Kodak 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

sold during a fi ve-year period following the closing of the transaction. This acquisition advances the Company’s strategy of diversifying its business

portfolio, and accelerates its participation in the digital commercial printing industry.

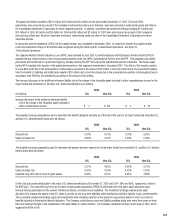

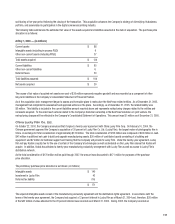

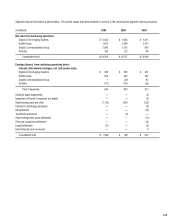

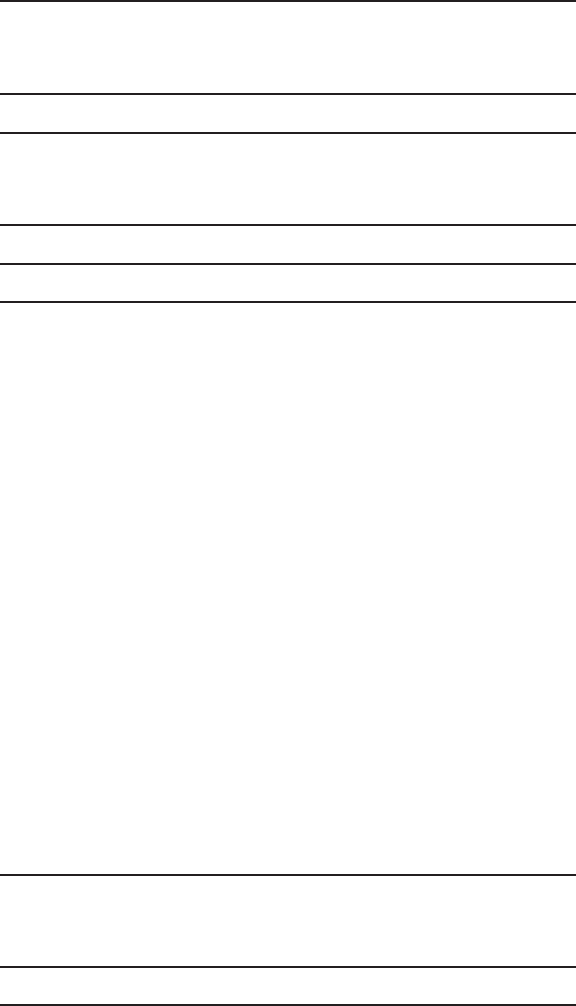

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition. The purchase price

allocation is as follows:

At May 1, 2004 — (in millions)

Current assets $ 88

Intangible assets (including in-process R&D) 9

Other non-current assets (including PP&E) 37

Total assets acquired $ 134

Current liabilities $ 65

Other non-current liabilities 6

Deferred taxes 33

Total liabilities assumed $ 104

Net assets acquired $ 30

The excess of fair value of acquired net assets over cost of $30 million represents negative goodwill and was recorded as a component of other

long-term liabilities in the Company’s Consolidated Statement of Financial Position.

As of the acquisition date, management began to assess and formulate plans to restructure the NexPress-related entities. As of December 31, 2005,

management had completed its assessment and approved actions on the plans. Accordingly, as of December 31, 2005, the related liability was

$6 million. This liability is included in the current liabilities amount reported above and represents restructuring charges related to the entities and

net assets acquired. To the extent such actions related to the Company’s historical ownership in the NexPress Solutions LLC joint venture, the

restructuring charges will be refl ected in the Company’s Consolidated Statement of Operations. This amount was $1 million as of December 31, 2005.

China Lucky Film Co. Ltd.

On October 22, 2003, the Company announced that it signed a twenty-year agreement with China Lucky Film Corp. On February 10, 2004, the

Chinese government approved the Company’s acquisition of 20 percent of Lucky Film Co. Ltd. (Lucky Film), the largest maker of photographic fi lm in

China, in exchange for total consideration of approximately $174 million. The total consideration of $174 million was composed of $90 million in cash,

$47 million in additional net cash to build and upgrade manufacturing assets, $30 million of contributed assets consisting of a building and

equipment, and $7 million for technical support and training that the Company will provide to Lucky Film. Under the twenty-year agreement, Lucky

Film will pay Kodak a royalty fee for the use of certain of the Company’s technologies as well as dividends on the Lucky Film shares that Kodak will

acquire. In addition, Kodak has obtained a twenty-year manufacturing exclusivity arrangement with Lucky Film as well as access to Lucky Film’s

distribution network.

As the total consideration of $174 million will be paid through 2007, the amount was discounted to $171 million for purposes of the purchase

price allocation.

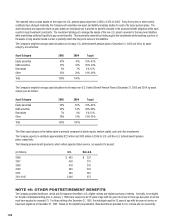

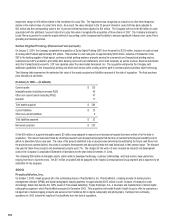

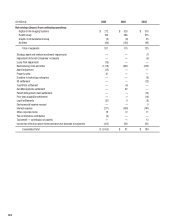

The preliminary purchase price allocation is as follows: (in millions)

Intangible assets $ 145

Investment in Lucky Film 42

Deferred tax liability (16)

$ 171

The acquired intangible assets consist of the manufacturing exclusivity agreement and the distribution rights agreement. In accordance with the

terms of the twenty-year agreement, the Company had acquired a 13 percent interest in Lucky Film as of March 31, 2004 and, therefore, $26 million

of the $42 million of value allocated to the 20 percent interest was recorded as of March 31, 2004. During 2005, the Company recorded an