Kodak 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

years and manufacturing-related buildings from 10-40 years to 5-20 years. Also included in 2005 manufacturing costs were accelerated depreciation

charges of $391 million related to the 2004-2007 Restructuring Program, compared with accelerated depreciation charges of $152 million in 2004.

Selling, General and Administrative Expenses

SG&A expenses were $2,668 million for 2005 as compared with $2,491 million for 2004, representing an increase of $177 million, or 7%. SG&A

increased as a percentage of sales from 18% for the prior year to 19% for the current year. The increase in SG&A is primarily attributable to SG&A

related to acquisitions of $293 million, unfavorable legal settlements totaling $21 million, and unfavorable exchange of $6 million, partially offset by

cost reduction initiatives.

Research and Development Costs

R&D costs were $892 million for 2005 as compared with $836 million for 2004, representing an increase of $56 million, or 7%. R&D as a

percentage of sales remained unchanged at 6%. The dollar increase in R&D is primarily attributable to write-offs for purchased in-process R&D

associated with acquisitions made in 2005 for $54 million and increases in R&D spend related to newly-acquired businesses of $95 million, partially

offset by signifi cant reductions in R&D spending related to traditional products.

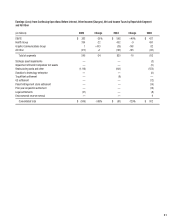

Loss From Continuing Operations Before Interest, Other Income (Charges), Net and Income Taxes

The loss from continuing operations before interest, other income (charges), net and income taxes for 2005 was $599 million as compared with a loss

of $87 million for 2004, representing an increase of $512 million. This increase is attributable to the reasons described above.

Interest Expense

Interest expense for 2005 was $211 million as compared with $168 million in the prior year. This increase is related to higher interest rates in 2005

and higher debt levels in the current year as a result of borrowings to fi nance acquisitions.

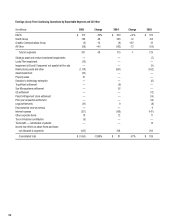

Other Income (Charges), Net

The other income (charges), net component includes principally investment income, income and losses from equity investments, foreign exchange,

and gains and losses on the sales of assets and investments. Other income for the current year was $44 million as compared with other income of

$161 million for the prior year. The decline of $117 million is primarily attributable to proceeds from two favorable legal settlements totaling

$101 million in 2004, with no similar favorable legal settlements in 2005. Also contributing to the decline for the year was a loss on foreign exchange

of $31 million due to the unhedged U.S. dollar denominated note payable outside of the U.S. relating to the KPG acquisition versus foreign exchange

losses of $10 million in 2004. Future foreign exchange gains or losses arising from this note payable will be substantially offset by currency forward

hedge contracts entered into on July 28, 2005.

The decline was also impacted by $44 million of charges, including a $19 million impairment of the investment in Lucky Film as a result of an

other-than-temporary decline in the market value of Lucky’s stock and a $25 million asset impairment. Additionally, equity income from joint ventures

declined by $18 million due to the acquisitions of KPG and NexPress, which were formerly accounted for under the equity method, and are now

consolidated in the Company’s Statement of Operations and included in the Graphic Communications Group segment. These items were partially

offset by a net year-over-year increase of $59 million from gains on the sale of properties and capital assets.

Income Tax (Benefi t) Provision

The Company’s annual effective tax rate from continuing operations decreased from a benefi t rate of 186% for 2004 to a provision rate of 90% for

2005. The change is primarily attributable to the inability to recognize a benefi t from losses in the U.S. as a result of the requirement to record a

valuation allowance against net U.S. deferred tax assets.

During the year ended December 31, 2005, the Company recorded a tax provision of $689 million representing an income tax rate on losses from

continuing operations of 90%. The income tax rate of 90% for the year ended December 31, 2005 differs from the Company’s statutory tax rate

of 35% primarily due to the inability to benefi t losses in the U.S., which resulted in the recording of the valuation allowance charge against net U.S.

deferred tax assets in the amount of $1,075 million. Some of the other signifi cant items that caused the difference from the statutory tax rate include

non-U.S. tax benefi ts of $106 million associated with total worldwide restructuring costs of $1,143 million; a benefi t of $101 million associated with

rate differentials on operations outside the U.S.; a benefi t of $28 million associated with export sales and manufacturing credits; a tax charge of $29

million associated with the remittance of earnings from subsidiary companies outside of the U.S. in connection with the American Jobs Creation Act

of 2004; and a tax benefi t of $44 million resulting from the Company’s audit settlement with the Internal Revenue Service for tax years covering 1993

through 1998.