Kodak 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

Valuation Allowance - U.S.

During the third quarter of 2005, based on management’s assessment of positive and negative evidence regarding the realization of the net deferred

tax assets, the Company recorded a valuation allowance of approximately $900 million against its net U.S. deferred tax assets. In accordance with

SFAS No. 109, “Accounting for Income Taxes” (SFAS 109), managements’ assessment included the evaluation of scheduled reversals of deferred tax

assets and liabilities, estimates of projected future taxable income, carryback potential and tax planning strategies.

Prior to the Company’s third quarter 2005 assessment of realizability, it was believed, based on available evidence including tax planning strategies,

that the Company would more likely than not realize its net U.S. deferred tax assets. The third quarter 2005 assessment considered the following

signifi cant matters based upon some recent changes that occurred in the quarter:

• In July 2005, management announced plans to signifi cantly accelerate its restructuring efforts and to signifi cantly reduce the assets

supporting its traditional business by the end of 2007. This global plan includes accelerating the reduction of traditional fi lm assets from

$2.9 billion in January 2004 to approximately $1 billion by 2007 and terminating approximately 10,000 employees. These actions will have a

negative impact on Kodak’s ability to generate taxable income in the U.S.

• On October 18, 2005, the Company entered into a new secured credit facility pursuant to which the borrowings in the U.S. are collateralized

by certain U.S. assets, including the Company’s intellectual property assets. Thus, management determined that the previous tax planning

strategy to sell the U.S. intellectual property to a foreign subsidiary to generate taxable income in the U.S. was no longer prudent nor feasible

and should not be relied upon as part of the third quarter assessment of realizability of the Company’s U.S. deferred tax assets.

Based upon management’s above-mentioned September 30, 2005 assessment of realizability, management concluded that it was no longer more

likely than not that the U.S. net deferred tax assets would be realized and, as such, recorded a valuation allowance of approximately $900 million.

In the fourth quarter of 2005, management updated its assessment of the realizability of its net deferred tax assets. As a result of management’s

assessment of positive and negative evidence regarding the realization of the net deferred tax assets, which included the evaluation of scheduled

reversals of deferred tax assets and liabilities, estimates of projected future taxable income, carryback potential and tax planning strategies, the

Company maintained that it was still no longer more likely than not that the U.S. net deferred tax assets would be realized and, as such, increased the

valuation allowance by approximately $181 million relating to deferred tax benefi ts generated in the fourth quarter. In addition, the Company expects

to record a valuation allowance on all U.S. tax benefi ts generated in the future until an appropriate level of profi tability in the U.S. is sustained or until

the Company is able to generate enough taxable income through other tax planning strategies and transactions. Both the net deferred tax asset

balances and the offsetting valuation allowance include estimates attributable to the recent acquisitions of KPG and Creo. Deferred tax amounts

attributable to these businesses are expected to be fi nalized during 2006 with the completion of the Company’s purchase accounting for these

acquired entities.

As of December 31, 2005, the Company had a valuation allowance of $1,229 million relating to its net deferred tax assets in the U.S. of $1,308 million.

The valuation allowance of $1,229 million is attributable to (i) the charges totaling $1,081 million that were recorded in the third and fourth quarters

of 2005 and (ii) a valuation allowance of $148 million recorded in a prior year for certain state tax carryforward deferred tax assets relating to which

management believes it is not more likely than not that the assets will be realized. The remaining net deferred tax assets in excess of the valuation

allowance of $79 million relate to certain foreign tax credit deferred tax assets relating to which management believes it is more likely than not that

the assets will be realized.

Valuation Allowance – Outside the U.S.

As of December 31, 2005, the Company had a valuation allowance of approximately $177 million relating to its deferred tax assets outside of the U.S.

of $534 million. The valuation allowance of $177 million is attributable to certain net operating loss and capital loss carryforwards relating to which

management believes it is not more likely than not that the assets will be realized.

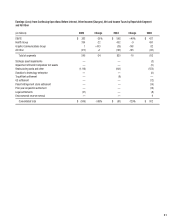

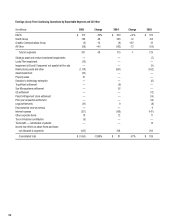

(Loss) Earnings From Continuing Operations

The loss from continuing operations for 2005 was $1,455 million, or $5.05 per basic and diluted share, as compared with earnings from continuing

operations for 2004 of $81 million, or $.28 per basic and diluted share, representing a decrease of $1,536 million. This decrease in earnings from

continuing operations is attributable to the reasons described above.

Digital & Film Imaging Systems

Worldwide Revenues

Net worldwide sales for the D&FIS segment were $8,460 million for 2005 as compared with $9,366 million for 2004, representing a decrease

of $906 million, or 10%. The decrease in net sales was primarily attributable to declines related to negative price/mix, driven primarily by the

digital capture SPG and the traditional fi lm capture SPG, which reduced net sales by approximately 5.9 percentage points, and volume

declines in the fi lm capture SPG and the wholesale and retail photofi nishing portions of the consumer output SPG, which decreased sales by

approximately 4.3 percentage points. These decreases were partially offset by favorable exchange, which increased net sales by approximately

0.5 percentage points.