Kodak 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.100

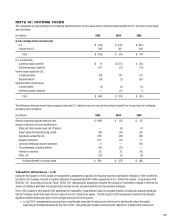

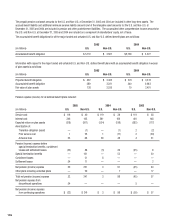

The Company has been utilizing net operating loss carryforwards to offset taxable income from its operations in China that have become profi table.

The Company has been granted a tax holiday in China that became effective when the net operating loss carryforwards were fully utilized during

2004. The tax holiday thus became effective during 2004, and the Company’s tax rate in China was zero percent for 2004 and 2005. For 2006, 2007

and 2008, the Company’s tax rate will be 7.5%, which is 50% of the normal 15% tax rate for the jurisdiction in which Kodak operates. Thereafter, the

Company’s tax rate will be 15%.

Retained earnings of subsidiary companies outside the U.S. were approximately $1,906 million and $2,265 million at December 31, 2005 and 2004,

respectively. Deferred taxes have not been provided on such undistributed earnings, as it is the Company’s policy to permanently reinvest its retained

earnings, and it is not practicable to determine the deferred tax liability on such undistributed earnings in the event they were to be remitted.

However, the Company periodically repatriates a portion of these earnings to the extent that it can do so tax-free, or at minimal cost.

As discussed, the Jobs Creation Act was signed into law in October of 2004. The Act creates a temporary incentive for U.S. multinationals to

repatriate foreign subsidiary earnings by providing a 85% dividends received deduction for certain dividends from controlled foreign corporations.

The deduction is subject to a number of limitations and requirements, including adoption of a specifi c domestic reinvestment plan for the

repatriated earnings. The Company repatriated approximately $580 million in dividends subject to the 85% dividends received deduction.

Accordingly, the Company recorded a corresponding tax provision of $29 million with respect to such dividends during 2005.

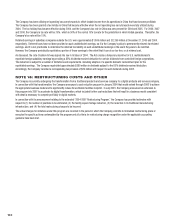

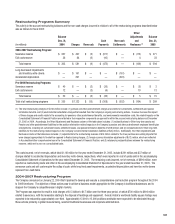

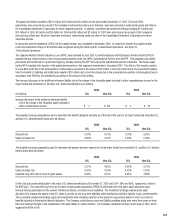

NOTE 16: RESTRUCTURING COSTS AND OTHER

The Company is currently undergoing the transformation from a traditional products and services company to a digital products and services company.

In connection with this transformation, the Company announced a cost reduction program in January 2004 that would extend through 2006 to achieve

the appropriate business model and to signifi cantly reduce its worldwide facilities footprint. In July 2005, the Company announced an extension to

this program into 2007 to accelerate its digital transformation, which included further cost reductions that will result in a business model consistent

with what is necessary to compete profi tably in digital markets.

In connection with its announcement relating to the extended “2004-2007 Restructuring Program,” the Company has provided estimates with

respect to (1) the number of positions to be eliminated, (2) the facility square footage reduction, (3) the reduction in its traditional manufacturing

infrastructure, and (4) the total restructuring charges to be incurred.

The actual charges for initiatives under this program are recorded in the period in which the Company commits to formalized restructuring plans or

executes the specifi c actions contemplated by the program and all criteria for restructuring charge recognition under the applicable accounting

guidance have been met.