Kodak 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

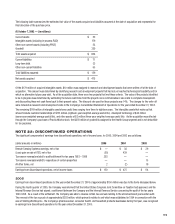

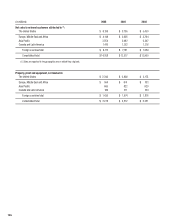

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition and represents the

fi nal allocation of the purchase price.

At October 7, 2003 — (in millions)

Current assets $ 52

Intangible assets (including in-process R&D) 179

Other non-current assets (including PP&E) 53

Goodwill 350

Total assets acquired $ 634

Current liabilities $ 71

Long-term debt 23

Other non-current liabilities 65

Total liabilities assumed $ 159

Net assets acquired $ 475

Of the $179 million of acquired intangible assets, $10 million was assigned to research and development assets that were written off at the date of

acquisition. This amount was determined by identifying research and development projects that had not yet reached technological feasibility and for

which no alternative future uses exist. As of the acquisition date, there were two projects that met these criteria. The value of the projects identifi ed

to be in progress was determined by estimating the future cash fl ows from the projects once commercialized, less costs to complete development,

and discounting these net cash fl ows back to their present value. The discount rate used for these projects was 14%. The charges for the write-off

were included as research and development costs in the Company’s Consolidated Statement of Operations for the year ended December 31, 2003.

The remaining $169 million of intangible assets have useful lives ranging from three to eighteen years. The intangible assets that make up that

amount include customer relationships of $123 million (eighteen-year weighted-average useful life), developed technology of $44 million

(seven-year weighted-average useful life), and other assets of $2 million (three-year weighted-average useful life). As the acquisition was effected

through the Company’s purchase of PracticeWorks stock, the $350 million of goodwill is assigned to the Health Group segment and is not deductible

for tax purposes.

NOTE 22: DISCONTINUED OPERATIONS

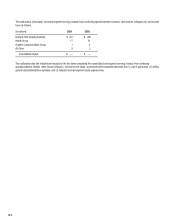

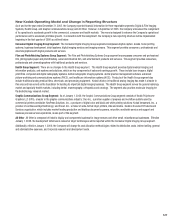

The signifi cant components of earnings from discontinued operations, net of income taxes, for 2005, 2004 and 2003 are as follows:

(dollar amounts in millions) 2005 2004 2003

Remote Sensing Systems earnings, net of tax $ — $ 38 $ 39

(Loss) gain on sale of RSS, net of tax (55) 439 —

Tax reserve reversals related to audit settlement for tax years 1993 – 1998 203 — —

Tax reserve reversals related to repurchase of certain properties — — 15

All other items, net 2 (2) 10

Earnings from discontinued operations, net of income taxes $ 150 $ 475 $ 64

2005

Earnings from discontinued operations for the year ended December 31, 2005 of approximately $150 million was due to the items discussed below.

During the fourth quarter of 2005, the Company was informed that the United States Congress Joint Committee on Taxation had approved, and the

Internal Revenue Service had signed, a settlement between the Company and the Internal Revenue Service concerning the audit of the tax years

1993-1998. As a result of the settlement, the Company was able to reverse certain tax accruals relating to the aforementioned years under audit.

The reversal of the tax accruals of approximately $203 million, which primarily relates to and which was established in 1994 in connection with the

sale of Sterling Winthrop Inc., the Company’s pharmaceutical, consumer health, and household products businesses during that year, was recognized

in earnings from discontinued operations for the year ended December 31, 2005.