Kodak 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

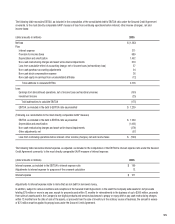

curtailment gains and losses with respect to certain of its retirement plans in 2005. These curtailment events resulted in the remeasurement of the

respective plans’ obligations, which impacted the accounting for the additional minimum pension liabilities. As a result of these remeasurements, the

Company was required to increase its additional minimum pension liabilities by $223 million during 2005. This increase is refl ected in the pension and

postretirement liabilities component within the accompanying Consolidated Statement of Financial Position as of December 31, 2005. The net-of-tax

amount of $156 million relating to the increase of the additional minimum pension liabilities is refl ected in the accumulated other comprehensive loss

component within the accompanying Consolidated Statement of Financial Position as of December 31, 2005. The related decrease in the long-term

deferred tax asset of $67 million was refl ected in the other long-term assets component within the accompanying Consolidated Statement of Financial

Position as of December 31, 2005.

The Company has a dividend policy whereby it makes semi-annual payments of dividends, when declared, on the Company’s 10th business day each

July and December to shareholders of record on the close of the fi rst business day of the preceding month. On May 11, 2005, the Board of Directors

declared a semi-annual cash dividend of $.25 per share payable to shareholders of record at the close of business on June 1, 2005. This dividend

was paid on July 15, 2005. On October 18, 2005, the Board of Directors declared a semi-annual cash dividend of $.25 per share payable to

shareholders of record at the close of business on November 1, 2005. This dividend was paid on December 14, 2005. The total dividends paid for

the year ended December 31, 2005 was $144 million.

The Company made contributions (funded plans) or paid benefi ts (unfunded plans) totaling approximately $185 million relating to its major U.S. and

non-U.S. defi ned benefi t pension plans in the year ended December 31, 2005.

The Company paid benefi ts totaling approximately $240 million relating to its U.S., United Kingdom and Canada other postretirement benefi t plans,

which represent the Company’s major other postretirement plans, in the year ended December 31, 2005.

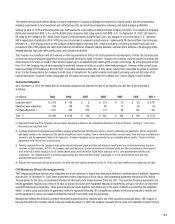

The Company believes that its cash fl ow from operations in addition to asset sales and intellectual property monetization will be suffi cient to cover its

working capital and capital investment needs and the funds required for future debt reduction, restructuring payments, dividend payments, employee

benefi t plan payments/contributions, and modest acquisitions. The Company’s cash balances and its fi nancing arrangements, as described under

“Sources of Liquidity” below, will be used to bridge timing differences between expenditures and cash generated from operations.

Sources of Liquidity

Refer to Note 9, “Short-Term Borrowings and Long-Term Debt” of the Notes to Financial Statements for presentation of long-term debt, related

maturities and interest rates as of December 31, 2005 and 2004.

Short-Term Borrowings

As of December 31, 2005, the Company and its subsidiaries, on a consolidated basis, maintained $1,132 million in committed bank lines of credit and

$773 million in uncommitted bank lines of credit to ensure continued access to short-term borrowing capacity.

Secured Credit Facilities

On October 18, 2005 the Company closed on $2.7 billion of Senior Secured Credit Facilities (Secured Credit Facilities) under a new Secured Credit

Agreement (Secured Credit Agreement) and associated Security Agreement and Canadian Security Agreement. The Secured Credit Facilities consists

of a $1.0 billion 5-Year Committed Revolving Credit Facility (5-Year Revolving Credit Facility) expiring October 18, 2010 and $1.7 billion of Term Loan

Facilities (Term Facilities) expiring October 18, 2012.

The 5-Year Revolving Credit Facility can be used by Eastman Kodak Company (U.S. Borrower) for general corporate purposes including the issuance

of letters of credit. Amounts available under the facility can be borrowed, repaid and re-borrowed throughout the term of the facility provided the

Company remains in compliance with covenants contained in the Secured Credit Agreement. As of December 31, 2005, there was no debt

outstanding and $111 million of letters of credit issued under this facility.

Under the Term Facilities, $1.2 billion was borrowed at closing primarily to refi nance debt originally issued under the Company’s previous

$1.225 billion 5-Year Facility to fi nance the acquisition of Creo Inc. on June 15, 2005. The $1.2 billion consists of a $920 million 7-Year Term Loan to

the U.S. Borrower and $280 million 7-Year Term Loan to Kodak Graphic Communications Canada Company (KGCCC or, the Canadian Borrower). At

December 31, 2005, the balances reported in Long-term debt, net of current portion, on the Consolidated Statement of Financial Position were

$920 million and $280 million for the U.S. Borrower and the Canadian Borrower, respectively. Debt issue costs incurred of approximately $57 million

associated with the Secured Credit Facilities are recorded as an asset and amortized over the life of the borrowings. The remaining $500 million

under the Term Facilities is committed by the Lenders and available to the U.S. Borrower, through June 15, 2006. For this $500 million commitment,

a 1.50% annual fee is paid on the unused amount to the Lenders.

In addition to the $2.7 billion of Secured Credit Facilities, the Secured Credit Agreement allows for up to an additional $500 million for a new secured

credit loan based on terms and pricing available and agreed to at the time the new credit loan would be established. There are no fees for this feature.