Kodak 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

PART II

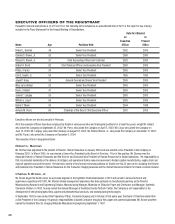

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED

STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY

SECURITIES

Eastman Kodak Company common stock is principally traded on the New York Stock Exchange under the symbol “EK.” There are 76,539

shareholders of record of common stock as of January 31, 2006.

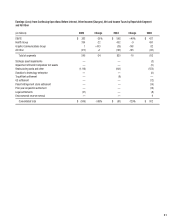

Market Price Data

2005 2004

Price per share: High Low High Low

1st Quarter $ 35.19 $ 30.87 $ 31.55 $ 24.25

2nd Quarter 33.10 24.63 27.44 24.55

3rd Quarter 29.24 23.97 33.50 24.75

4th Quarter 25.14 20.77 34.74 28.93

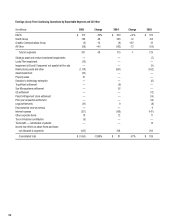

Dividend Information

The Company has a dividend policy whereby it makes semi-annual payments of dividends, when declared, on the Company’s 10th business day each

July and December to shareholders of record on the close of the fi rst business day of the preceding month.

On May 11, 2005, the Board of Directors declared a semi-annual cash dividend of $.25 per share payable to shareholders of record at the close of

business on June 1, 2005. This dividend was paid on July 15, 2005. On October 18, 2005, the Board of Directors declared a semi-annual cash

dividend of $.25 per share payable to shareholders of record at the close of business on November 1, 2005. This dividend was paid on

December 14, 2005. The total dividends paid for the year ended December 31, 2005 was $144 million.

On May 12, 2004, the Board of Directors declared a semi-annual cash dividend of $.25 per share payable to shareholders of record at the close of

business on June 1, 2004. This dividend was paid on July 15, 2004. On October 19, 2004, the Board of Directors declared a semi-annual cash

dividend of $.25 per share payable to shareholders of record at the close of business on November 1, 2004. This dividend was paid on

December 14, 2004. The total dividends paid for the year ended December 31, 2004 was $143 million.

ITEM 6. SELECTED FINANCIAL DATA

Refer to Summary of Operating Data on page 130.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

Critical Accounting Policies and Estimates

The accompanying consolidated fi nancial statements and notes to consolidated fi nancial statements contain information that is pertinent to

management’s discussion and analysis of the fi nancial condition and results of operations. The preparation of fi nancial statements in conformity with

accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the

reported amounts of assets, liabilities, revenue and expenses, and the related disclosure of contingent assets and liabilities.

The Company believes that the critical accounting policies and estimates discussed below involve the most complex management judgments due to

the sensitivity of the methods and assumptions necessary in determining the related asset, liability, revenue and expense amounts.

Revenue Recognition

Kodak recognizes revenue when it is realized or realizable and earned. For the sale of multiple-element arrangements whereby equipment is

combined with services, including maintenance and training, and other elements, including software and products, the Company allocates to, and

recognizes revenue from, the various elements based on their fair value. For full service solutions sales, which consist of the sale of equipment

and software which may or may not require signifi cant production, modifi cation or customization, there are two acceptable methods of accounting:

percentage of completion accounting and completed contract accounting. For certain of the Company’s full service solutions, the completed contract

method of accounting is being followed by the Company. This is due to insuffi cient historical experience resulting in the inability to provide reasonably