Kodak 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

In instances where the Company provides slotting fees or similar arrangements, this incentive is recognized as a reduction in revenue when payment

is made to the customer (or at the time the Company has incurred the obligation, if earlier) unless the Company receives a benefi t over a period of

time, in which case the incentive is recorded as an asset and is amortized as a reduction of revenue over the term of the arrangement. Arrangements

in which the Company receives an identifi able benefi t include arrangements that have enforceable exclusivity provisions and those that provide a

clawback provision entitling the Company to a pro rata reimbursement if the customer does not fulfi ll its obligations under the contract.

The Company may offer customer fi nancing to assist customers in their acquisition of Kodak’s products. At the time a fi nancing transaction is

consummated, which qualifi es as a sales-type lease, the Company records equipment revenue equal to the total lease receivable net of unearned

income. Unearned income is recognized as fi nance income using the effective interest method over the term of the lease. Leases not qualifying as

sales-type leases are accounted for as operating leases. The Company recognizes revenue from operating leases on an accrual basis as the rental

payments become due.

The Company’s sales of tangible products are the only class of revenues that exceeds 10% of total consolidated net sales. All other sales classes are

individually less than 10%, and therefore, have been combined with the sales of tangible products on the same line in accordance with Regulation S-X.

Incremental direct costs (i.e. costs that vary with and are directly related to the acquisition of a contract which would not have been incurred but for

the acquisition of the contract) of a customer contract in a transaction that results in the deferral of revenue are deferred and netted against revenue

in proportion to the related revenue recognized in each period if: (1) an enforceable contract for the remaining deliverable items exists; and (2) delivery

of the remaining items in the arrangement is expected to generate positive margins allowing realization of the deferred costs. Otherwise, these costs

are expensed as incurred and included in cost of goods sold in the accompanying Consolidated Statement of Operations.

Research and Development Costs

Research and development (R&D) costs, which include costs in connection with new product development, fundamental and exploratory research,

process improvement, product use technology and product accreditation, are charged to operations in the period in which they are incurred. In

connection with a business combination, the purchase price allocated to research and development projects that have not yet reached technological

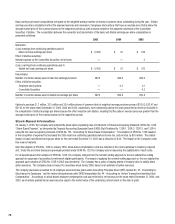

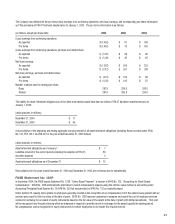

feasibility and for which no alternative future use exists is charged to operations in the period of acquisition. R&D costs were $892 million,

$836 million and $760 million in 2005, 2004 and 2003, respectively.

Advertising

Advertising costs are expensed as incurred and included in selling, general and administrative expenses in the accompanying Consolidated Statement

of Operations. Advertising expenses amounted to $490 million, $513 million and $596 million in 2005, 2004 and 2003, respectively.

Shipping and Handling Costs

Amounts charged to customers and costs incurred by the Company related to shipping and handling are included in net sales and cost of goods sold,

respectively, in accordance with EITF Issue No. 00-10, “Accounting for Shipping and Handling Fees and Costs.”

Impairment of Long-Lived Assets

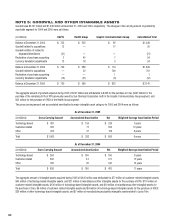

The Company applies the provisions of SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” Under the guidance of SFAS

No. 144, the Company reviews the carrying value of its long-lived assets, other than goodwill and purchased intangible assets with indefi nite useful

lives, for impairment whenever events or changes in circumstances indicate that the carrying value may not be recoverable. The Company assesses

the recoverability of the carrying value of long-lived assets by fi rst grouping its long-lived assets with other assets and liabilities at the lowest level for

which identifi able cash fl ows are largely independent of the cash fl ows of other assets and liabilities (the asset group) and, secondly, by estimating the

undiscounted future cash fl ows that are directly associated with and that are expected to arise from the use of and eventual disposition of such asset

group. The Company estimates the undiscounted cash fl ows over the remaining useful life of the primary asset within the asset group. If the carrying

value of the asset group exceeds the estimated undiscounted cash fl ows, the Company records an impairment charge to the extent the carrying value

of the long-lived asset exceeds its fair value. The Company determines fair value through quoted market prices in active markets or, if quoted market

prices are unavailable, through the performance of internal analyses of discounted cash fl ows or external appraisals.

In connection with its assessment of recoverability of its long-lived assets and its ongoing strategic review of the business and its operations, the

Company continually reviews the remaining useful lives of its long-lived assets. If this review indicates that the remaining useful life of the long-lived

asset has been reduced, the Company adjusts the depreciation on that asset to facilitate full cost recovery over its revised estimated remaining

useful life.

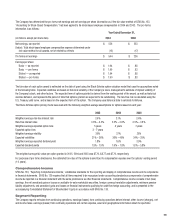

Derivative Financial Instruments

The Company accounts for derivative fi nancial instruments in accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities.” All derivative instruments are recognized as either assets or liabilities and are measured at fair value. Certain derivatives are designated

and accounted for as hedges. The Company does not use derivatives for trading or other speculative purposes.