Kodak 2005 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

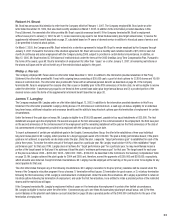

per year. Although the total perquisites in 2005 for P. J. Faraci, J. T. Langley and B. V. Masson fall below this disclosure threshold,

information regarding their perquisites is nevertheless shown in order to provide more fulsome disclosure. More detailed information on

perquisites is provided below where the value of an individual item exceeds 25% of total perquisites for the applicable executive. Where no

amount is shown, there were no tax reimbursements and the value of the perquisites or personal benefi ts provided was less than the

minimum amount required to be reported.

Perquisites for 2004 and 2005 are valued at their incremental cost to the Company. The incremental cost to the Company for personal use of

Company aircraft is calculated based on the direct operating costs to the Company, including fuel costs, FBO handling and landing fees, vendor

maintenance costs, catering, travel fees and other miscellaneous direct costs. Fixed costs that do not change based on usage, such as salaries

and benefi ts of crew, training of crew, utilities, taxes and general maintenance and repairs, are excluded. The amounts reported for 2004 and

2005 refl ect a change in valuation methodology from 2003 in which the cost of personal use of Company aircraft is calculated using the Standard

Industrial Fare Level (SIFL) tables found in the tax regulations.

For D. A. Carp, the amount for 2005 includes a tax reimbursement of $22,973 due to income attributed to him and $199,680 in incremental

costs to the Company, both relating to his use of Company aircraft. The amount for 2004 includes a tax reimbursement of $21,485 due to income

attributed to him and $121,875 in incremental costs to the Company, both relating to his use of Company aircraft. For 2003, the amount is for a

tax reimbursement relating to his use of Company aircraft. The Company required D. A. Carp to use Company transportation for security reasons

in each of these three years.

For A. M. Perez, the amount for 2005 includes relocation expenses of $704,848 and a tax reimbursement on these relocation expenses of

$564,032, and $152,208 in incremental costs to the Company relating to his use of Company aircraft. The Company requires A. M. Perez to use

Company transportation for security reasons effective upon his promotion to Chief Executive Offi cer. The amount for 2004 includes relocation

expenses of $19,455 and a tax reimbursement on these relocation expenses of $2,787, and $37,125 relating to his use of Company aircraft. For

2003, the amount shown includes a tax reimbursement for relocation expenses paid under the Company’s new hire relocation program and

A. M. Perez’s March 3, 2003 offer letter.

For R. H. Brust, the amount for 2005 includes $51,000 in incremental costs to the Company relating to his use of Company aircraft.

For P. J. Faraci, the amount for 2005 includes relocation expenses of $15,016 and a tax reimbursement on these relocation expenses of $11,116.

For J. T. Langley, the amount for 2005 includes $36,600 in incremental costs to the Company relating to his use of Company aircraft. For

B. V. Masson, the amount for 2005 includes $8,400 in incremental costs to the Company relating to his use of Company aircraft.

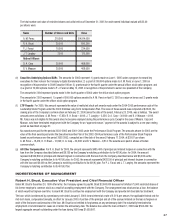

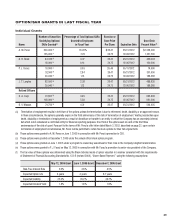

(d) Restricted Stock Awards The awards shown represent grants of restricted stock or restricted stock units valued as of the date of grant.

Dividends are paid on the restricted shares and restricted units as and when dividends are paid on Kodak common stock. The following table

shows a breakdown of restricted stock or restricted stock unit grants for 2003-2005:

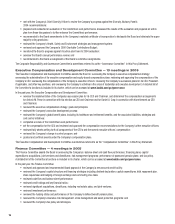

Name Year Number of Shares Granted Award Program Value Valuation Date

A. M. Perez 2005 60,000 Promotion Award $26.57 06/01/05

2003 100,000 Signing Bonus 30.97 04/02/03

50,000 Retention Award 20.93 10/01/03

R. H. Brust 2005 27,000 (1) Retention Award 26.32 05/12/05

J. T. Langley 2003 15,000 (2) Signing Bonus 20.93 10/01/03

Retired Offi cer

B. V. Masson 2003 20,000 Retention Award 23.64 10/21/03

(1) One-third of these shares will vest on each of February 1, 2007, February 1, 2008 and February 1, 2009. The terms of Mr. Brust’s retention agreement

provide that if he terminates employment for other than cause on or after January 3, 2007, all remaining restrictions on the shares will lapse and he will not

forfeit these shares.

(2) One-half of these shares vested on October 1, 2005 and one-half will vest on October 1, 2006. Under the terms of Mr. Langley’s offer letter, if his

employment is terminated without cause or if he terminates his employment for good reason, he is entitled to retain a prorated portion of the restricted

shares and the restrictions will lapse.