Kodak 2005 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

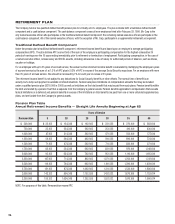

RETIREMENT PLAN

The Company funds a tax-qualifi ed defi ned benefi t pension plan for virtually all U.S. employees. The plan contains both a traditional defi ned benefi t

component and a cash balance component. The cash balance component covers all new employees hired after February 28, 1999. Mr. Carp is the

only named executive offi cer who participates in the traditional defi ned benefi t component; the remaining named executive offi cers participate in the

cash balance component. All of the named executive offi cers, with the exception of Mr. Carp, participate in a supplemental retirement arrangement.

Traditional Defi ned Benefi t Component

Under the pension plan’s traditional defi ned benefi t component, retirement income benefi ts are based upon an employee’s average participating

compensation (APC). The plan defi nes APC as one-third of the sum of the employee’s participating compensation for the highest consecutive 39

periods of earnings over the 10 years ending immediately prior to retirement or termination of employment. Participating compensation, in the case of

a named executive offi cer, is base salary and EXCEL awards, including allowances in lieu of salary for authorized periods of absence, such as illness,

vacation or holidays.

For an employee with up to 35 years of accrued service, the annual normal retirement income benefi t is calculated by multiplying the employee’s years

of accrued service by the sum of: a) 1.3% of APC plus b) 0.3% of APC in excess of the average Social Security wage base. For an employee with more

than 35 years of accrued service, the amount is increased by 1% for each year in excess of 35 years.

The retirement income benefi t is not subject to any deductions for Social Security benefi ts or other offsets. The normal form of benefi t is an

annuity, but a lump sum payment is available in limited situations. Federal laws place limitations on compensation amounts that may be included

under a qualifi ed pension plan ($210,000 in 2005) as well as limitations on the total benefi t that may be paid from such plans. Pension benefi ts within

the limit are funded by a pension trust that is separate from the Company’s general assets. Pension benefi ts applicable to compensation that exceeds

federal limitations or is deferred and pension benefi ts in excess of the limitations on total benefi ts are paid from one or more unfunded supplementary

plans, and are funded from the Company’s general assets.

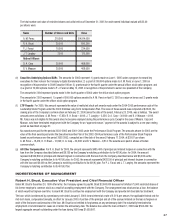

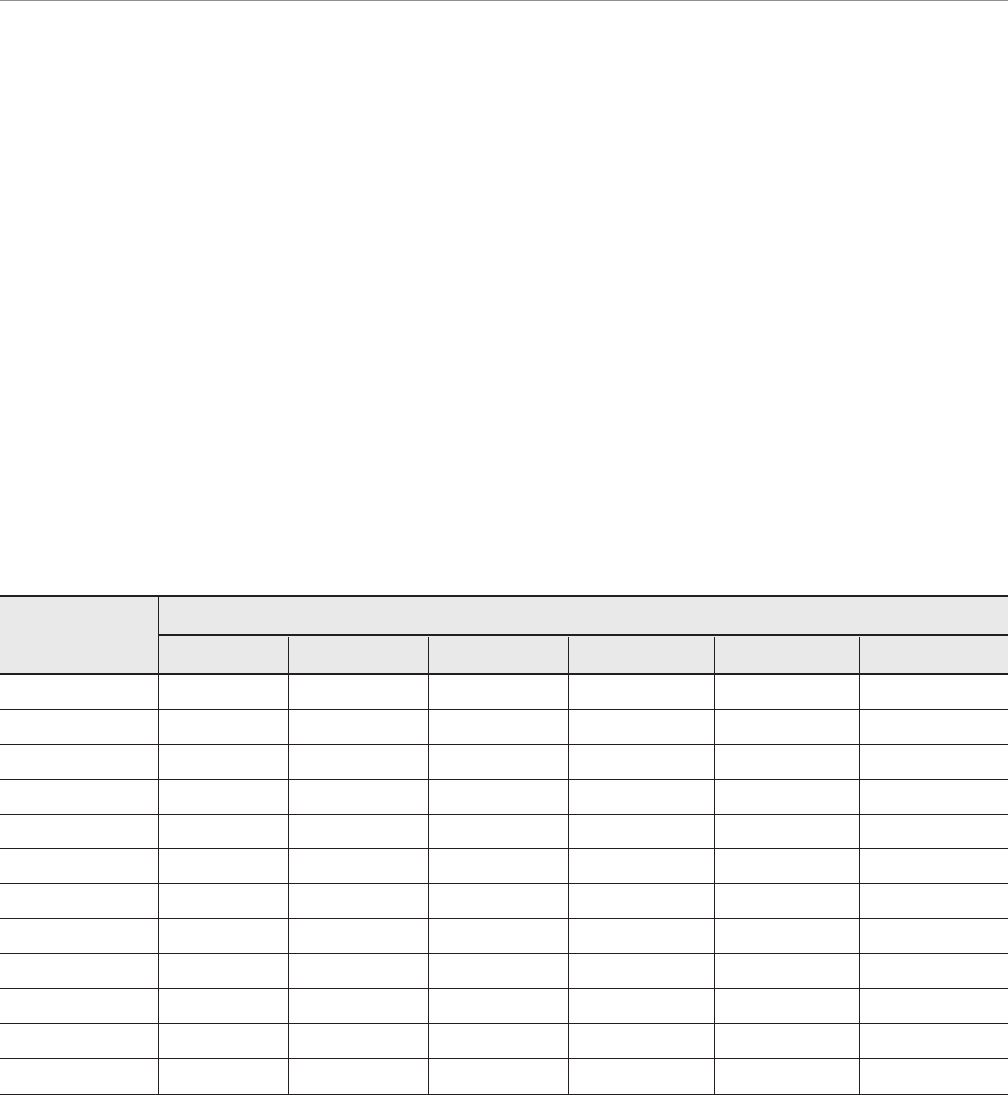

Pension Plan Table

Annual Retirement Income Benefi ts — Straight Life Annuity Beginning at Age 65

Years of Service

Remuneration 3 20 25 30 35 40

$ 500,000 $ 23,152 $ 154,348 $ 192,935 $ 231,522 $ 270,109 $ 283,614

750,000 35,152 234,348 292,935 351,522 410,109 430,614

1,000,000 47,152 314,348 392,935 471,522 550,109 577,614

1,250,000 59,152 394,348 492,935 591,522 690,109 724,614

1,500,000 71,152 474,348 592,935 711,522 830,109 871,614

1,750,000 83,152 554,348 692,935 831,522 970,109 1,018,614

2,000,000 95,152 634,348 792,935 951,522 1,110,109 1,165,614

2,250,000 107,152 714,348 892,935 1,071,522 1,250,109 1,312,614

2,500,000 119,152 794,348 992,935 1,191,522 1,390,109 1,459,614

2,750,000 131,152 874,348 1,092,935 1,311,522 1,530,109 1,606,614

3,000,000 143,152 954,348 1,192,935 1,431,522 1,670,109 1,753,614

3,250,000 155,152 1,034,348 1,292,935 1,551,522 1,810,109 1,900,614

NOTE: For purposes of this table, Remuneration means APC.