Kodak 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

Pursuant to the Secured Credit Agreement and associated Security Agreement, each subsidiary organized in the U.S. jointly and severally guarantees

the obligations under the Secured Credit Agreement and all other obligations of the Company and its subsidiaries to the Lenders. The guaranty is

supported by the pledge of certain U.S. assets of the U.S. Borrower and the Company’s U.S. subsidiaries including, but not limited to, receivables,

inventory, equipment, deposit accounts, investments, intellectual property, including patents, trademarks and copyrights, and the capital stock of

Material Subsidiaries. Excluded from pledged assets are real property, “Principal Properties” and equity interests in “Restricted Subsidiaries”, as

defi ned in the Company’s 1988 Indenture.

Material Subsidiaries are defi ned as those subsidiaries with revenues or assets constituting 5 percent or more of the consolidated revenues or assets

of the corresponding borrower. Material Subsidiaries will be determined on an annual basis under the Secured Credit Agreement.

Pursuant to the Secured Credit Agreement and associated Canadian Security Agreement, Eastman Kodak Company and Kodak Graphic

Communications Company (KGCC, formerly Creo Americas, Inc.), jointly and severally guarantee the obligations of the Canadian Borrower, to the

Lenders. Certain assets of the Canadian Borrower in Canada were also pledged in support of its obligations, including, but not limited to, receivables,

inventory, equipment, deposit accounts, investments, intellectual property, including patents, trademarks and copyrights, and the capital stock of the

Canadian Borrower’s Material Subsidiaries.

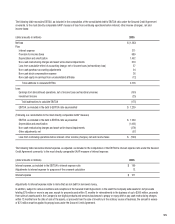

Interest rates for borrowings under the Secured Credit Agreement are dependent on the Company’s Long Term Senior Secured Credit Rating. The

Secured Credit Agreement contains various affi rmative and negative covenants customary in a facility of this type, including two quarterly fi nancial

covenants: (1) a consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) to consolidated interest expense (subject to

adjustments to exclude interest expense not related to borrowed money) ratio, on a rolling four-quarter basis, of no less than 3 to 1, and (2) a

consolidated debt for borrowed money to consolidated EBITDA (subject to adjustments to exclude any extraordinary income or losses, as defi ned by

the Secured Credit Agreement, interest income and certain non-cash items of income and expense) ratio of not greater than: 4.75 to 1 as of

December 31, 2005; 4.50 to 1 as of March 31, 2006; 4.25 to 1 as of June 30, 2006; 4.00 to 1 as of September 30, 2006; and 3.50 to 1 as of

December 31, 2006 and thereafter.

As of December 31, 2005, the Company’s consolidated debt to EBITDA ratio was 2.89 and the consolidated EBITDA to consolidated interest ratio was

6.24. Consolidated EBITDA and consolidated interest expense, as adjusted, are non-GAAP fi nancial measures. The Company believes that the

presentation of the consolidated debt to EBITDA and EBITDA to consolidated interest expense fi nancial measures is useful information to investors,

as it provides information as to how the Company actually performed against the fi nancial restrictions and requirements under the Secured Credit

Facilities, and how much headroom the Company has within these covenants.