Kodak 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

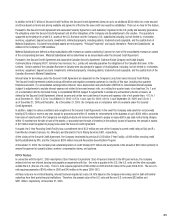

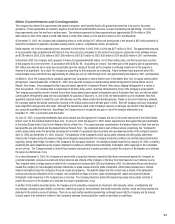

Other Commitments and Contingencies

The Company has entered into agreements with several companies, which provide Kodak with products and services to be used in its normal

operations. These agreements are related to supplies, production and administrative services, as well as marketing and advertising. The terms of

these agreements cover the next two to sixteen years. The minimum payments for these agreements are approximately $204 million in 2006,

$200 million in 2007, $173 million in 2008, $98 million in 2009, $105 million in 2010 and $241 million in 2011 and thereafter.

At December 31, 2005, the Company had outstanding letters of credit totaling $117 million and surety bonds in the amount of $85 million primarily to

ensure the completion of payment of possible casualty claims, workers’ compensation claims, and customs.

Rental expense, net of minor sublease income, amounted to $149 million in 2005, $161 in 2004 and $157 million in 2003. The approximate amounts

of noncancelable lease commitments with terms of more than one year, principally for the rental of real property, reduced by minor sublease income,

are $138 million in 2006, $120 million in 2007, $98 million in 2008, $75 million in 2009, $58 million in 2010 and $80 million in 2011 and thereafter.

In December 2003, the Company sold a property in France for approximately $65 million, net of direct selling costs, and then leased back a portion

of this property for a nine-year term. In accordance with SFAS No. 98, “Accounting for Leases,” the entire gain on the property sale of approximately

$57 million was deferred and no gain was recognizable upon the closing of the sale as the Company’s continuing involvement in the property is

deemed to be signifi cant. As a result, the Company is accounting for the transaction as a fi nancing. Future minimum lease payments under this

noncancelable lease commitment are approximately $5 million per year for 2006 through 2010, and approximately $10 million for 2011 and thereafter.

On March 8, 2004, the Company fi led a complaint against Sony Corporation in federal district court in Rochester, New York, for digital camera patent

infringement. Several weeks later, on March 31, 2004, Sony sued the Company for digital camera patent infringement in federal district court in

Newark, New Jersey. Sony subsequently fi led a second lawsuit against the Company in Newark, New Jersey, alleging infringement of a variety of

other Sony patents. The Company fi led a counterclaim in the New Jersey action, asserting infringement by Sony of the Company’s kiosk patents.

The Company successfully moved to transfer Sony’s New Jersey digital camera patent infringement case to Rochester, New York, and the two digital

camera patent infringement cases are now consolidated for purposes of discovery. In June 2005, the federal district court in Rochester, New York

appointed a special master to assist the court with discovery and the claims construction briefi ng process. Based on the current discovery schedule,

the Company expects that claims construction hearings in the digital camera cases will take place in 2006. Both the Company and Sony Corporation

seek unspecifi ed damages and other relief. Although this lawsuit may result in the Company’s recovery of damages, the amount of the damages, if

any, cannot be quantifi ed at this time. Accordingly, the Company has not recognized any gain or loss in the fi nancial statements as of

December 31, 2005, in connection with this matter.

On June 13, 2005, a purported shareholder class action lawsuit was fi led against the Company and two of its current executives in the United States

District Court for the Southern District of New York. On June 20, 2005 and August 10, 2005, similar lawsuits were fi led against the same defendants

in the United States District Court for the Western District of New York. The cases have been consolidated in the Western District of New York and the

lead plaintiffs are John Dudek and the Alaska Electrical Pension Fund. The complaints fi led in each of these actions (collectively, the “Complaints”)

seek to allege claims under the Securities Exchange Act on behalf of a proposed class of persons who purchased securities of the Company between

April 23, 2003 and September 25, 2003, inclusive. The substance of the Complaints is that various press releases and other public statements

made by the Company during the proposed class period allegedly misrepresented the Company’s fi nancial condition and omitted material information

regarding, among other things, the state of the Company’s fi lm and paper business. An amended complaint was fi led on January 20, 2006, containing

essentially the same allegations as the original complaint but adding an additional named defendant. Defendants’ initial responses to the Complaints

are not yet due. The Company intends to defend these lawsuits vigorously but is unable currently to predict the outcome of the litigation or to estimate

the range of potential loss, if any.

On or about November 9, 2005, the Company was served with a purported derivative lawsuit that had been commenced against the Company, as

a nominal defendant, and eleven current and former directors and offi cers of the Company, in the New York State Supreme Court, Monroe County.

The Complaint seeks to allege claims on behalf of the Company that, between April 2003 and September 2003, the defendant offi cers and directors

caused the Company to make allegedly improper statements, in press release and other public statements, which falsely represented or omitted

material information about the Company’s fi nancial results and guidance. The plaintiff alleges that this conduct was a breach of the defendants’

common law fi duciary obligations to the Company, and constituted an abuse of control, gross mismanagement, waste and unjust enrichment.

Defendants’ initial responses to the Complaint are not yet due. The Company intends to defend this lawsuit vigorously but is unable currently to

predict the outcome of the litigation or to estimate the range of possible loss, if any.

In addition to the matters described above, the Company and its subsidiary companies are involved in other lawsuits, claims, investigations and

proceedings, including product liability, commercial, intellectual property, environmental, and health and safety matters, which are being handled and

defended in the ordinary course of business. There are no such matters pending representing contingent losses that the Company and its General

Counsel expect to be material in relation to the Company’s business, fi nancial position, results of operations or cash fl ows.