Kodak 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

The negative rating outlook refl ects Moody’s concern regarding the Company’s challenges to transition to a digital product and services business,

including requirements to fund investment and restructuring costs, and uncertain prospects for achieving solid digital business profi tability.

Starting on April 22, 2005 and throughout the year, S&P lowered its credit ratings on Eastman Kodak Company fi ve times. The Company’s Corporate

Rating was lowered from BBB- to B+, and the Kodak Senior Unsecured debt rating was cut from BBB- to B. On September 16, 2005, S&P issued a

BB rating on the Company’s $2.7 billion Senior Secured Credit Agreement (Secured Bank Loan), and assigned it a recovery rating of “2,” indicating

S&P’s expectation of substantial (80%-100%) recovery of principal in a payment default scenario. Subsequently, the Secured Bank Loan rating was

lowered to B+. S&P’s rating outlook on the Company remains negative refl ecting their “reduced confi dence in Kodak’s profi tability and cash fl ow

prospects in light of the ongoing and rapid deterioration of its traditional consumer imaging business, unproven profi t potential of its emerging digital

imaging business, high cash restructuring costs, and economic uncertainty.”

The Company is in compliance with all covenants or other requirements set forth in its credit agreements and indentures. Further, the Company does

not have any rating downgrade triggers that would accelerate the maturity dates of its debt. However, the Company could be required to increase the

dollar amount of its letters of credit or other fi nancial support up to an additional $108 million at the current credit ratings. As of the fi ling date of this

Form 10-K, the Company has not been requested to materially increase its letters of credit or other fi nancial support. However, at the current Senior

Unsecured Rating of B2 by Moody’s and B by S&P, Convertible Securities holders may, at their option, convert their Convertible Securities to common

stock. Further downgrades in the Company’s credit rating or disruptions in the capital markets could impact borrowing costs and the nature of its

funding alternatives. However, further downgrades will not impact borrowing costs under the Company’s $2.7 billion Secured Credit Facilities.

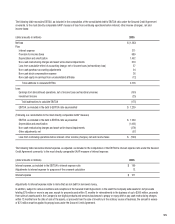

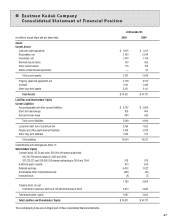

Contractual Obligations

As of December 31, 2005, the impact that our contractual obligations are expected to have on our liquidity and cash fl ow in future periods is

as follows:

(in millions) Total 2006 2007 2008 2009 2010 2011+

Long-term debt (1) $ 3,470 $ 706 $ 8 $ 274 $ 35 $ 36 $ 2,411

Operating lease obligations 569 138 120 98 75 58 80

Purchase obligations (2) 1,021 204 200 173 98 105 241

Total (3) (4) $ 5,060 $ 1,048 $ 328 $ 545 $ 208 $ 199 $ 2,732

(1) Represents maturities of the Company’s long-term debt obligations as shown on the Consolidated Statement of Financial Position. See Note 9, “ Short-Term

Borrowings and Long-Term Debt.”

(2) Purchase obligations include agreements related to supplies, production and administrative services, as well as marketing and advertising, that are enforceable

and legally binding on the Company and that specify all signifi cant terms, including: fi xed or minimum quantities to be purchased; fi xed, minimum or variable price

provisions; and the approximate timing of the transaction. Purchase obligations exclude agreements that are cancelable without penalty. The terms of these

agreements cover the next two to sixteen years.

(3) Funding requirements for the Company’s major defi ned benefi t retirement plans and other postretirement benefi t plans have not been determined, therefore,

they have not been included. In 2005, the Company made contributions to its major defi ned benefi t retirement plans and other postretirement benefi t plans of

$185 million ($25 million relating to its U.S. defi ned benefi t plans) and $240 million ($236 million relating to its U.S. other postretirement benefi ts plan),

respectively. The Company expects to contribute approximately $22 million and $259 million, respectively, to its U.S. defi ned benefi t plans and other

postretirement benefi t plans in 2006.

(4) Because their future cash outfl ows are uncertain, the other long-term liabilities presented in Note 10: Other Long-Term Liabilities are excluded from this table.

Off-Balance Sheet Arrangements

The Company guarantees debt and other obligations of certain customers to ensure that fi nancing is obtained to facilitate sales of products, equipment

and services. At December 31, 2005, these guarantees totaled a maximum of $204 million, with outstanding guaranteed amounts of $134 million.

The guarantees for the other unconsolidated affi liates and third party debt mature between 2006 and 2011. The customer fi nancing agreements and

related guarantees typically have a term of 90 days for product and short-term equipment fi nancing arrangements, and up to fi ve years for long-term

equipment fi nancing arrangements. These guarantees would require payment from Kodak only in the event of default on payment by the respective

debtor. In some cases, particularly for guarantees related to equipment fi nancing, the Company has collateral or recourse provisions to recover and

sell the equipment to reduce any losses that might be incurred in connection with the guarantees.

Management believes the likelihood is remote that material payments will be required under any of the guarantees disclosed above. With respect to

the guarantees that the Company issued in the year ended December 31, 2005, the Company assessed the fair value of its obligation to stand ready to