Kodak 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.89

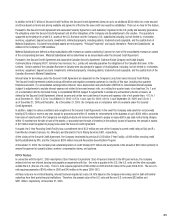

In addition to the $2.7 billion of Secured Credit Facilities, the Secured Credit Agreement allows for up to an additional $500 million for a new secured

credit loan based on terms and pricing available and agreed to at the time the new credit loan would be established. There are no fees for this feature.

Pursuant to the Secured Credit Agreement and associated Security Agreement, each subsidiary organized in the U.S. jointly and severally guarantees

the obligations under the Secured Credit Agreement and all other obligations of the Company and its subsidiaries to the Lenders. The guaranty is

supported by the pledge of certain U.S. assets of the U.S. Borrower and the Company’s U.S. subsidiaries including, but not limited to, receivables,

inventory, equipment, deposit accounts, investments, intellectual property, including patents, trademarks and copyrights, and the capital stock of

Material Subsidiaries. Excluded from pledged assets are real property, “Principal Properties” and equity interests in “Restricted Subsidiaries”, as

defi ned in the Company’s 1988 Indenture.

Material Subsidiaries are defi ned as those subsidiaries with revenues or assets constituting 5 percent or more of the consolidated revenues or assets

of the corresponding borrower. Material Subsidiaries will be determined on an annual basis under the Secured Credit Agreement.

Pursuant to the Secured Credit Agreement and associated Canadian Security Agreement, Eastman Kodak Company and Kodak Graphic

Communications Company (KGCC, formerly Creo Americas, Inc.), jointly and severally guarantee the obligations of the Canadian Borrower, to the

Lenders. Certain assets of the Canadian Borrower in Canada were also pledged in support of its obligations, including, but not limited to, receivables,

inventory, equipment, deposit accounts, investments, intellectual property, including patents, trademarks and copyrights, and the capital stock of the

Canadian Borrower’s Material Subsidiaries.

Interest rates for borrowings under the Secured Credit Agreement are dependent on the Company’s Long Term Senior Secured Credit Rating.

The Secured Credit Agreement contains various affi rmative and negative covenants customary in a facility of this type, including two quarterly

fi nancial covenants: (1) a consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) to consolidated interest expense

(subject to adjustments to exclude interest expense not related to borrowed money) ratio, on a rolling four-quarter basis, of no less than 3 to 1, and

(2) a consolidated debt for borrowed money to consolidated EBITDA (subject to adjustments to exclude any extraordinary income or losses, as

defi ned by the Secured Credit Agreement, interest income and certain non-cash items of income and expense) ratio of not greater than: 4.75 to 1

as of December 31, 2005; 4.50 to 1 as of March 31, 2006; 4.25 to 1 as of June 30, 2006; 4.00 to 1 as of September 30, 2006; and 3.50 to 1

as of December 31, 2006 and thereafter. As of December 31, 2005, the Company was in compliance with all covenants under the Secured

Credit Agreement.

In addition, subject to various conditions and exceptions in the Secured Credit Agreement, in the event the Company sells assets for net proceeds

totaling $75 million or more in any year, except for proceeds used within 12 months for reinvestments in the business of up to $300 million, proceeds

from sales of assets used in the Company’s non-digital products and services businesses to prepay or repay debt or pay cash restructuring charges

within 12 months from the date of sale of the assets, or proceeds from the sale of inventory in the ordinary course of business, the amount in excess

of $75 million must be applied to prepay loans under the Secured Credit Agreement.

If unused, the 5-Year Revolving Credit Facility has a commitment fee of $5.0 million per year at the Company’s current credit rating of Ba3 and B+

from Moody’s Investor Services, Inc. (Moody’s) and Standard & Poor’s Rating Services (S&P), respectively.

At the closing of the Secured Credit Agreement, the Company terminated its previous $1.225 billion 5-Year Facility, a $160 million revolving credit

facility established by KPG, and the Company’s $200 million Accounts Receivable Securitization Program.

At December 31, 2005, the Company had outstanding letters of credit totaling $117 million and surety bonds in the amount of $85 million primarily to

ensure the payment of casualty claims, workers’ compensation claims, and customs.

KPG Notes

In connection with the April 1, 2005 redemption of Sun Chemical Corporations’ (Sun) 50 percent interest in the KPG joint venture, the Company

entered into two non-interest bearing note payable arrangements with Sun. One note is payable in the U.S. (the U.S. note) and the other is payable

outside the U.S. (the non-U.S. note). The U.S. note requires payments of $40 million in 2006 and $10 million in the years 2008-2013. The non-U.S.

note requires payments of $160 million in 2006 and $40 million in the years 2008-2013.

As these notes are non-interest bearing, interest has been imputed at a rate of 6.16% based on the Company’s borrowing rate for debt with similar

maturities from third-party fi nancial institutions. Therefore, the present value of the U.S. note and the non-U.S. note were $83 million and

$331 million, respectively, at December 31, 2005.