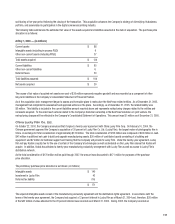

The following pension benefi t payments, which refl ect expected future service, are expected to be paid:

(in millions) U.S. Non-U.S.

2006 $ 465 $ 237

2007 462 218

2008 459 209

2009 460 203

2010 460 200

2011-2015 2,346 973

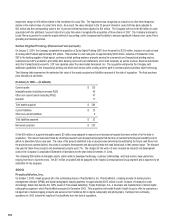

NOTE 18: OTHER POSTRETIREMENT BENEFITS

The Company provides healthcare, dental and life insurance benefi ts to U.S. eligible retirees and eligible survivors of retirees. Generally, to be eligible

for the plan, individuals retiring prior to January 1, 1996 were required to be 55 years of age with ten years of service or their age plus years of service

must have equaled or exceeded 75. For those retiring after December 31, 1995, the individuals must be 55 years of age with ten years of service or

have been eligible as of December 31, 1995. Based on the eligibility requirements, these benefi ts are provided to U.S. retirees who are covered by