Kodak 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.75

Maintenance and repairs are charged to expense as incurred. Upon sale or other disposition, the applicable amounts of asset cost and accumulated

depreciation are removed from the accounts and the net amount, less proceeds from disposal, is charged or credited to net (loss) earnings.

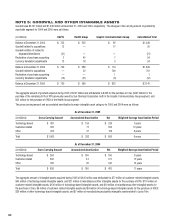

Goodwill

Goodwill represents the excess of purchase price over the fair value of net assets acquired. The Company applies the provisions of SFAS No. 142,

“Goodwill and Other Intangible Assets.” In accordance with SFAS No. 142, goodwill is not amortized, but is required to be assessed for impairment at

least annually. The Company has elected to make September 30 the annual impairment assessment date for all of its reporting units, and will perform

additional impairment tests when events or changes in circumstances occur that would more likely than not reduce the fair value of the reporting unit

below its carrying amount. SFAS No. 142 defi nes a reporting unit as an operating segment or one level below an operating segment. The Company

estimates the fair value of its reporting units through internal analyses and external valuations, which utilize income and market approaches through

the application of discounted cash fl ow and market comparable methods. The assessment is required to be performed in two steps, step one to test

for a potential impairment of goodwill and, if potential losses are identifi ed, step two to measure the impairment loss. The Company completed step

one in its fourth quarter and determined that there were no such impairments. Accordingly, the performance of step two was not required. Due to

the realignment of the Kodak operating model and change in reporting structure, as described in Note 23, “Segment Information” and effective

January 1, 2006, the Company reassessed its goodwill for impairment during the fi rst quarter of 2006, and determined that no reporting units’

carrying values exceeded their respective estimated fair values based on the realigned reporting structure and, therefore, there is no impairment.

Revenue

The Company’s revenue transactions include sales of the following: products; equipment; software; services; equipment bundled with products

and/or services; and integrated solutions. The Company recognizes revenue when realized or realizable and earned, which is when the following

criteria are met: persuasive evidence of an arrangement exists; delivery has occurred; the sales price is fi xed or determinable; and collectibility is

reasonably assured. At the time revenue is recognized, the Company provides for the estimated costs of customer incentive programs, warranties and

estimated returns and reduces revenue accordingly.

For product sales, the recognition criteria are generally met when title and risk of loss have transferred from the Company to the buyer, which may

be upon shipment or upon delivery to the customer site, based on contract terms or legal requirements in foreign jurisdictions. Service revenues are

recognized as such services are rendered.

For equipment sales, the recognition criteria are generally met when the equipment is delivered and installed at the customer site. Revenue is

recognized for equipment upon delivery as opposed to upon installation when there is objective and reliable evidence of fair value for the

installation, and the amount of revenue allocable to the equipment is not legally contingent upon the completion of the installation. In instances in

which the agreement with the customer contains a customer acceptance clause, revenue is deferred until customer acceptance is obtained, provided

the customer acceptance clause is considered to be substantive. For certain agreements, the Company does not consider these customer acceptance

clauses to be substantive because the Company can and does replicate the customer acceptance test environment and performs the agreed upon

product testing prior to shipment. In these instances, revenue is recognized upon installation of the equipment.

Revenue for the sale of software licenses is recognized when: (1) the Company enters into a legally binding arrangement with a customer for the

license of software; (2) the Company delivers the software; (3) customer payment is deemed fi xed or determinable and free of contingencies or

signifi cant uncertainties; and (4) collection from the customer is probable. If the Company determines that collection of a fee is not reasonably

assured, the fee is deferred and revenue is recognized at the time collection becomes reasonably assured, which is generally upon receipt of payment.

Software maintenance and support revenue is recognized ratably over the term of the related maintenance period.

The Company’s transactions may involve the sale of equipment, software, and related services under multiple element arrangements. The Company

allocates revenue to the various elements based on their fair value. Revenue allocated to an individual element is recognized when all other revenue

recognition criteria are met for that element.

Revenue from the sale of integrated solutions, which includes transactions that require signifi cant production, modifi cation or customization of

software, is recognized in accordance with contract accounting. Under contract accounting, revenue is recognized by utilizing either the

percentage-of-completion or completed-contract method. The Company currently utilizes the completed-contract method for all solution sales, as

suffi cient history does not currently exist to allow the Company to accurately estimate total costs to complete these transactions. Revenue from other

long-term contracts, primarily government contracts, is generally recognized using the percentage-of-completion method.

At the time revenue is recognized, the Company also records reductions to revenue for customer incentive programs in accordance with the provisions

of Emerging Issues Task Force (EITF) Issue No. 01-09, “Accounting for Consideration Given from a Vendor to a Customer (Including a Reseller of the

Vendor’s Products).” Such incentive programs include cash and volume discounts, price protection, promotional, cooperative and other advertising

allowances, and coupons. For those incentives that require the estimation of sales volumes or redemption rates, such as for volume rebates or

coupons, the Company uses historical experience and internal and customer data to estimate the sales incentive at the time revenue is recognized.